A nice recovery in the broader market today, after a temporary gap lower this morning. I’ve put together two trade setups in each direction depending on your bias. The bull’s sails seem to be a bit limp despite the bears not really being able to take advantage of the situation. While the bulls aren’t giving

JM Smucker says, “It’s Peanut Butter Jelly Time!!!” Stock: J.M. Smucker (SJM) Long or Short: Long Entry: 90.25 Stop-Loss: 87.97

Freeport McMoran (FCX) bouncing off of the rising channel Stock: Freeport McMoran (FCX) Long or Short: Long Entry: 35.50 Stop-Loss: 34.89

Swing-Trades With Risk and One and Bear Flag in Another Another boring range bound market much like we saw on Friday of last week. Perhaps the folks in the Hampton are still shoveling snow out of their driveway (or maybe they are just helping their maid-servants). Nonetheless, the market really isn’t giving us much of

Polyone Corp (POL) Breaking to New Highs Stock: Polyone Corp (POL) Long or Short: Long Entry: 23.16 Stop-Loss: 22.49

Gentex Corp (GNTX) breaking through long-term resistance Stock: Gentex Corp (GNTX) Long or Short: Long Entry: 19.71 Stop-Loss: 19.15

A long and short setup is fitting for a market like this It’s a market that seems to be trading back-and-forth, day-after-day without giving a clear direction as to where it ultimately wants to go. As traders we always want to know where it is going but to be completely honest, it is actually a

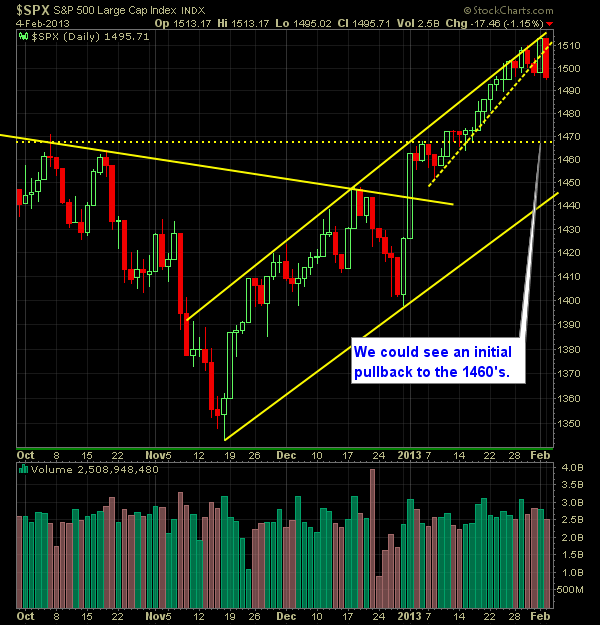

Pre-market update (updated 9am eastern): European markets are trading 0.7% higher. Asian markets traded -1.8% lower.. US futures are trading moderately higher, ahead of the bell. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45am), Redbook (8:55am), ISM Non-Manufacturing Index (10am) Technical Outlook (SPX): Major reversal action on the SPX and broader market

United Continental Holdings (UAL) bear-flag on multiple time frames Stock: United Continental Holdings (UAL) Long or Short: Short Entry: 24.11 Stop-Loss: 24.73

Smith & Wesson bouncing off of short-term trend-line Stock: Smith & Wesson (SWHC) Long or Short: Long Entry: 8.66 Stop-Loss: 8.45