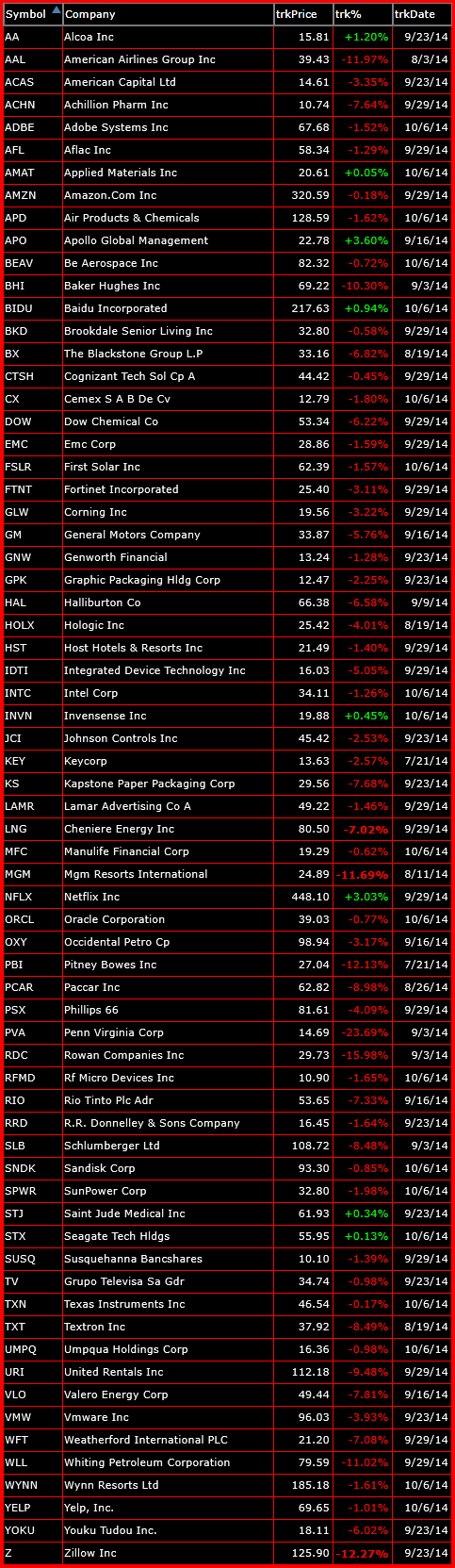

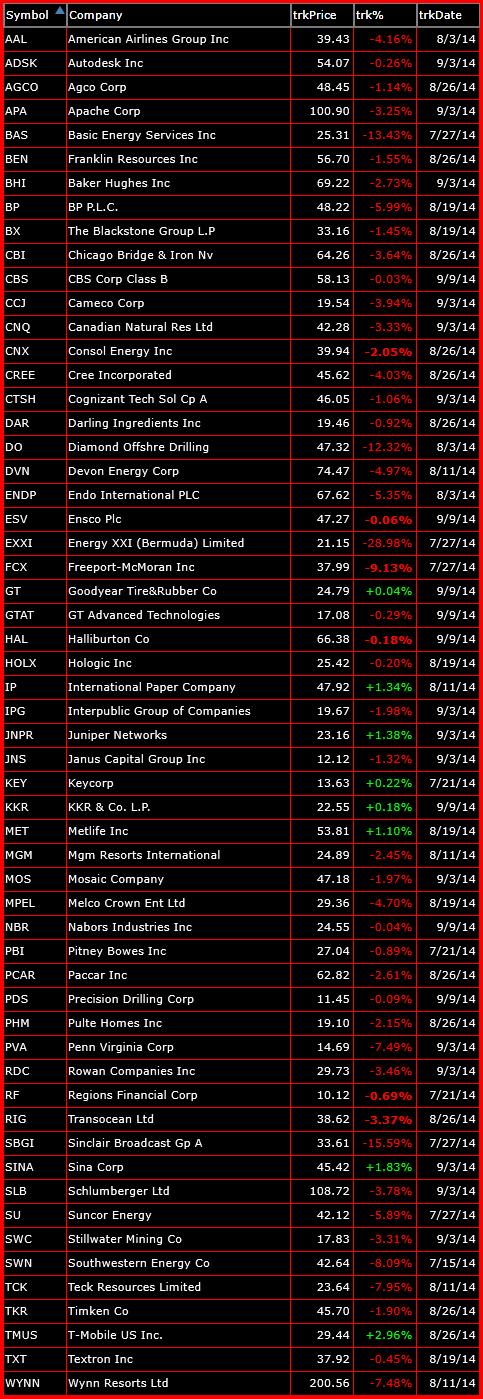

Here’s this week’s bullish list of trade setups. For obvious reasons, there’s not a ton of them out there as the market has simply destroyed 95% of the ones that were out there prior to this huge sell off. So the ones I am watching are those that have the potential to bounce off of

Staying patient in this market is of huge importance. I cannot stress it enough. Just because the market is open doesn’t mean you should be always trading it. I would love to have more positions open right now but I don’t because the market hasn’t shown that it is quite ready to start the second

The amount of opportunities to the longs side is limited at this juncture. The charts have been gutted of late and the opportunities found in the patters before have now been negated. That’s why my watch-list is about half the size of what you are accustomed to seeing from me. The setups are just few

On the daily chart of the S&P 500, the market is no doubt flawed, but today if found support off a long-term trend-line that began back in December 2012 and that trend line was tested and held just like it did back in August last month. I’m not overly confidence at this point that the

After a strong three-day pop last week, the bears have responded with an equally as impressive three-day sell-off. The conclusion to all this is that the market simply isn’t going anywhere, so staying light and nimble and not trying to react to every whim of the market is key. That means not constantly flipping back

The bulls have been completely out of it today, and the charts are showing it. The long setups have been decimated over the past few trading sessions and there are slim pickings at the moment. That can all change if we can get the bulls to recover some of today’s losses or put together a

Heading into today, stocks looked like they were on the cusp of a significant sell-off. But after some rumors circulating about what the Fed will be doing going forward in regards to interest rates, well, the market is back above 2000 and looking to make another push towards all-time highs. With the FOMC Statement coming

The bulls are not on their best behavior these days. Much of it is to do with digesting recent gains during August, which is why we haven’t seen the kind of selling that was experienced on July 31st of this year. Nonetheless, it doesn’t hurt to have a combination of long and short positions in

The market is bending but it hasn’t yet broken And that’s the reason why I am so reluctant to get short until we violate some key support levels. Right now I consider 1990 to be the closest support level to be watching here. If that is broken and we close below that level, I’ll be

On Friday, the market demonstrated that it still had signs of life. Today the market doesn’t seem as certain, but nonetheless, it is still staying right near the new closing highs established last week. I’m cognizant of the fact that SPX has rallied over 100 points since establishing last August’s lows. I’m also aware