It is a new month and the market behavior today is acting as if it wants nothing to do with the gains seen last month. That wouldn’t be surprising either considering that August is the worst month of the year, historically, for the Dow and S&P 500. As a result, I don’t have huge levels

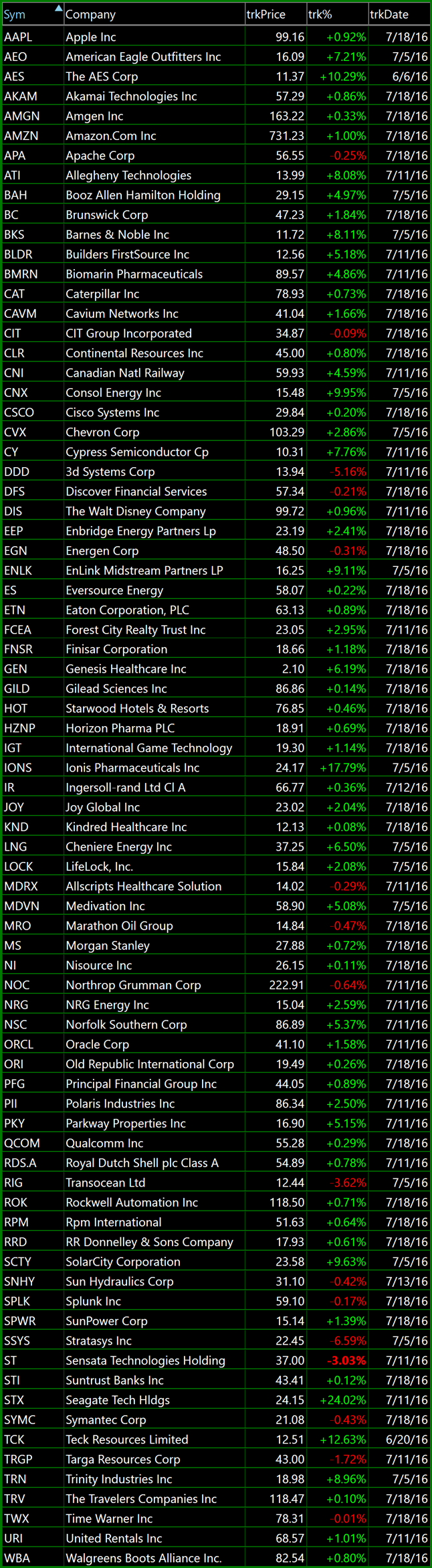

There is a lot that could go bad this week. Apple (AAPL) earnings are after the bell, then you have Amazon (AMZN) later in the week. Not to mention the slew of economic news from the Fed tomorrow at 2pm eastern when they release their FOMC Statement and then again with the GDP to close

This week is going to be a challenge for traders – there is no doubt about it. Regardless of whether the market finishes higher or lower on the week, you have the biggest weak of earnings where tons of big names are reporting their results, followed by the Fed’s FOMC Statement on Wednesday, and GDP

I like the trade setup in Tesla (TSLA) here. I think it provides a clear reward/risk parameter, and if earnings were not on August 3rd, a clear path to $270/share. With earnings you never know how things are going to turn out, which is why I don’t hold stocks through those events. It is simply

Huge support underneath SPDR Gold Trust (GLD) right now which is what immediately attracted me to this bounce setup. Maybe it doesn’t hold but it has such a clear level of support, that if it does not hold, I can get out of the trade with a minimal loss. If the trade works, then the

The market is trading sideways the past couple of days. I don’t see that being bearish at this point. Especially when you consider the ramp the market has been on since the Brexit sell-off. The can change in the favor of the bears, but first some technical damage needs to be done and when looking

With three days of sideways action on the S&P 500, I am turning my attention towards stocks that have either bull-flagged its price action or pulled back to a key support level, following a massive move higher. I found the latter RR Donnelley & Sons (RRD) with a stiff pullback to the break out level

The bulls are trying to start the week off right, with more upside. This is despite the failed coup attempt in Turkey over the weekend and more law enforcement officers being killed domestically. The latter hasn’t mattered much to the market, nor has terrorist attacks within and outside US borders. I’m not stating an opinion

Goldman Sachs (GS) is approaching resistance at the $161-162 area. If it can break through that and the 200-day moving average I would put a price target of $170-175 on the stock. It may not reach the 200-day moving average today as it is outside of its R3 pivot level already, but if it can

Last week I wrote about there being some confusion on the SharePlanner Reversal Indicator. There were multiple reversals within a short time frame, and direction wasn’t entirely clear. With this week’s breakout to new all-time highs though, that confusion I spoke of, can be put to rest now. The direction issue has resolved itself on