Here a few shorts to consider for today and tomorrow as market conditions continue to weaken. Haliburton (HAL) Dow Chemical (DOW) Mosaic (MOS)

I'm somewhat surprised by the strength that we've seen so far in the market today. Europe appears to be on the verge of implosion, and we're rallying like there's nothing to be worried about (denial? short-covering?). I'm still long on SCO (oil 2x short), and will likely bail on it, if oil can push above

The market is showing signs of hitting a new rough patch, particularly with issues in Europe running amuk and unable to resolve any of their issues. Below I have three charts showing signs of cracking, and once they clear critical support levels, should see the bottom fall out from underneath them. All three are swing

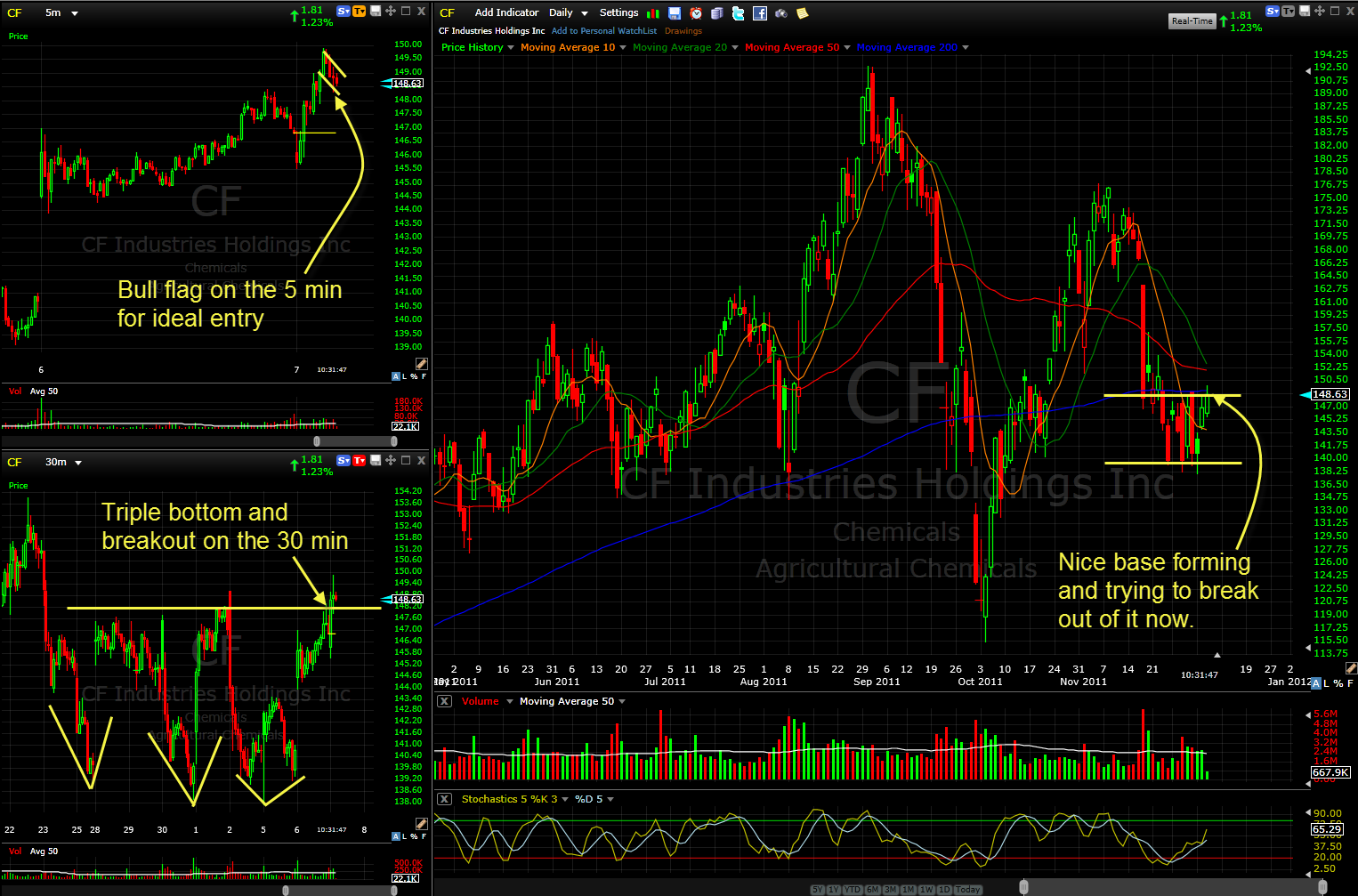

I jumped into CF Industries Holdings (CF) this morning as a swing-trade. The trade may or may not end up being profitable – but that is besides the point for this discussion. What I want to do, is show you WHY I traded CF.

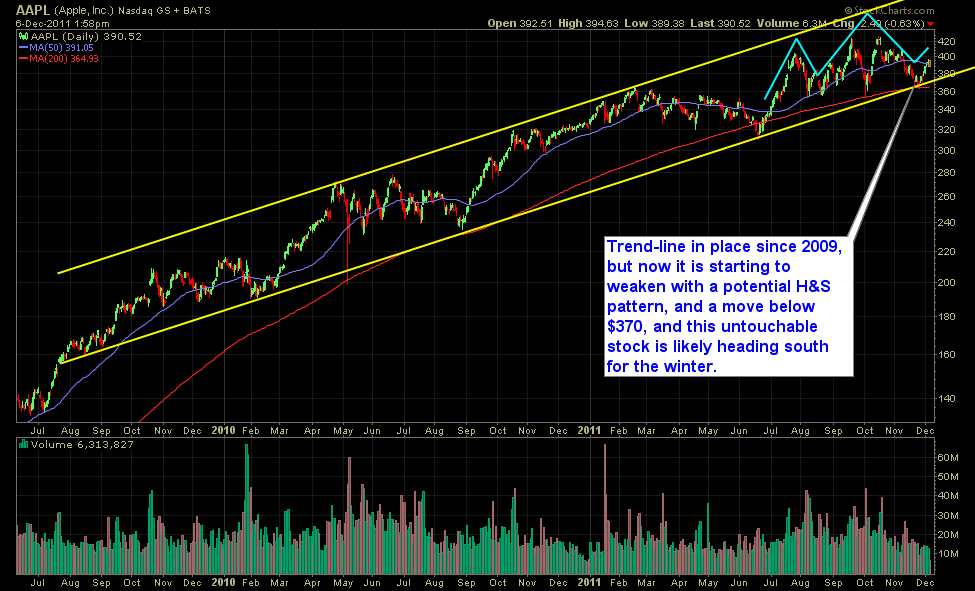

Apple, Inc. (AAPL)

If you’re to ask me, I think Google (GOOG) has done a remarkable job of holding its value this year. I know there have been some fairly rough patches where it declined in excess of 20% on multiple occasions, but as it stands right now, GOOG is close to breaking out to multi-year highs.

Bank of America (BAC), like Netflix (NFLX), has been one of the year’s most talked about stocks. Before 2008, it would have been hard to believe we’d have a market that put BAC in $5 territory (or $2.50 back in 2009), but such has been the case of late. You have tons of rumors

The S&P is on the cusp of breaking out of that blasted triangle, and once it does, the move down in the market should be somewhat of a self-fulfilling prophesy as everyone and their mom seems to be watching it. Whether we break it (and yes we could bounce here still) is anyone’s guess, but

Here’s one of your more traditional “Security-Analysis” stock screens where I am essentially looking for companies selling well below their book value. The stocks below represent 14 companies that are trading at less than half its book value.

