What a Year for Swing-Trading in the Splash Zone!

There was so much euphoria surrounding this market. Traders saw stocks rise to records on almost a daily basis. Heck, money was literally being created out of thin air. Don’t believe me, just take a look at the crypto market whose top 10 biggest coin’s cumulative value is worth over $500 billion!

Ask millenials what bitcoin is, and the typical response will be similar to that of a person singing along to a song on the radio, but only knowing half the words.

Ask anyone older, and they will reflect back on the late 90’s and what it was like every time a company put out an announcement that they would be creating a website. Yes, the comparisons are eerily similar and the exuberance identical.

But cryptocurrencies are here, and despite the record finishes for the stock market this year, they stole the show.

Meanwhile, I placed 317 trades in 2017 (none of which involved cryptocurrencies). I almost beat my record of 327 in 2016, but not quite.

I actually still have two trades that remain open from 2017 and both are holding some solid profits, with Splunk (SPLK) and Fedex (FDX) each up about 8%. Once those two trades are finished, the year will be officially be done.

For now, I simply manage the trade!

So let’s get to it. Let’s get down to the nuts and bolts of 2018, and just how well did it go?

First off, out of my 317 trades, 183 of them were winners. For a 58% winning percentage.

Related: See all of my Swing-Trades and Past Performance

Historically, my average has been around 52-53%. As you can imagine, I was very happy about the pop in my winning percentage.

Only time will tell, whether I can keep the 58% winning percentage going into 2018. I think I can do it, I am certain going to try to do not only 58%, but more than 58% – perhaps 60% is in the cards in 2018!

People who enjoy the thrill of placing a trade will be thrilled about having 317 trades, but for me in particular, I don’t like that number. There needs to be far fewer trades in 2018. I want to do a better job of riding the trends on existing trades much higher. If I am holding my trades longer, by identifying and trusting the technical analysis of the charts with a greater degree of confidence, the number of trades that I make, will naturally go down.

In 2018 I want to see less than 250 trades, and to do so, I need hold the trades longer. But I can’t simply do that arbitrarily. I need to hold the trades longer, because the stocks are trending higher (or lower, depending on the side of the trade I am on).

So, I’m not looking to trade less for the sake of trading less, instead I am wanting to trade less in 2018, because I believe, it will result in greater profits, less commissions and a better return on the individual risk for each trade.

Okay, so that’s an area of improvement for my trading, now how about something I did well:

I was consistently profitable. The S&P 500 was down only one month on the entire year, I finished higher each month during 2017, which takes my streak to 23 straight months without a down month.

Not every month was easy, during the month of August, it looked like the S&P 500 would close notably lower on the month – about 2% or so, but in the final three days, it made an improbable rally that saw the index go from firmly in the red to just barely in the green.

Here are some additional quick facts about my swing trades:

- Favorite trading month: August – The market spent most of the month trading lower, and it was the one of the few months that actually provided me with some decent shorting opportunities. opportunities to profit on the short side. August actually provided some quality short setups.

- Most hated trading month: December – this has become my least favorite of all the trading months. The light volume was difficult to trade and the boredom was almost too much at times, as stocks found every reason not to move during trading hours.

- Favorite Quarter: Q3 – Probably the most opportunities to short the market, also, the gains were consistent

- Most annoying Quarter: Q4 – intraday sell-offs followed by an immediate bounce back resulted in a number of trades getting stopped out, only to see them go right back up. That wasn’t the least bit irritating.

- Best Long Trade: Twitter (TWTR) – First time trading it, and though it wasn’t my biggest gain, from beginning to end, each decision made along the way was the right one, and it returned 8.5% overall. It was really a nice and easy trade. I enjoy those!

- Favorite Short Trade: Intel (INTC) – Not much to choose from considering how few opportunities there were.

- Ugly trade of 2017: Alibaba (BABA) on 11/9, closed on 11/15 with a loss of 3.8%, the biggest loss I took all year. I only had 8 trades in in 2017 more than 3.0% in losses, which is something, no doubt, worth being proud of.

