The Stock Market Crash of 2022 continues with a test this past week of the June lows following the very hawkish FOMC Statement. Can we expect a stock market rally here that will allow the market to form a double bottom, as well as an end to this stock market correction? In this video, I

Talk of another stock market crash is upon us. With SPY ETF dropping over 4% in the last two trading sessions, the dead cat bounce / bear market rally appears to be over. Will stocks retest the lows from June, or is there hope for the dip buyers to rescue the stock market from what

With an amazing stock market rally over the last few weeks, is it safe to say the stock market bottom is in or should we expect the stock market crash to continue? In this video I provide my analysis on the stock market by using technical analysis on the SPY, QQQ and IWM ETFs.

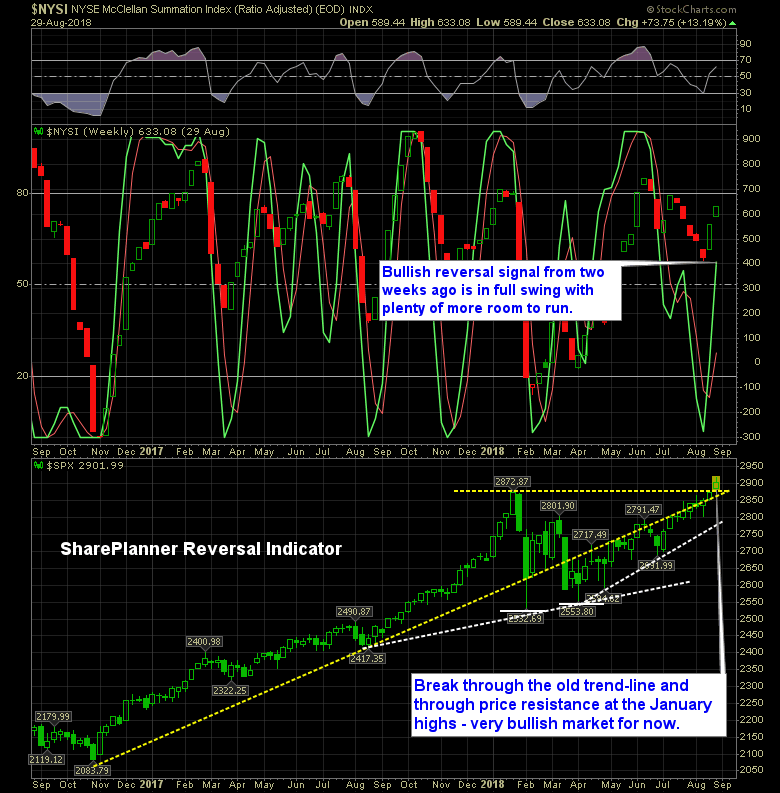

The bulls should continue to push this market higher, despite the selling seen today. Sure the market is overheated and overbought, but it can stay that way for quite some time, before rationale minds start to take profits.

