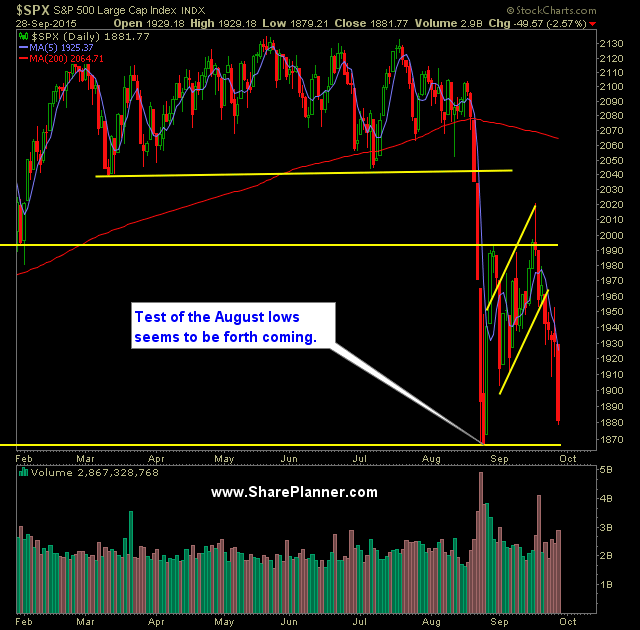

Technical Outlook: SPX sold off for a fifth straight day with a 50 point sell-off yesterday. SPX is only 14 points away from testing the August lows, which seems inevitable that it will be tested at this point. The volume from yesterday on SPY wasn’t as strong as I would have expected considering the

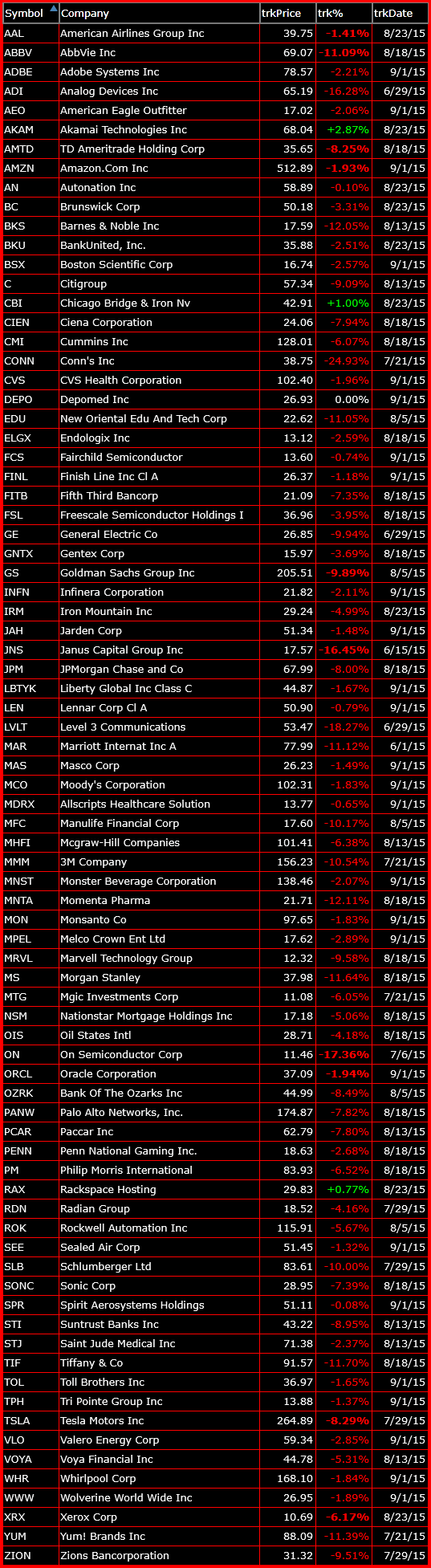

The bulls are nowhere to be found, and today’s selling is a bit downright scary. I came into today with 40% of my portfolio short on this market and I covered BID today at $32.48 (swing-trade) for a 6% gain. So now I am 30% short and yes, I am in the quandary now where

The short lived bounce yesterday has turned into bearish pandemonium today with them the market facing a possible 2% decline on the day. I added two short positions from the list below yesterday and I added another one today. All three of which are doing just fine. So I still have 70% cash that I

The bulls are showing signs of running out of steam finally with the sell-off on Thursday following the FOMC statement which was followed by the huge gap down lower on Friday. Today looked as if we’d finally see that bounce and after a respectable gap up and rally thereafter, the momentum in the market began

The bulls have hit the snooze button to begin this week, as the market seems to be languishing after a rather impressive rally last week. We are seeing today, much of what we have seen the previous two days of trading and that is a market that lacks any real kind of energy, except for

I came into today with my portfolio 100% in cash. But early on this morning when the market showed signs of weakening, I went ahead and added a short position to the portfolio. I don’t have any desire to add more short exposure until I can see what this market intends to do overnight. I

This market… 10 weeks of down, up, down, up on the weekly chart of SPX, despite the market pushing much lower during the last three weeks, it is nonetheless, making it very difficult to short for any length of time beyond a day-trade. Then sprinkle this sell off with massive gaps in both directions. Over

The bears are back in the driver’s seat after last week’s dead cat bounce. This is none surprising as I have mentioned numerous times in my recent trading plans to not trust the strength of the bounce. I also noted that at the 50% Fibonacci retracement level, we could end up seeing some real

We are on a historic 3-day rally that started Wednesday of last week and ended on Friday. Today we see some selling but not anything to get too serious about. And with trading in the final hour, all bets are off as to what this market might try to do in to the close. With

Where has “Turnaround Tuesday” Gone off to? Geesh! Just when you thought that there was something holy and sacred in the market, you come to find out that even Turn Around Tuesdays are not immune to the wiles of the market coyote. Three out of the last four tradings sessions have been down on Tuesdays