My Swing Trading Approach

Still 100% cash today. If I do trade today, whether long or short, it will be small increments.

Indicators

- VIX – VIX rally yesterday of 13% pushed the index back above 20. A potential rally back up to 30 appears very possible here.

- T2108 (% of stocks trading below their 40-day moving average): Minimal decline yesterday of 5.5%. Traded down to 24%. Needs to see a much lower reading to see a bottom formed in equities.

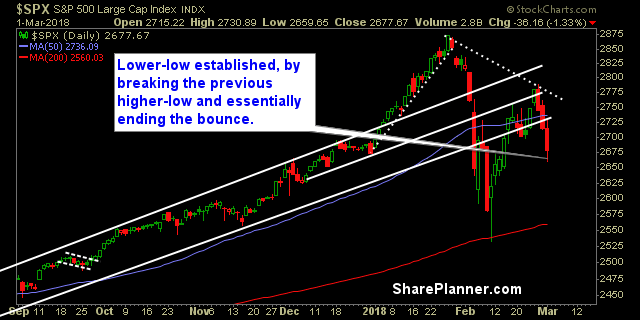

- Moving averages (SPX): Broke back below the 20-day moving average, and appears ready to retest the 200-day moving average again.

- RELATED: Patterns to Profits: An Intro Trading Course

Industries to Watch Today

Only Real Estate and Utilities managed to avoid losses yesterday. Technology led the way to the downside. Energy appears ready to test the February closing lows. Defensive looks ready to break below the February lows

My Market Sentiment

I wouldn’t be surprised if the market found a bottom at some point today, and then engages in a relief bounce, following three straight days of selling. Yesterday’s break of the February 22nd lows was not ideal for SPX, and ultimately it probably goes lower.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode, Ryan examines one swing trader's disaster of a trade in Robinhood (HOOD) and the problems that come with not managing the trade and managing the risk in every swing trade that one takes.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.