My Swing Trading Approach

Yesterday, I booked profits in Netflix (NFLX) for a +1.3% profit and I added one short position to the portfolio, which should play out well at the open of today’s market. The dip mentality remains strong in this market, so today will be a key test for it. If a rebound is in the cards, it would make sense to add a new long position to the portfolio as well.

Indicators

- Volatility Index (VIX) – SPX broke its five day winning streak yesterday, but the VIX still managed to drop further with a 1.22% drop to 15.38. Look for a much needed bounce in this indicator today.

- T2108 (% of stocks trading above their 40-day moving average): A rare day in the red for this indicator of late, as it dropped 1.7% to 85%. Expect some deterioration in it again today.

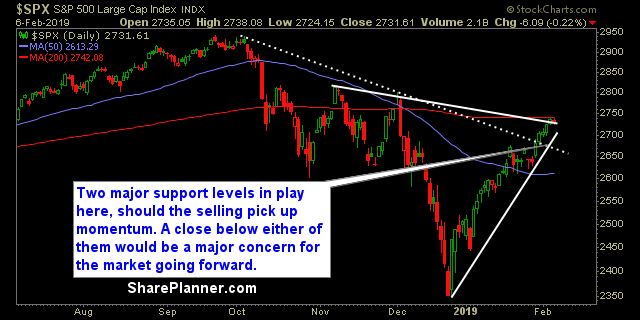

- Moving averages (SPX): Price has hovered just a few points below the 200-day moving average but has yet to actually test it legitimately. Nonetheless, traders seem to be taking profits ahead of a real test and today, we are looking at a potential break of the 5-day moving average as well.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Technology showing relative strength with Industrials still, but that will be put to the test today with weakness ahead of the bell, while Healthcare continues to pile on the profits and extend its gains for a sixth straight day. Materials and Energy worked in lockstep to drag the market lower yesterday.

My Market Sentiment

We are seeing the market deep in the red ahead of the opening bell. There will more than likely be an attempt to buy the dip early on – whether it takes is anyone’s guess at this point. A strong day in the red, and without being able to break the 200-day moving average could create a strong technical sell-off, as traders look to book their profits quickly.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 10% Long, 10% Short.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

The percentage amount for your stop-losses and where to put them at when trading the stock market can be very difficult to determine. In this podcast episode, Ryan talks about times when it works using tight stop-losses versus very wide stop-losses and the tricks that you can use to narrow the stop-loss even further.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.