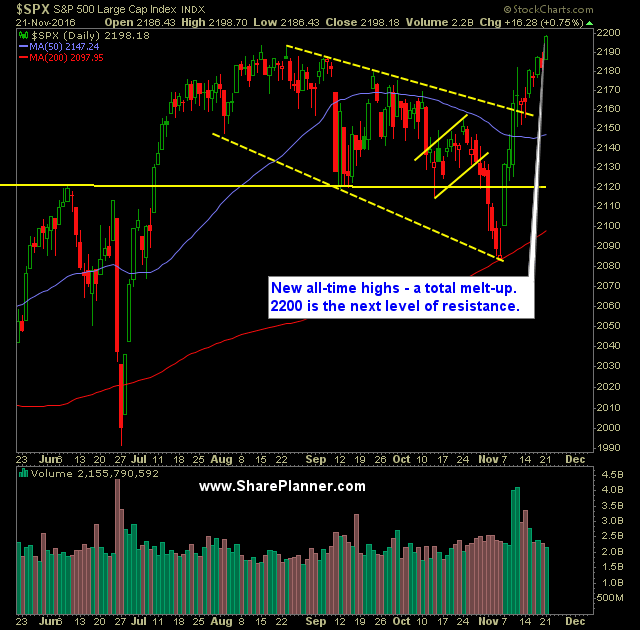

Technical Analysis:

- Strong rally on S&P 500 (SPX) yesterday to jump start what is historically a bullish week of trading.

- As has been stated in previous trading plans, the 5-day moving average continues to remain intact for the market as well as being tested on a daily basis.

- Volume on SPDRs S&P 500 (SPY) dropped yesterday from the previous day’s reading and remains well below recent averages. Essentially, the high emotional-levels of traders buying everything in sight is receding, which means you may see some consolidation in the near future in price action.

- CBOE Market Volatility Index (VIX) continues to get crushed for a third consecutive day, and dropping 3.4% down to 12.42. That is the lowest closing level attained since September 28th.

- With the break of the rising trend-line from the August lows, I think the VIX is poised to test those lows again which would be 11.02.

- United States Oil Fund (USO) appears ready to make a run again towards the October highs, following the massive breakout yesterday. In order to do so, any weakness today, must avoid a move back into yesterday’s gap.

- SPX 30 minute chart continues to trend higher – a near-perfect series of higher-highs and higher-lows.

- Nasdaq (COMPQ) established new all time highs yesterday with the Dow Jones Industrial Average (DJIA), Russell 2000 (RUT) and SPX.

- Expect volume to get very light as the week moves closer to the Thanksgiving holiday.

My Trades:

- Did not close out any of my long positions yesterday.

- Added one new swing-trade to the portfolio yesterday.

- I may add a new swing-trade to the portfolio, but am also content in riding the portfolio as it currently is. Very strong and profitable.

- I am currently 50% Long / 50% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.