A rather quiet day in the stock market turned chaotic after Carl Icahn started talking in apocalyptic terms during an interview on TV. While I wouldn’t be surprised by this market if we popped back up tomorrow and recovered Monday’s losses, I nonetheless had to take notice of the market action at hand.

Also the fact that we are trading outside the upper Bollinger Band on the weekly chart makes me a bit uneasy since historically that has lead to near-term sell-offs. As a result, I curbed some of our long exposure by getting out of PAY at $24.69 for 5.2% in gains or $1,030, plus I closed out MOS at 48.59 for a 1.72% gain and $344. Finally I cut my losses in IR at 67.59 for a -0.5% loss or -$106. The total combined winnings on the day was a solid $1,268 in gains.

So don’t stay on the sidelines, go ahead and give our Free 7-Day trial of the SharePlanner Splash Zone a try at no cost to you. With it you will get my swing-trades and Oscar’s day-trades, all via our real-time trade environment with email and text alerts as well as our chatroom. Start the process by clicking here.

And with that, here are tonight’s swing-trading setups for tomorrow:

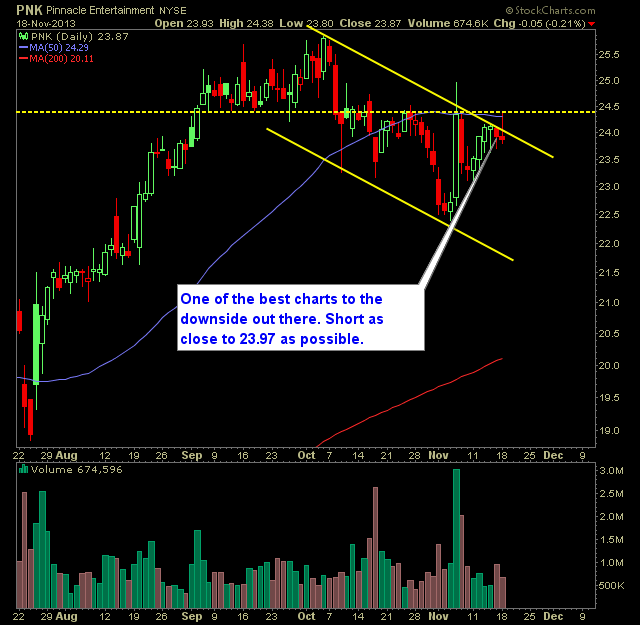

Short Pinnacle Entertainment (PNK):

Short Radian Group (RDN):

Short Acadia Pharmaceuticals (ACAD)

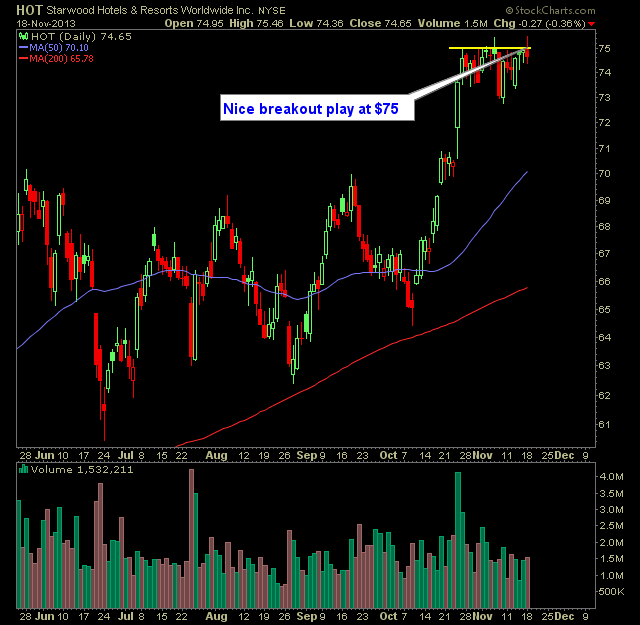

Long Starwood Hotels & Resorts Worldwide (HOT)

Long Las Vegas Sands (LVS)

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Each year I like to take a moment to reflect on my swing trading from the prior year. The 2025 trading year offered a lot to be happy about, but it also changed my views in a number of ways and gave me some lessons to take from it, as well as some new perspectives to take into 2026 as I navigate the stock market for yet another year. I'm hoping this moment of reflection in this podcast episode will be as beneficial for you as it was for me in making it.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.