- Most traded stock: Alibaba (BABA) – 14 times

- Most traded ETF: Bearish 3:1 SPX (SPXU) – 34 times

- Favorite sector: Technology – The industrial sector was also a great sector to trade, but the bulk of my trades focused on tech.

- Most hated sector: Oil – even when I did have profits in this sector, they were very difficult to hold on to.

- Favorite Industry: Semiconductors – there was a lot of profits to be made in this industry, all throughout the year. Some really great trades in that one.

- Least Desirable Industry to trade: Global Banks. I just couldn’t put a finger on this industry. A few wins, but mostly trade setups that showed all the potential, but nothing noteworthy in the results column.

Best trading strategies employed

I profited immensely by focusing primarily on the technology sector and staying away from other more difficult areas like oil and basic materials. In the second half of the year, they became much better for trading, but the first half of the year, they were dead money. While the industrials were a phenomenal sector to be in, and was, overall, my second favorite sector to trade, technology led the way with the best opportunities. By focusing on tech stocks, much of my profits came from this area of the market.

The other strategy, and it was as simple as can be, was to ‘Buy-the-Dip’. I am not a blind “BTD”er” though. I like to see evidence on, at least, the intraday chart that the market is willing to bounce first before jumping in. Using that strategy though was a great one, and it allowed me to take advantage of a few solid buying opportunities that the market presented.

It is hard to sit on the sidelines and watch a stock that you wanted to trade just rally without you. I hate it as much as anyone, but chasing after it, is a dangerous proposition too. What I found helped me quite a bit, was to wait a few days and let a bull flag pattern develop that will allow me to take advantage of the next leg-up that the stock makes. When I did that, it gave me an excellent reward-to-risk ratio, while keeping away from the chaser’s mentality.

Greatest lessons learned

There were times where I jumped the gun and pulled out of some of my trades far too early, particularly in an effort to keep my losses ‘super-small’. While at times that saved some capital for me, at other times it forfeited the eventual gains that would have been realized had I adhered to my original stop-loss until there was a better one to be had. But another similar issue was found with me booking profits far too early in a trade. I would close it out on strength because it was overstretched, or because I didn’t necessarily care a great deal about the candle pattern.

It is one thing to do that on a trade that is only moving gradually higher. That I can understand. If you have been in a stock for a couple of weeks, and you are only sporting 1-2% in profits, perhaps sell and move on to a better opportunity.