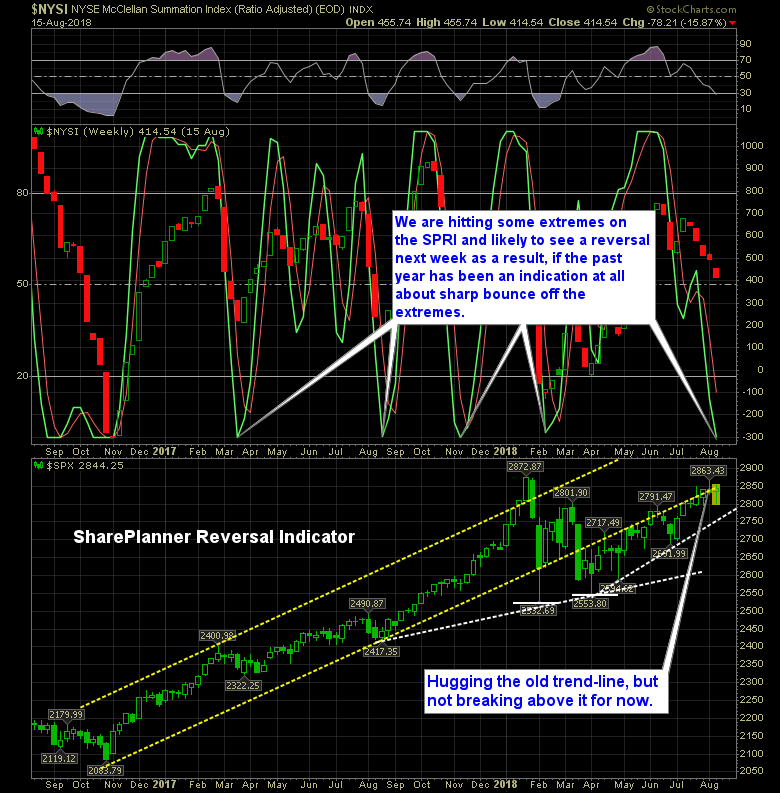

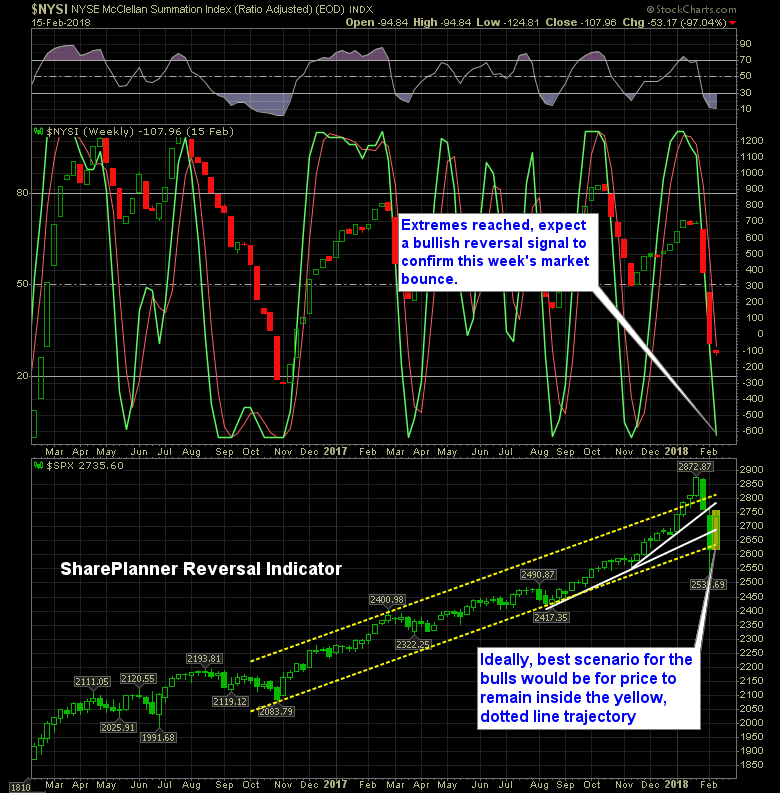

We thought there might have been an early bullish reversal a month ago, but that didn’t pan out, and the downside continued for the market. But now the SharePlanner Reversal Indicator is at an extreme place, and recent history (over the past year), suggests its time in the extremes is short lived. That’s why I

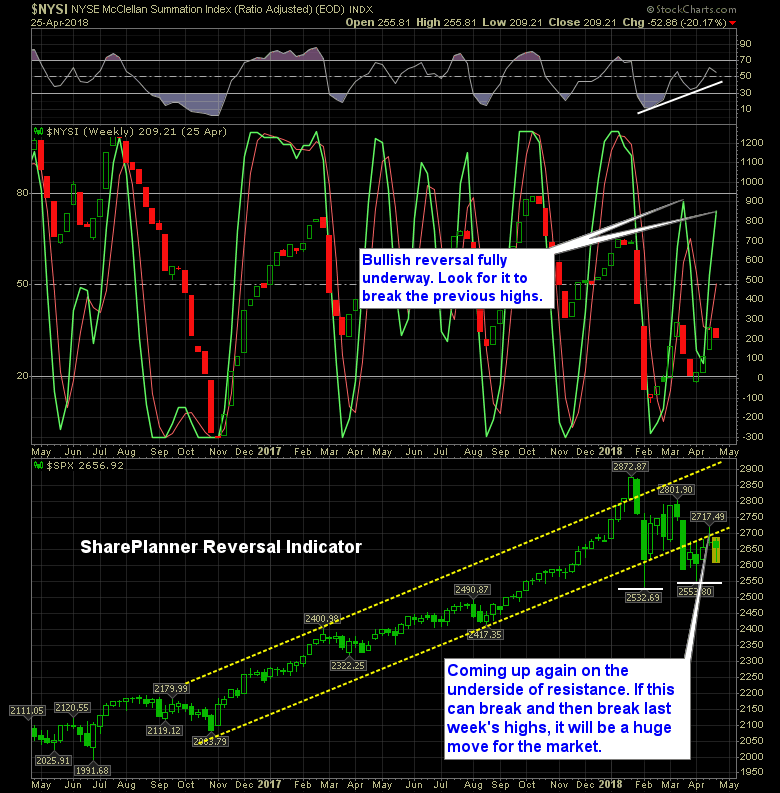

The bulls can make it happen here as April quickly comes to a close. Last week the bullish reversal signal came through for the market, and while, it hasn’t been a clean ride, some substantial improvement in the market’s technicals can be had here.

