My Swing Trading Strategy

I sold out of my two remaining swing-trades yesterday as their stops were taken out in the early going of trading. I’m 100% cash, but flexible with whatever direction I trade going forward. With all the selling we have seen so far this month, it wouldn’t surprise me to see us rally into month’s end, similar to October 2018.

Indicators

- Volatility Index (VIX) – While a very solid day for the $VIX it still cannot hold its own without giving up a huge chunk of its daily gains, as it managed to do in afternoon trading. Currently sitting at a meager 16.8.

- T2108 (% of stocks trading above their 40-day moving average): An 18% decline yesterday taking the indicator all the way down to 32% and decisively breaking the May lows and the lowest reading since January 7, 2019

- Moving averages (SPX): Below all the major moving averages except for the 200-day MA, which it isn’t too far away from breaking.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities was the one sector to finish higher on the day, while Energy had its worst day of 2019 due to the massive sell-off in oil. Discretionary has been in the middle of the road with all the recent selling – not too crazy, while Healthcare still exhibits relative strength. Technology could be poised for a bounce here following its 2% sell off yesterday.

My Market Sentiment

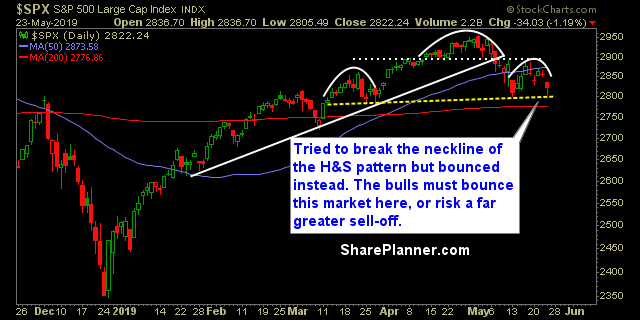

Bounced at the end of day yesterday off of the neckline of the head and shoulders pattern. Any sustained bounce must take out the high-end of the right shoulder to nullify the bearish pattern overall.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I go over the major reasons why traders fail and the biggest obstacles to finding success as swing traders in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.