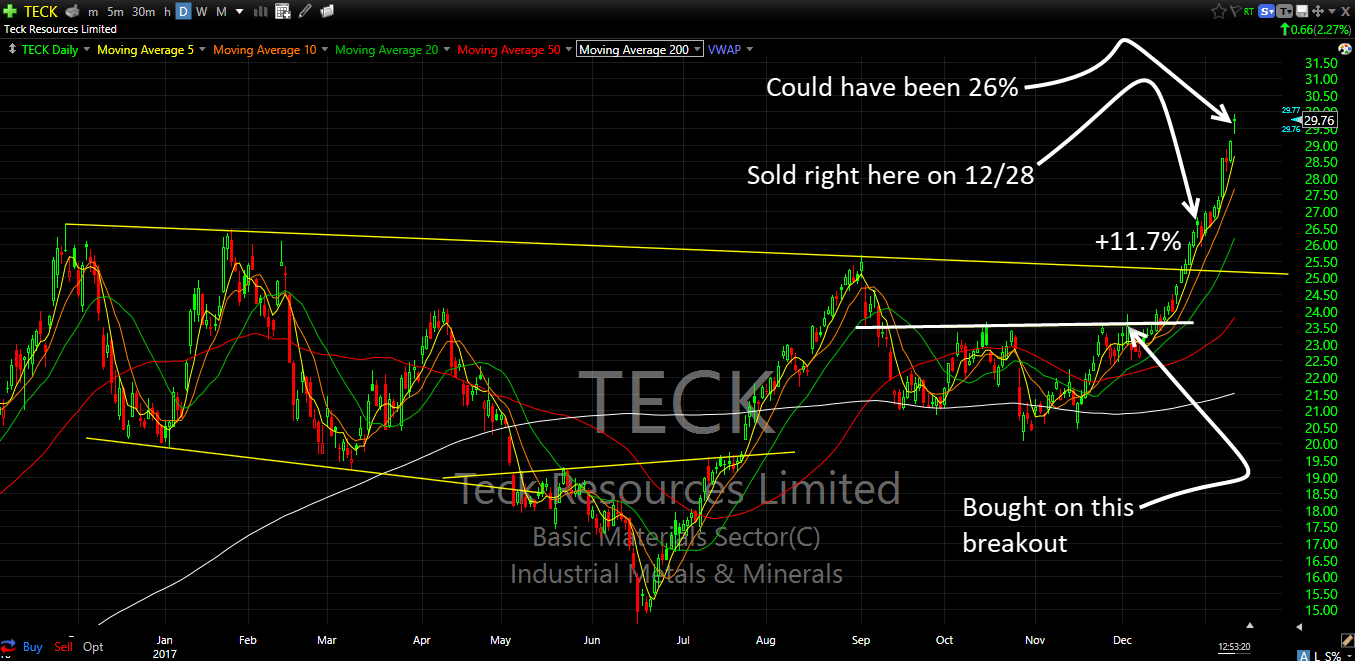

There were two trades that really stuck out to me: Teck Resources (TECK) and Square (SQ). The former made a nice 11.7% on the trade. I rationalized that I didn’t like the candle and that the stock was extremely overbought (both were true at the time), but with momentum stocks that are soaring in an industry that is moving just as fast, these are golden opportunities. I didn’t maximize the value of the trade as I should have.

The latter example, SQ, I made a solid 4.4% profit in two days, but the bigger picture was there was plenty more to be had. Though it made its way to almost $50/share, there may have been one day along the way that might have shaken me out of the trade and that was on 11/9 with the massive sell off and subsequent bounce. Even assuming that I would have been stopped, it was still about a 10% return that could have easily of been realized, instead of the 4.4% I walked away with..

Finally, the last lesson that I want to share is with shorting a market, even for hedging purposes during a very bullish run.

There were a few times last year, where I was far too quick to pull the trigger on SPXU, and other times I went ahead and even pulled the trigger on QID or a QQQ short. The year was marked with intraday sell-offs that saw immediate “V-shaped” bounces.

Heck we could see declines of more than 2%, only to see the bulls rally the troops back to or near break even on the day. We saw it on a monthly basis too, when the bulls saved August on the last day, in the last minute of trading from finishing lower on the month.

I’m not saying that there wasn’t legitimate opportunities to short the market, but there were times on an intraday basis, where I was simply pulling the trigger far too quickly.

These are trading lessons to learn from

Making the mistakes that I made during a very successful trading year is okay and nothing to be ashamed of. What is most important, is that I am recognizing those mistakes and am trying to learn from them for the year ahead.

In 2018, I will make mistakes, I guarantee it! But it is what I learn from them that will make me a far greater trader in the years that follow. Spotting some of these tendencies is important, because it will only allow me to grow in my trading abilities.

I would also encourage you you to take the next step in your trading, by joining the best community of traders, with the SharePlanner Trading Block. There are traders of all types and skill levels, collaborating each day to become better and more profitable in their craft. I am there each day as well sharing my market insights and my real-time trade alerts. Every trade I make, I post it in the chatroom as well as send it out via text (international too) and email.

You can sign up today and receive a Free 7-Day Trial to see if the Trading is right for you, by clicking here.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode, Ryan examines one swing trader's disaster of a trade in Robinhood (HOOD) and the problems that come with not managing the trade and managing the risk in every swing trade that one takes.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.