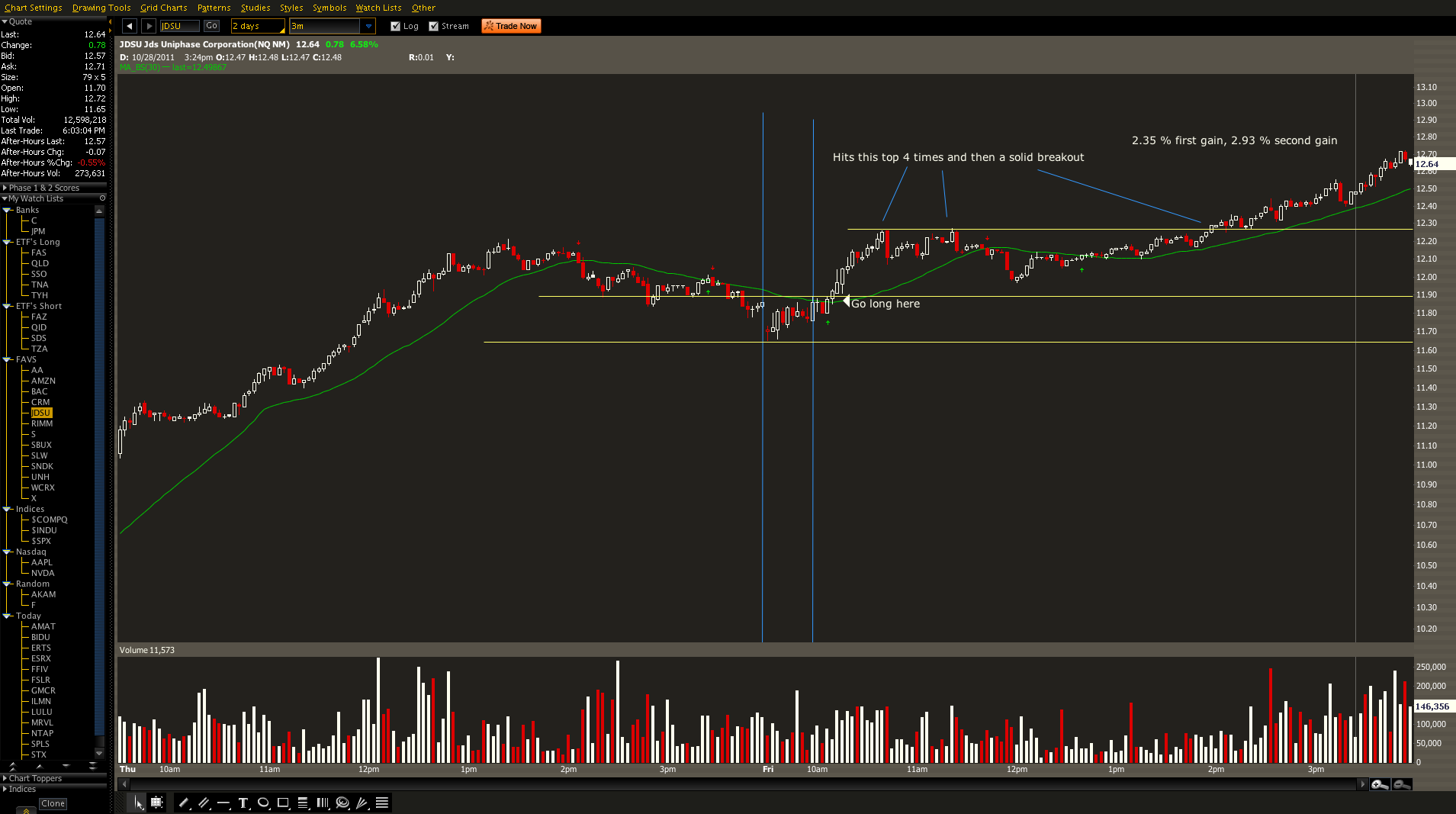

JDSU continues to be a solid gainer for me...a stock that usually moves quick in either direction, which is what I tend to like for fast day-trade gains. Get in after the 10 am mark, get out at the 30 day moving average. Note how you play it again for a 2nd time and double

This is a good example of a selling short that fails, although I say that with a grain of salt. I'm not going to short something JUST because it's showing it on the chart. This stock is already falling off about 4% in 30 minutes, so to keep shorting it after 10 am would be

I was at a fire station with my 2 year old and missed this. These don't come around every day!

