My Swing Trading Strategy

New week, month and quarter. I’m 100% cash coming into the day and will look to get long with 1-2 new positions. Always the potential for an April fools market fade. Be aware.

Indicators

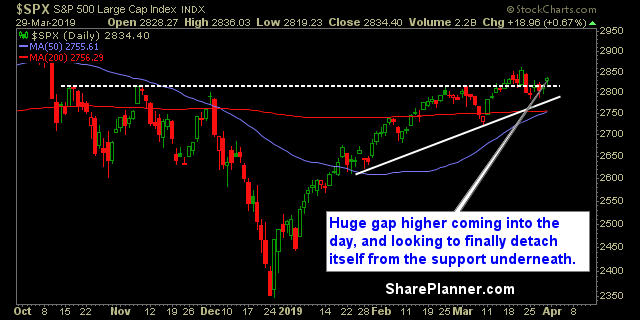

- Volatility Index (VIX) – a 5% decline on Friday, and has dropped four of the last five sessions. Looking, once again to test the March lows.

- T2108 (% of stocks trading above their 40-day moving average): Breadth, wasn’t all that impressive, and the T2108 showed it with only a 2% move higher and only 52% of stocks trading above their 40-day moving average.

- Moving averages (SPX): Back above the 10-day moving average, and all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology pulled it together on Friday, and looking to continue the trend of higher-lowers and higher-highs, with a possible test of the March highs. Double bottom in the short-term on Industrials that will confirm today. Staples continues to print new rally highs. Watch for a breakout of consolidation in Discretionary.

My Market Sentiment

The market was an absolute chop-fest for much of March. Today the market is looking to gap higher and pull away from support underneath. Always the potential for a market fade on these gap ups, but so far, considering the Friday’s push higher, today’s continuation looks promising.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.