I’m no fan of Blackberry (BBRY) in general, in fact the only trade I made in the stock was late last year as a short position which made me a nice profit. However, there may be a bounce opportunity worth taking, especially for those who still believe that this market isn’t, at least temporarily, in

Its bearish out there folks and as you constantly hear me repeating week after week when the market was rising to always maintain a bearish watch-list not matter how bullish the market is. You never know when you’ll need it. Well, conditions started rapidly deteriorating last week, culminating in a nasty head and shoulders pattern on the

Last Friday’s sell-off definitely made an impact on the number of quality long trade setups that are out there. But there are still quite a few to be had. The biggest question at this juncture is whether the market is just using this as a lame dead-cat bounce attempt or if this is just

We’ve had an interesting day so far on the S&P 500, where the bears are attempting to put the market back down below 2100 and below key support on the 30 minute chart at 2104. For the second time in three days the 5 day and 10 day moving average has been lost. Overall none

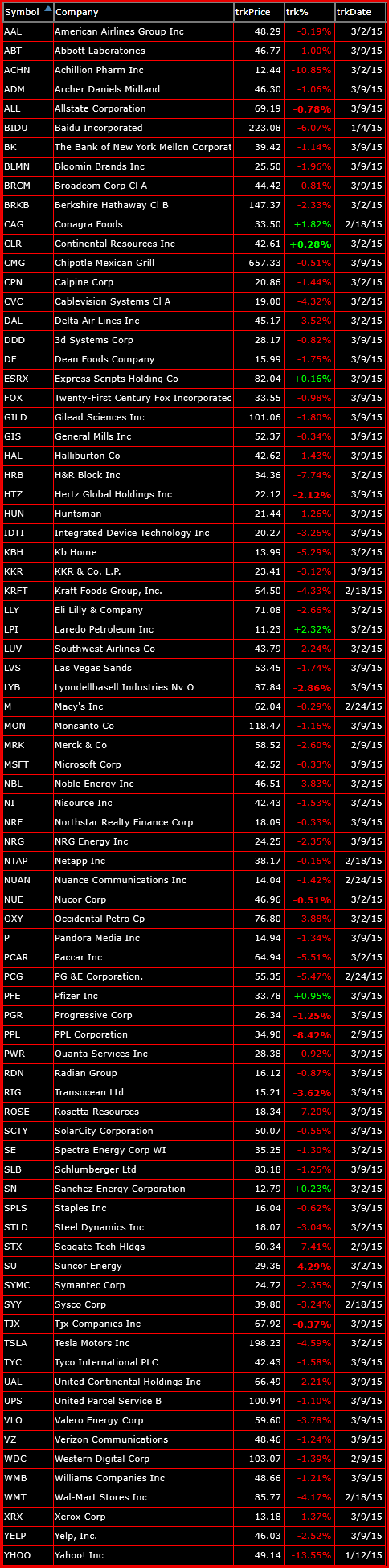

Here’s this week’s Bullish List of trade setups that you should be following for swing-trading purposes:

It goes without saying that the bears are not fairing to well in this market and understandably so. Below you will find my complete list of bearish trade setups and the ones that appeal to me most. While compiling this list, I was trying to think today – how can one really have an edge

International Paper (IP) has had some positive news come out today where intraday it caused the stock price to spike suddenly. But the magic isn’t in the intraday action but rather in the potential breakout on the daily chart that has my attention for the past few days. Currently it is finding solid support off

The market isn’t going much of anywhere so far today, but the uptrend remains well in tact. So far today, SPX is holding the 5-day moving average which leaves little reason to doubt that the market won’t continue its current rally that it has been on of late. Below I have provided the current

The market has been on a strong run through February and doesn’t seem to be looking to stop now or anytime soon. But how many times have we seen a market that looks unstoppable suddenly…well… stop. We saw that occur in December and carry through into January. So while the market looks like it is

It suddenly feels like 2013 again. However, we still have to be careful with this market as there is still plenty of headline risk involved – particularly with the Fed, Greece, and the fluctuation in the price of oil. Nonetheless, I’d be steering far from adding short positions at this point, and focusing solely on the list