Playing the Pharmacyclics (PCYC) Bounce Stock: Parmacyclics (PCYC) Long or Short: Long Entry: $80.56 Stop-Loss: $77.78

Green Mountain Coffee (GMCR) Ascending Triangle Stock: Green Mountain Coffee Roasters (GMCR) Long or Short: Long Entry: $81.28 Stop-Loss: $78.28

Big day for the market today – breaking above the 1648 level was key. Now they just need to hold it until the close. If 1648 and more so, the 20-day moving average, breaks then this market will be in the same condition as it was for the past month. With that said, I’ve added

I'm a huge fan of trading Ascending Triangles. What are they exactly? Let's take a look at the Ascending Triangle Pattern I found posted on StockCharts.com... Notice how on all six points it bounces perfectly off of the resistance overhead and the rising support below. If you are a new trader these are some of

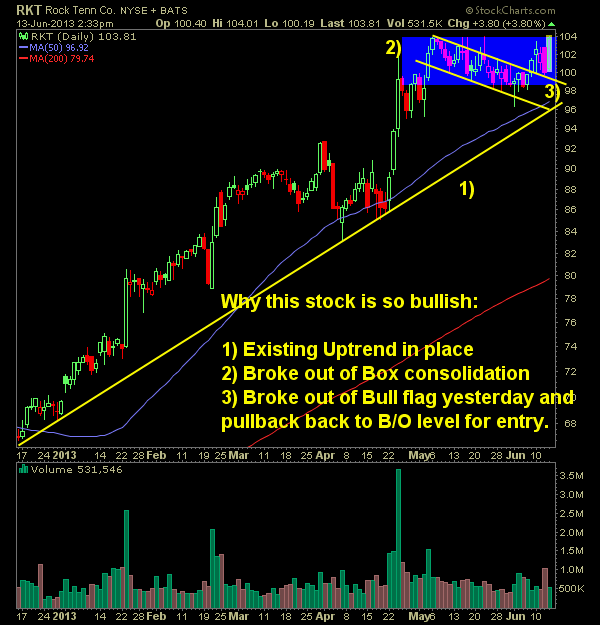

Here is a trade that I made in RKT this morning. What you will want to observe here is just how simple the setup is, and more times than not, with a little bit of risk management at your disposal, you can consistently profit from this trade setup. My Entry on this setup was

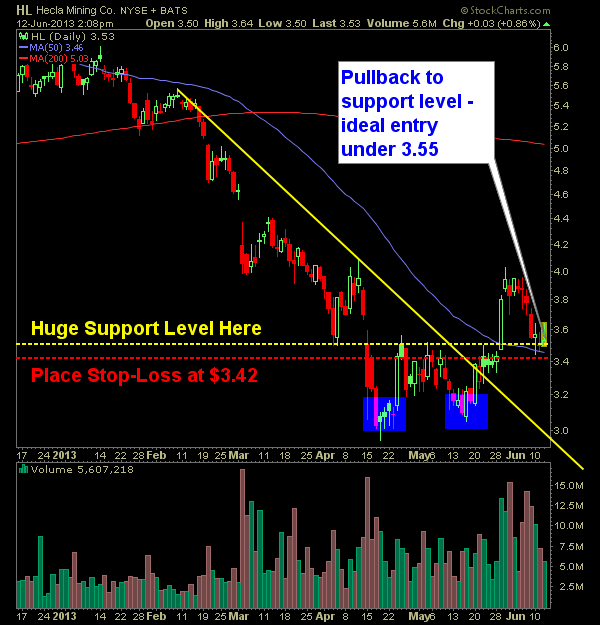

I know being long these days isn’t the “cool” thing to be over the last half month or so. But there are still some excellent swing trades out there. Two Swing Trades To Consider:

Kohls (KSS) breaking out of bull flag Stock: Kohls Corp (KSS) Long or Short: Long Entry: $51.99 Stop-Loss: $50.59

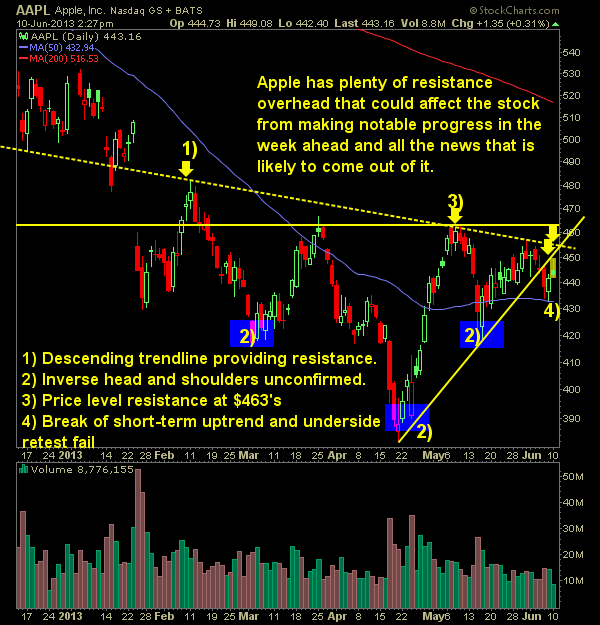

Last week I was coming around to the notion that the Apple stock might in fact be on the verge to recovering, particularly with the inverse head and shoulders pattern that was forming. But fast forward a week, and the conditions have rapidly deteriorated and the concerns from last week are much more apparent this

May look at taking my first short trade in almost three months (that's a record for me) That doesn't make me necessarily a perma-bull (though I do feel like it), I have just not found it, based on the way I trade personally, to successfully trade short in this market. However, this market does worry

CME Group (CME) breaking out of continuation triangle Stock: CME Group (CME) Long or Short: Long Entry: $70.06 Stop-Loss: $67.43