My Swing Trading Approach

I am still taking a cautious approach with this market while it is stuck in consolidation. I added one new position yesterday, and may add another today, but will not be overly aggressive with my trading, until we can get some kind of breakout.

Indicators

- VIX – Volatility increased by another 1.3% yesterday and closed at 21.77.

- T2108 (% of stocks trading below their 40-day moving average): Stocks gave up their gains yesterday, and T2108 barely showed any improvement.

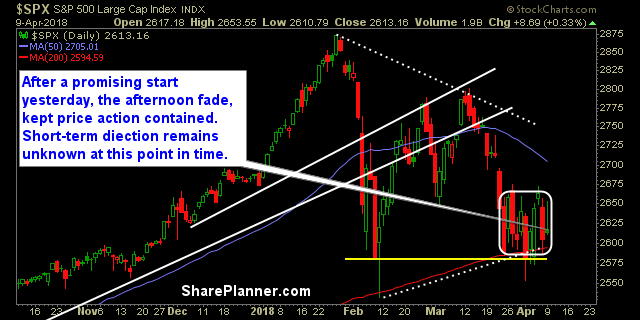

- Moving averages (SPX): The 200-day moving average still remains in play. The 20-day moving average is still an area of significant resistance to be reckoned with.

- RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Healthcare and Technology led the way. Industrials and Consumer Cyclical struggled, with the former showing signs of possibly breaking down in the near-term. Energy remains in a basing pattern, and poised to try breaking out of it once again.

My Market Sentiment

Multi-week consolidation pattern keeping price contained. Yesterday’s rally was quickly faded in the final hour of trading. Any move that is to be taken seriously, needs to break out of the box.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 3 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode, Ryan examines one swing trader's disaster of a trade in Robinhood (HOOD) and the problems that come with not managing the trade and managing the risk in every swing trade that one takes.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.