Swing Trading Strategy:

More Jobless Claims…

We have 5.25m vs. 5m expected on the Jobless Claims front this morning. The Market loves it, in fact the last four jobless claims that have centered around the impact of the Coronavirus, there have been 22 million jobs lost and every time the market has viewed that as bullish. If you have any expectation for the market to make sense, don’t. It rarely does. I actually wouldn’t be surprised if the market didn’t eventually fade this move today. The rally initially appears to be out of relief that it isn’t way beyond market expectations, or somewhere in double digits.

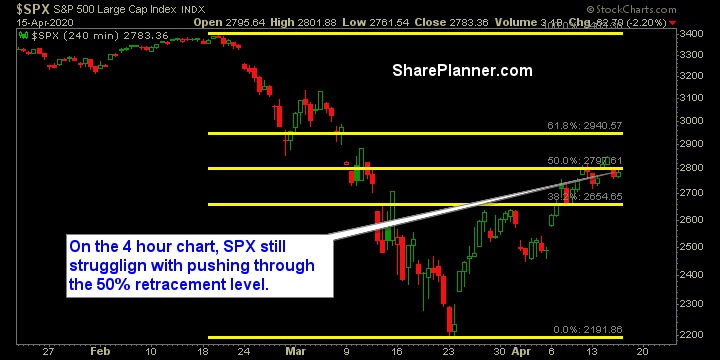

Yesterday’s sell-off saw SPX break back below the 5-day moving average, and still being hit with low volume on the sell-offs, which isn’t putting a lot of conviction behind the moves. Nonetheless the risk is extreme in this market still as the moves of 50-100 points are taking place on a daily basis and makes for a very difficult market for holding trades overnight without taking on incredible amounts of gap and headline risk. So the key here remains to trade small. You don’t have to swing big. The people who are doing so are having to do it out of desperation. During this time it is more important to trade well, than to trade big.

Indicators

- Volatility Index (VIX) – VIX snapped a 4 day losing streak and closed 8.2% higher, and only the 3rd time in the last 12 sessions.

- T2108 (% of stocks trading above their 40-day moving average): A 24% decline takes the indicator back down to 21%. Not a massive decline but has the makings of a bearish island gap reversal.

- Moving averages (SPX): Closed and broke below the 5-day moving average.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

It was Energy and Healthcare that held up the best yesterday. But Technology and Discretionary, the leaders of late also held up quite well. The biggest losers remained Materials, Financials and Real Estate.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.