Summary: This screen identifies those stocks with strong insider ownership and a willingness to continue increasing their stake in their own company. Continued buying from the insiders is what I am looking for here. Frequency: Bi-Weekly Target: Long Setups, US Stocks, Small, Mid, Large Cap Last Updated: March 10, 2014 Screen Results:

Summary: Option plays with some of the highest levels of volatility found among those traded, with a recent surge of strong volume. Frequency: Updated Weekly Target: Option Plays, US Stocks, Small, Mid, Large Cap Last Updated: March 10, 2014 Screen Results: [/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

Summary: These are companies that continue to impress regularly when it comes to their earnings. They have a history of repeatedly beating earnings estimates. Frequency: Updated Monthly Target: Earnings Plays, S&P 500 Stocks Last Updated: February 17, 2014 Screen Results:

Summary: The last two earnings reports has shown a strong earnings percentage change that ranks among the best among its peers despite 6 months prior their EPS percentage change was among the worst. Frequency: Updated Monthly Target: Long Setups, US Stocks, Small, Mid, Large Cap Last Updated: February 17, 2014 Screen Results:

Summary: I am screening for those stocks with a strong dividend and a strong dividend growth rate. Frequency: Updated Monthly Target: Income Plays, Mid and Large Cap Last Updated: February 17, 2014 Screen Results:

Summary: Stocks with rising profits, strong price action, and a share price that does not truly reflect the growth rate. Frequency: Updated Monthly Target: Long Setups, S&P 500 Stocks Last Updated: February 17, 2014 Screen Results:

Summary: When times are uncertain and you need some stability in the portfolio to weather the storms of the market, the stocks below have a great track record of holding up when everything around them are falling apart. Frequency: Updated bi-weekly. Target: Long Setups, US Stocks, Large Cap Last Updated: March 10, 2014 Screen Results:

Summary: This screen identifies those stocks with strong insider ownership and a willingness to continue increasing their stake in their own company. Continued buying from the insiders is what I am looking for here. Frequency: Updated Monthly Target: Long Setups, US Stocks, Small, Mid, Large Cap Last Updated: March 10, 2014 Screen Results:

Summary: The stocks listed below are showing cracks and an above average likelihood that they will move lower in the days and weeks ahead with weakening price action as they close in on key support levels. Frequency: Updated Weekly Target: Short setups, US Stocks, Small, Mid, Large Cap Last Updated: March 10, 2014 Screen Results:

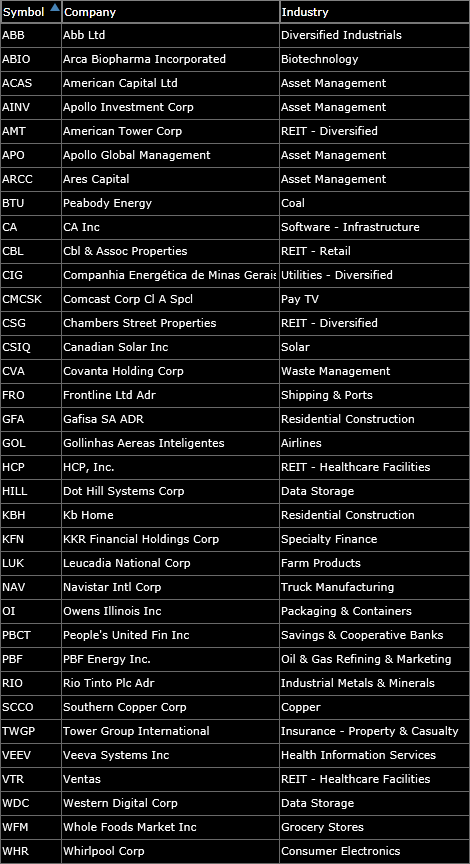

Summary: This screen targets stocks that are trading with a below average P/E ratio in conjunction with strong prospects for future growth as well as street interest. Frequency: Updated Weekly Target: Long setups, US Stocks, Small, Mid, Large Cap Last Updated: March 10, 2014 Screen Results: