Here’s tonight’s trade setups for tomorrow’s market: Long Best Buy (BBY)

Another week of profits in the books and ready for the next. So far the market has been up six days and down six days. Futures are up nicely this evening which should translate well for the swing-trading portfolio which bagged profits of 5.2% in ALGN and 4.4% in CX among other trades. On

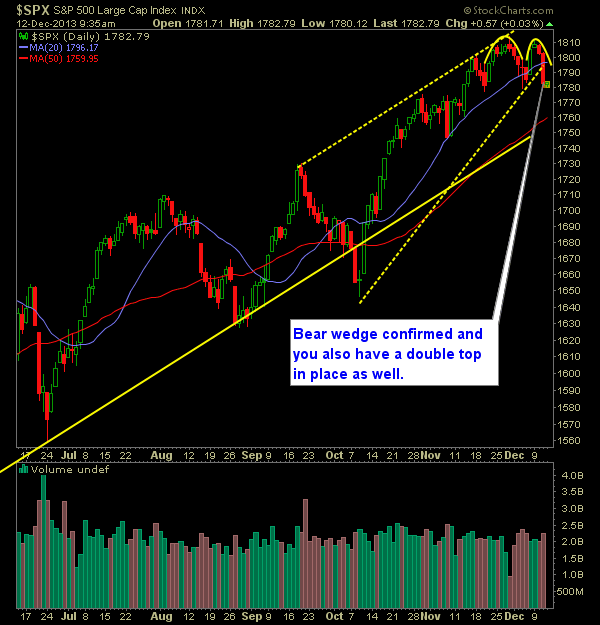

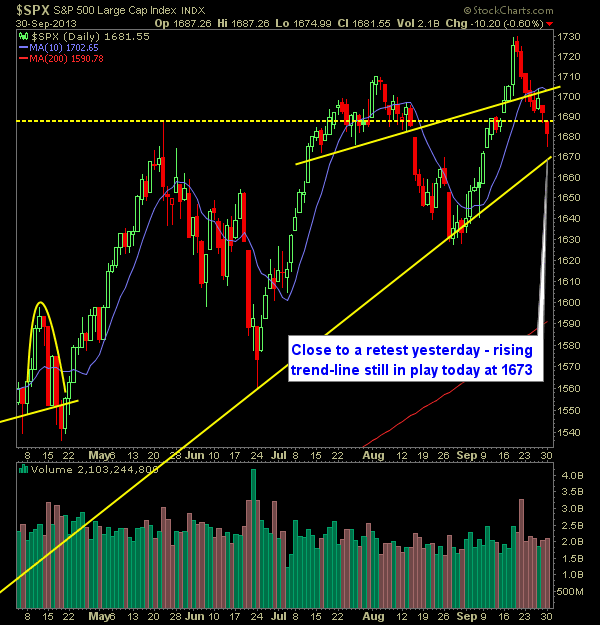

Pre-market update: Asian markets traded 0.8% lower. European markets are trading 0.5% lower. US futures are trading flat ahead of the market open. Economic reports due out (all times are eastern): Jobless Claims (8:30), Retail Sales (8:30), Import and Export Prices (8:30), Business Inventories (10), Quarterly Services Survey, EIA Natural Gas Report (10:30), Technical Outlook (SPX):

Pre-market update: Asian markets traded 1.0% lower. European markets are trading 0.6% higher. US futures are trading flat ahead of the market open. Economic reports due out (all times are eastern): MBA Purchase Applications (7), EIA Petroleum Status Report (10:30), Treasury Budget (2) Technical Outlook (SPX): Slight pullback on light volume yesterday poses little threat to

Nice megaphone play that has Baidu (BIDU) bouncing right back to the short-term uptrend. If it holds, it could be good for $10-15 to the upside. So if you are going to get long, get long above $154. The ideal stop-loss is probably somewhere around $149.50. Here’s the BIDU technical analysis:

Pre-market update: Asian markets traded -0.5% lower. European markets are trading 0.2% higher. US futures are trading 0.3% higher ahead of the market open. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Redbook (8:55), PMI Manufacturing Index (8:58), ISM Manufacturing Index (10), Construction spending (10) Technical Outlook (SPX): Yesterday’s sell-off

Here are my Swing-Trading setups that I am watching today: Long: Krispy Kreme Doughnuts (KKD)

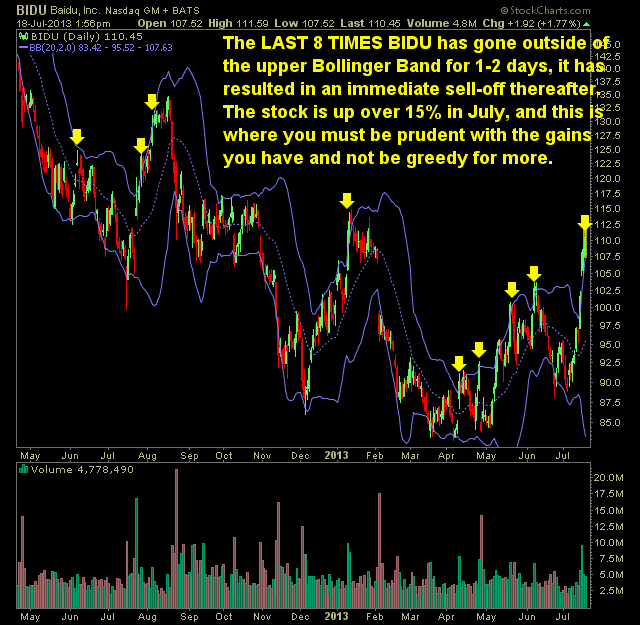

Baidu (BIDU) is offering us one heckuva short opportunity. Perfect rounded top with those beautiful golden arches (confession: I got hungry for some McDonalds as I was drawing those arches). The time to get in BIDU as a short is now. As it is just now breaking the neck of support on the stock

If you’ve held Baidu (BIDU) for much of or frankly any part of July, you have a nice chunk of cast in return for spotting this stock. If you’ve shorted it before this point…Yikes! you are probably regretting it big time. Nonetheless, Baidu (BIDU) despite its incredible rise higher, is hitting some familiar ground

$BBRY Daily Chart - Always trying to make a presence on my scans, but again 15.52 is the cherry on the cake. If it does not get to that level, there is no trade long or short. $BIDU Hourly Chart - Needs to cross 86.55 to looks like a good long trade. It will most