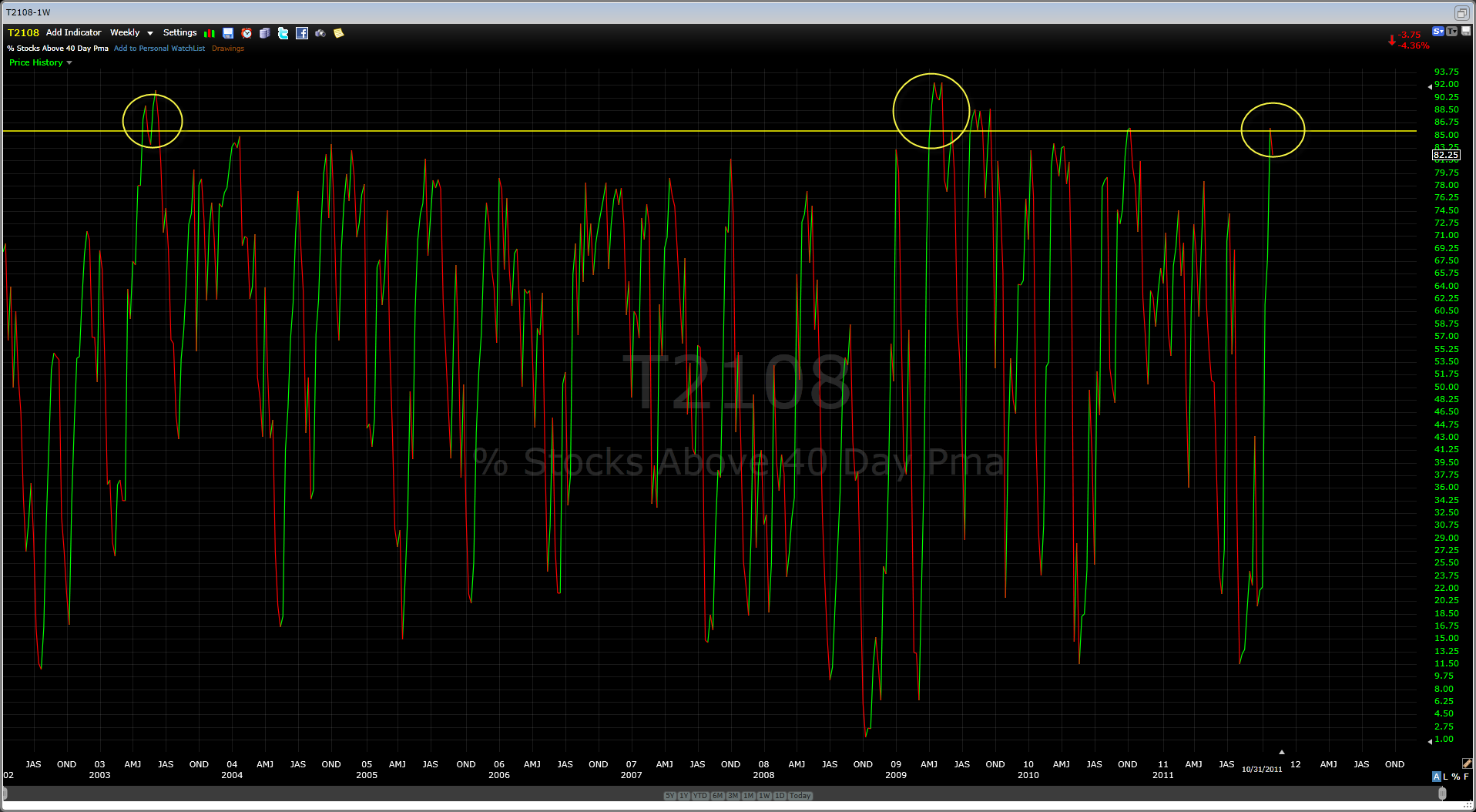

This is a chart that I don’t often publish, but I found it interesteing just how steep and extreme it is. The T2108 is a Worden specific chart that shows the number of stcks trading above the 40-day moving average. Only twice have we seen moves in the market that were more extreme than what