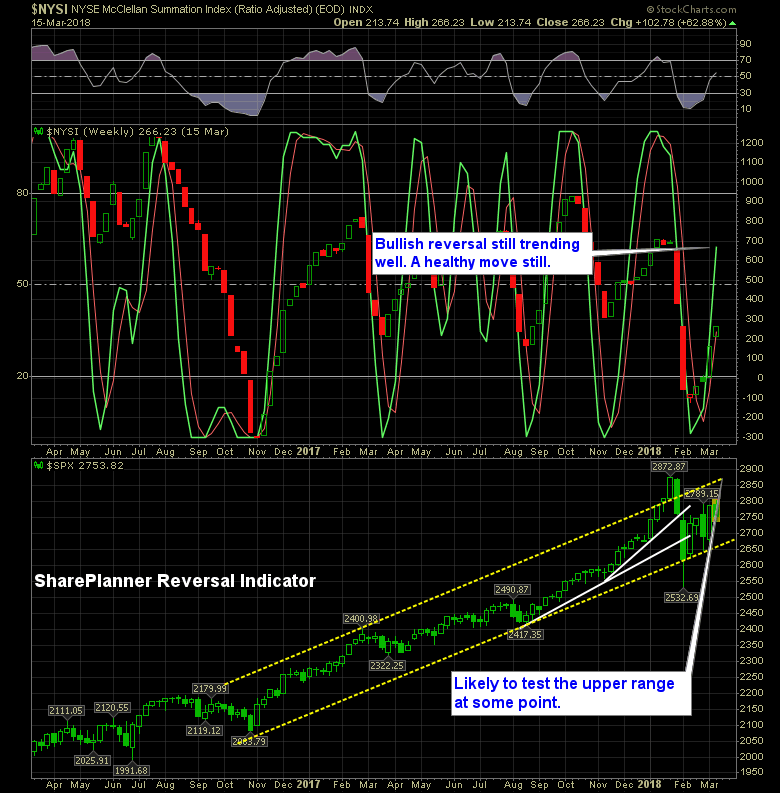

It has been a couple of weeks since we received the bullish reversal and it remains strong today. Price action this week has been less than desirable, to put it mildly, but that hasn’t affected the SharePlanner Reversal Indicator from trending bullish still.

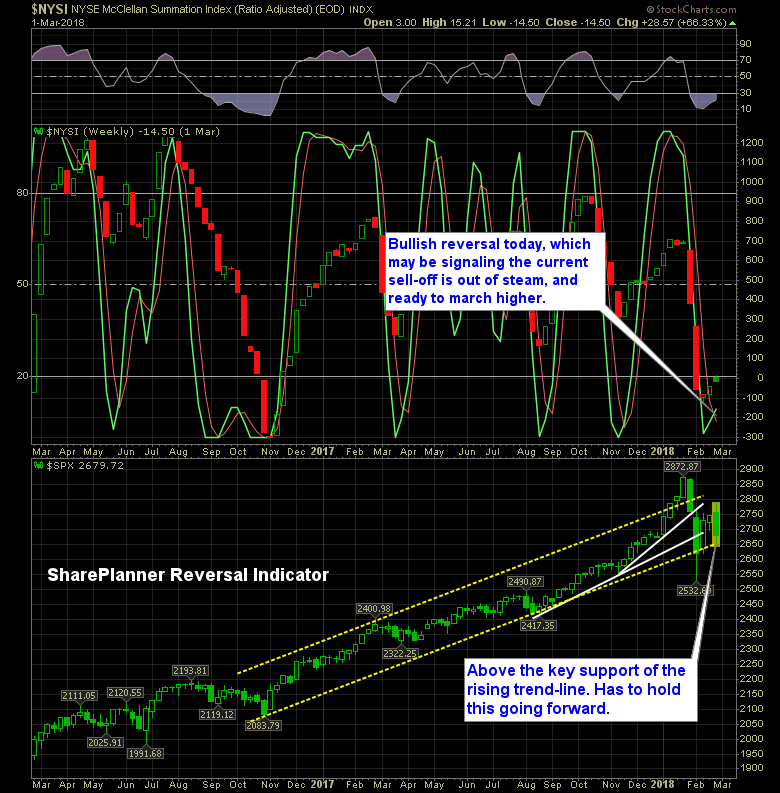

Bullish signal on the reversal indicator confirmed Last time we had a bullish reversal was back in mid-November when the market had been flat-lined for about a month. Once the signal took hold, the market rallied 300 points to the January highs, before the bearish signal finally took hold and gave us one of the

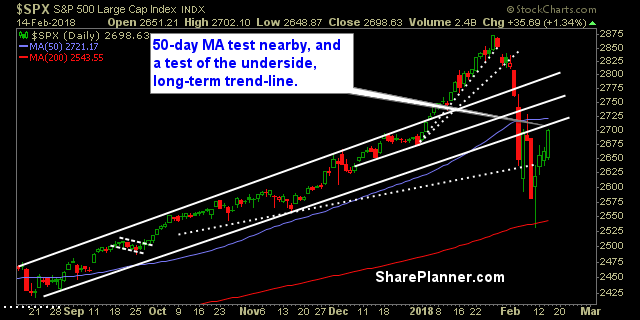

Last week’s sell-off hit extreme reading on the SharePlanner Reversal Indicator. Following the bounce off of the 200-day moving average on the S&P 500, it is no surprise, that we saw one of the best one-week rallies in years. However, with a three-day weekend ahead of us, next week represents another chapter in what has

My Swing Trading Approach I have large gains in Bank of America (BAC), Apple (AAPL) and Amazon (AMZN) after buying the dip last Friday, and have added a few more positions since. Will look to add more if there are more opportunities that arise. Indicators