The bulls are in full squeeze mode right now. And it isn’t looking pretty for the bears either. SPX, even the news coming from Boeing (BA) isn’t enough to keep it or the Dow down today.

One of the harder markets to short these days. And that follows a quarter where shorting stocks felt like printing money. I’ve tried a few times over the past couple of months, and have only had one winner of the bunch. It just doesn’t work well, and wouldn’t recommend anyone trying it right now, because

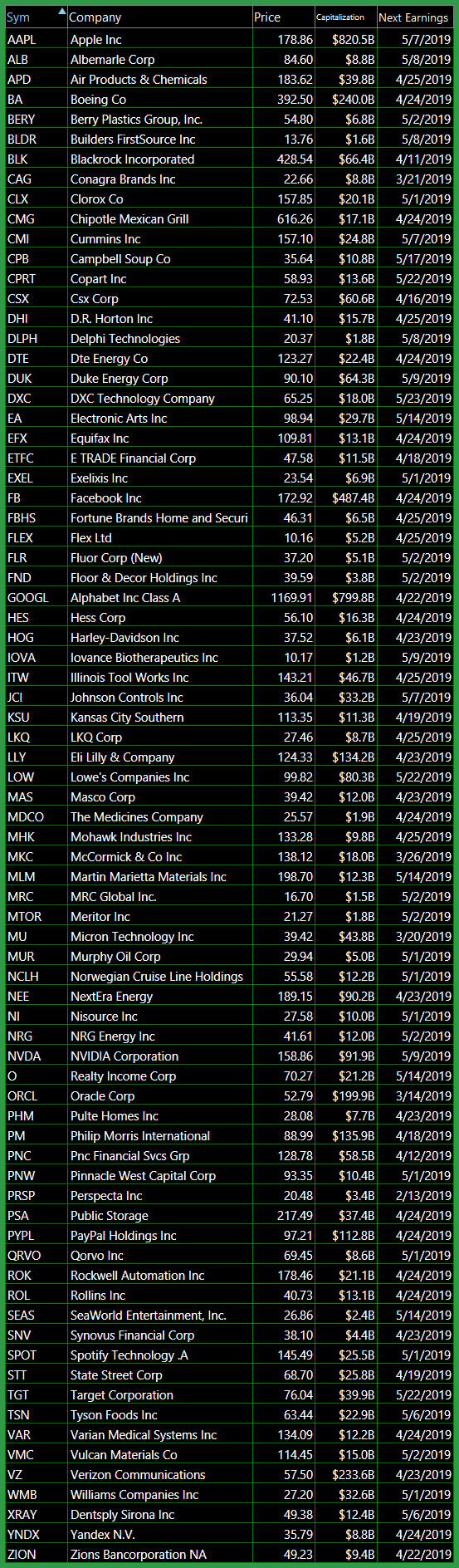

Here are the short setups that are in play here. I don’t have any of them to speak of, and until this market can hold a sell-off beyond the opening bell, I don’t see any real or meaningful reason to be short at this juncture.

I’m still long and strong here, with no shorts in sight. I don’t choose to be bullish or bearish, I let the market tell me that is what I need to be. It’s funny because, a lot of the successful behaviors in the stock market do not correspond well with life in general. For instance,

There’s not a lot stocks to swing-trade short out there… With that said, I haven’t taken a short position in any of these stocks listed below, and even though I had a short position coming into the day, that was quickly closed out at the open. The bulls made a big move today and that

Key emphasis (for now) being on the word “watch” I don’t see any reason to add any of those short position listed below to the portfolio until we can see some willingness from the market to start trending lower again, or at least break a support level or two. But lets be honest, that has

We’re two days into this week, and so far it’s nothing like last week. Except for the volume – while it is certainly better than Wednesday and Friday’s reading, it is nothing close to what we saw on Monday and Tuesday of last week. And I’d be lying to you right now, if I said

My Swing Trading Approach I closed my position in SPXU for a +5.9% profit and my short position in QQQ for a +2% profit. Not bad for a day where the Dow was down 600 points. I'm sitting in cash now and looking to deploy some of it today, should the market bounce hold. Indicators Volatility

My Swing Trading Approach I added one additional short position to my already bearish portfolio on Friday. I could add another one, if the market really took a dump today, but I doubt that I do. However, I could see myself cover my positions today because the market puts in a bottom, or I ride