$MA Continuation triangle in play here, and holding strong despite heavy market selling today. . $ALT Inverse cup and handle forming, and testing confirmation here. $JPM bearish wedge formed and testing rising support here. A break below $172.90 would confirm the bearish wedge here.

$TNX nearing a breakout again, watch as it approaches the 4.2% area. . $MARA price action will be heavily dependent of Bitcoin price action going forward, but technically, MARA weekly has very little resistance until the low-$30's. $HAL so far holding the rising trend-line, but would prefer it make a higher-high first, before retesting.

$MARA on a gap higher like this, gotta take some profit off the table in order to reduce risk. 5-day moving average would be my key on the trade. A close or hard move below and I would exit the trade. This resistance has been strong against price when it comes to $SLV. Fourth straight

$MARA cup and handle pattern forming but still needs to push through and close above the 200-day moving average first. $PLTR attempting to break through a long-term resistance level as well as confirm a multi-year cup and handle pattern. Next stop would be upper-$20's. Since Tuesday, $QQQ has been all consolidation - going sideways since

$MARA hitting up against some short-term resistance. Should it break through watch old trend-line resistance. $SPOT tested rising trend-line on Monday, and following earnings, had a strong bounce. Break July highs would establish higher high and the continuation of the existing trend. Nice gap above the resistance on $COIN today. But be cautious as price

Beautiful breakout in $CVX today, and through resistance and the 200-day moving average. $ZM getting excited about what another variant might mean for the stock. Breaking through resistance today, but I don't have a lot of confidence in this moving lasting. Watch for converging support levels to come into play on $MANU if price continues

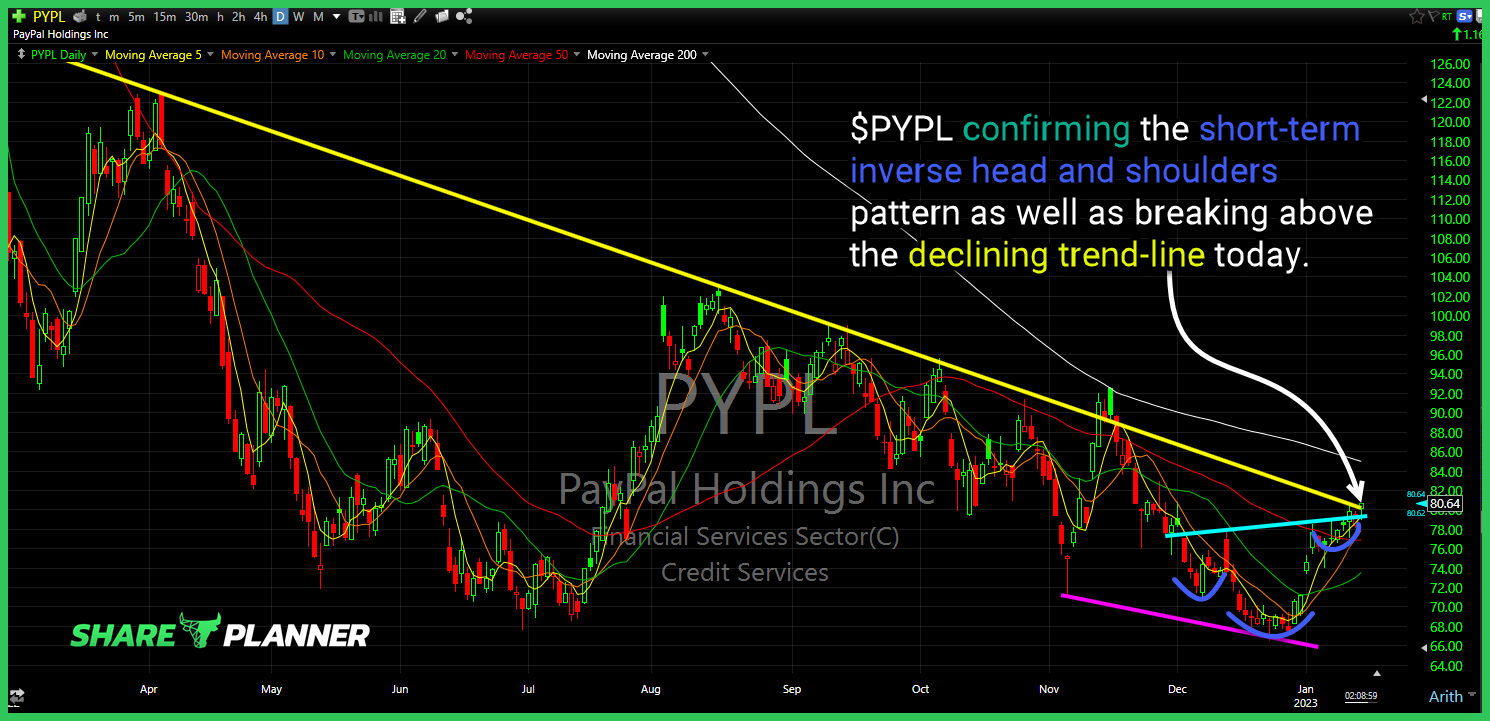

$PYPL confirming the short-term inverse head and shoulders pattern as well as breaking above the declining trend-line today.

