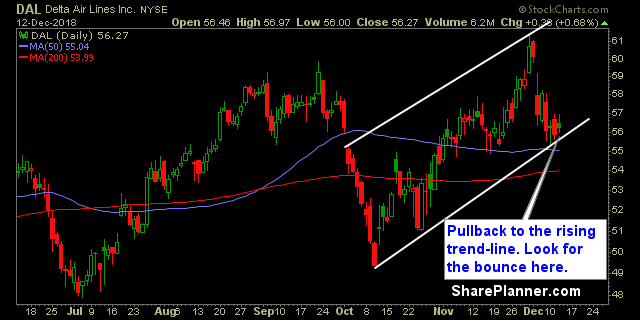

Thursday’s Swing-Trade Setups: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Delta Air Lines (DAL)

Thursday’s Swing-Trade Setups: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Starbucks (SBUX)

Wednesday’s Swing-Trades: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Starbucks (SBUX)

My Swing Trading Approach First, I’ll manage the profits in my existing positions, primarily by raising the stop-losses. Then I will look to add additional long exposure as the market permits. Indicators

Friday’s stock picks Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the Splash Zone and making some profits for yourself! Long General Cable (BGC)

It was another great May swing trading performance in the stock market for members of the Trading Block As you know by now, I am a huge proponent about swing trading transparency when it comes to my stock market performance. There are so few traders out there that actually show their results, much less go

I don’t typically post my weekly email as a post, but I thought it was a pretty informative one highlighting the success in the Trading Block as well as the conclusion of my recent three-part podcast series.

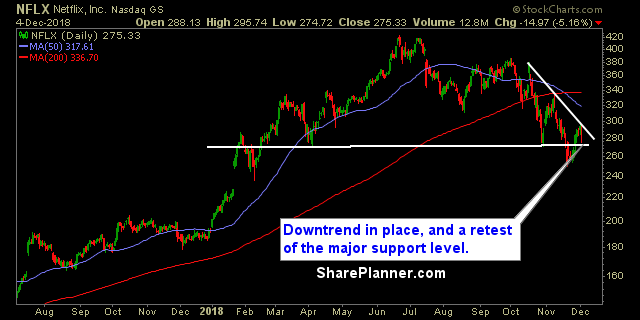

Technical Analysis: The Federal Reserve raised interest rates yesterday by a quarter point. Initially the S&P 500 (SPX) tried to rally on the news but quickly gave up its gains on the day to finish 0.8% down on the day. SPX also managed to close below its 5-day moving average for the first time since 12/2

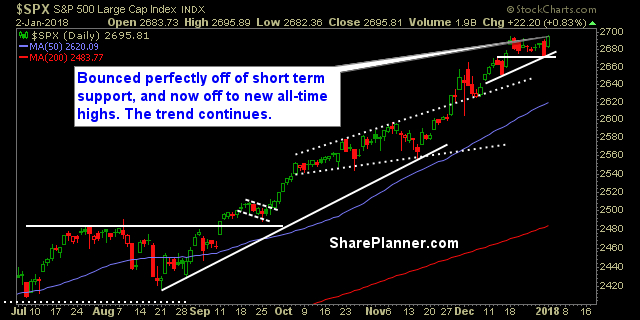

Technical Outlook: First legitimate sell-off on SPX yesterday since April 7th. SPX finished the day trading below the 5-day moving average. Watch the rising trend-line off of the February 11th lows. Currently the trend-line sits at 2087. A slew of earnings came out last night and this morning resulting in hard sell-offs in

Futures are looking ‘okay’ right now, but there is some fair value cooked into them. For instance, the Nasdaq isn’t down only a few points, instead, it is down about 1% from where it closed the day at 4pm eastern. From the looks of things with Google (GOOGL) and Microsoft (MSFT) putting