UPDATE: Emad was our winner, simply for following my @shareplanner twitter account. We'll do this again shortly so be ready for the next contest giveaway. I haven't done one of these in a while but it is about time that we get the giveaways rolling again. This time around, I am giving away my Swing-Trading

Today has marked another gap up, quick surge higher then steady consolidation thereafter. We may see some profit taking into the close considering how we have been trading against the intraday R3 pivot level all day. Today’s lazy trades offers a nice basing pattern in Just Energy (JE) and currently breaking out to the long

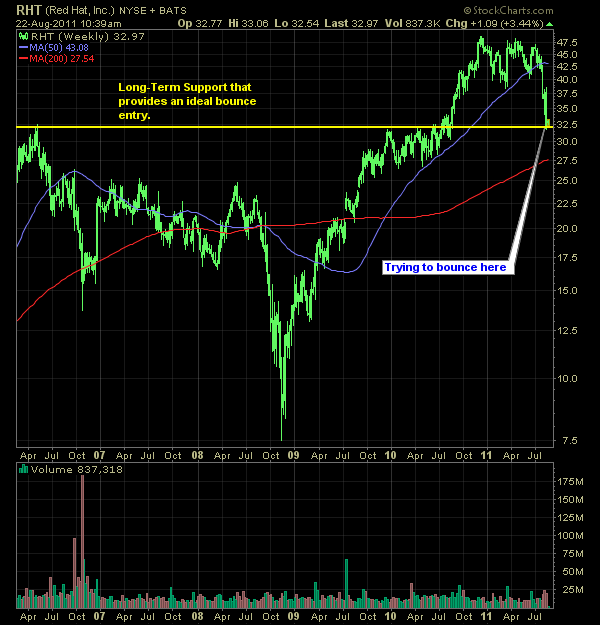

Even with a very strong and bullish open, the bears, nevertheless, took it as another shorting opportunity. I am watching 1134 on the S&P to see whether we can hold those intraday lows. We break that I think we will likely fill the morning gap up. I've provided a few bounce plays, two of which

When I provide my daily trading plan tomorrow, I will be 100% in cash – something that doesn’t happen all that often. At the close on Friday, I proceeded to close out all eight existing positions in my portfolio. But let me be clear, I’m not some dooms-and-gloom guy calling for a market crash on

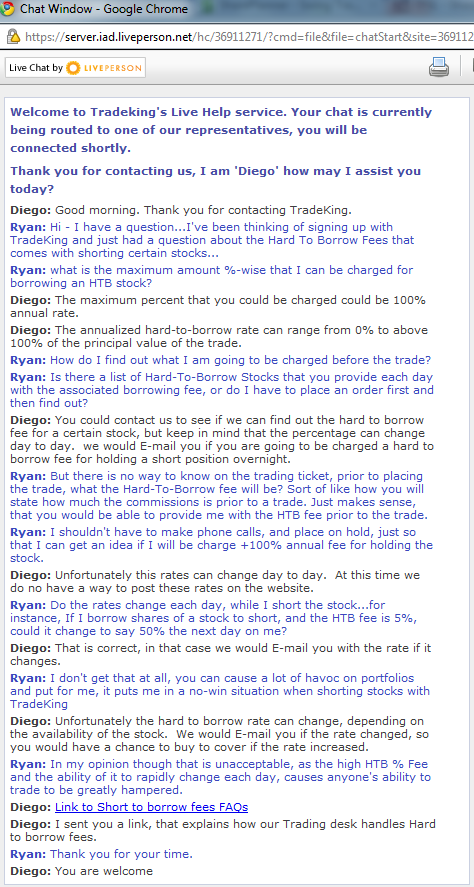

I was made aware this morning by one of the people in the SharePlanner chat-room that they are being charge astronomical “Hard-To-Borrow” fees for shorting stocks. Even for a lot of your regular, “run-of-the-mill” stocks are being charged a high percentage fee tagged with shorting them. This is troublesome to me, especially considering that unless

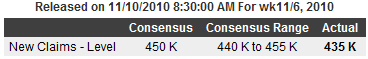

For immediate release Information received since the Federal Open Market Committee met in September confirms that the pace of recovery in output and employment continues to be slow. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is