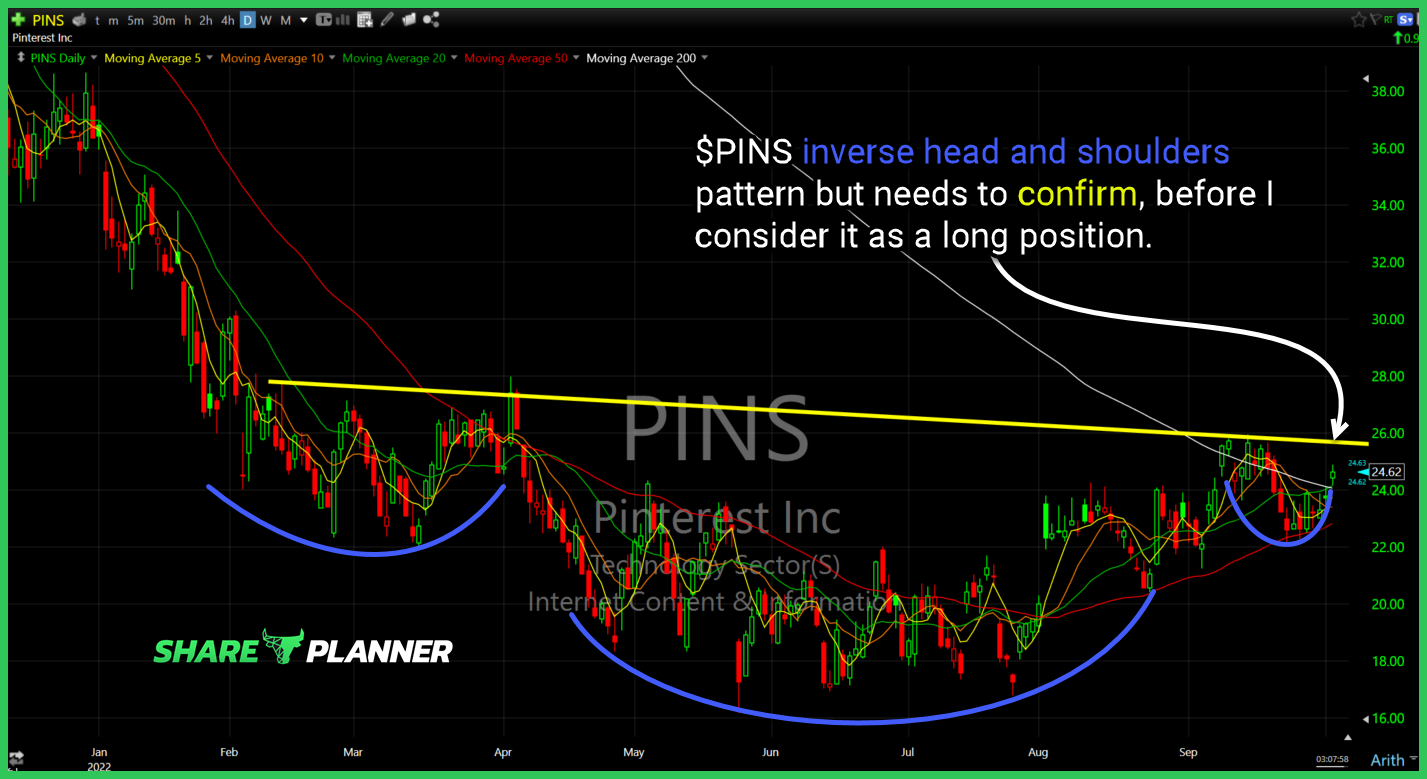

$PINS inverse head and shoulders pattern but needs to confirm, before I consider it as a long position.

$MA bear flag pattern could lead to a test of long-term support.

$SI head and shoulders confirmed. Now sitting on a new layer of support – if it breaks should lead to the next leg lower – very volatile though and managing risk will be difficult.