Self explanatory...yummy.

Nice example...gap up, moves down, back up a bit and then slams through the low of the day after 10 am. See more at www.talesofthedaytrade.blogspot.com

Self explanatory...see more at my blog www.talesofthedaytrade.blogspot.com

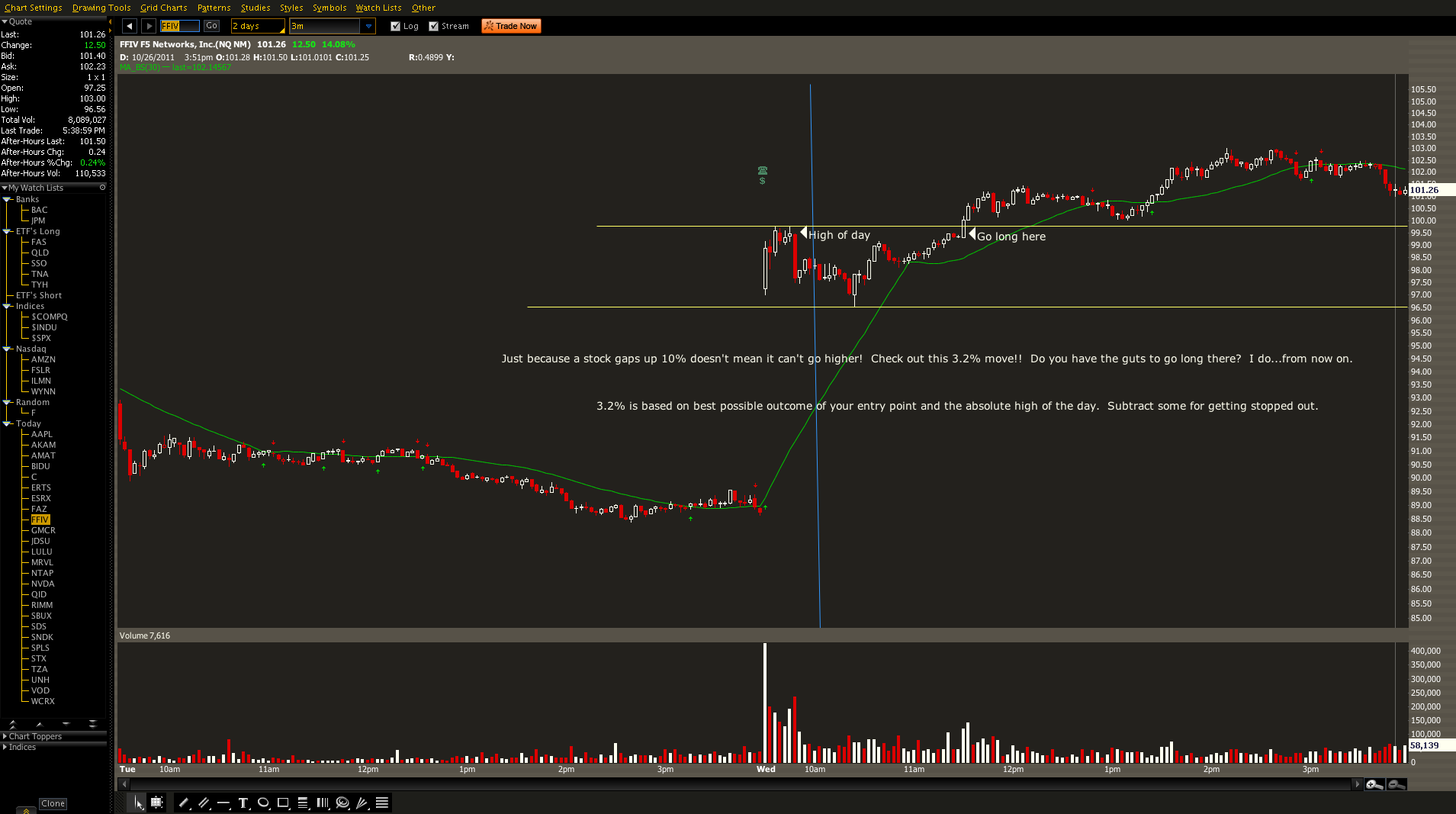

Here is a great example of when a stock gaps up and keeps going up for a good 10% move. Move all over? Look at other things for the day? I think not! If you traded the high of day breakout you'd make another 3-4%. Not bad!!!!