My Swing Trading Approach

I will look to add 1-2 new swing-trades this morning, if the market shows it can hold its lows and bounce higher. Otherwise, I will play it cautious and look to book gains while raising my stops.

Indicators

- VIX – Down for fourth straight day, and may be finding some support in the 12’s here l

- T2108 (% of stocks trading above their 40-day moving average): Breadth yesterday was poor, and that was reflected in T2108 with a 2% pullback. Resistance at 73% remains

- Moving averages (SPX): 5-day moving average back above all the major moving averages today. Price is above all the major moving averages, though a test of the 5-day may occur today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities staged a sharp rebound yesterday, while Energy strings together its third straight, solid rally. Technology lagged in a big way, and still causing fits for traders. I would continue to stay away from Financials particularly with the banks reporting, starting Friday. Discretionary remains in the middle of the pack with steady, consistent gains.

My Market Sentiment

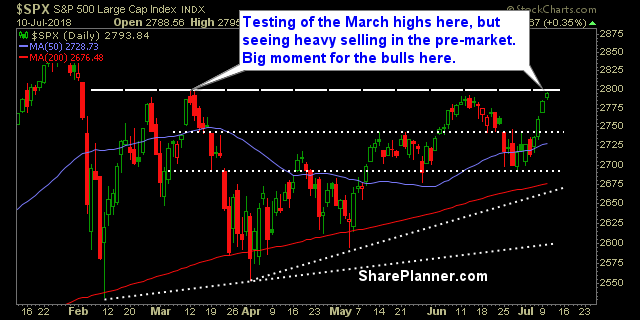

Some caution here with the market having ripped lower on Trump’s $200b list of tariffs against the Chinese. The fact that he did this isn’t anything new, so there’s a good chance that the market will buy this dip early on. The market closed right at the March highs, after breaking the June highs yesterday.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 4 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I cover the expectations that we should be setting for ourselves as swing traders, from the number of trades we should be expecting to take, how long and how short we should be in our trading portfolio, as well as what the expectations for a win-rate should be.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.