With the market gapping down over 500 points in the Dow, and limits placed in the premarket on selling in the S&P, this is shaping up to be one ugly day. With that said, when the market looks like it is on the brink of catastrophe, is when it most often makes a descent rally of sorts – meaning, we are setting up for one major short squeeze in this market (eventually). Short play setups are becoming more and more difficult to find, and the ability to borrow shares is rapidly decreasing.

Another interesting barometer is what people are typing into Google (GOOG) and Yahoo (YHOO) search engines to find Shareplanner. We are showing that one of our top search returns is based on anything to do with shorting the market. We see “ETF Shorts” and the number of search requests in regards to ultra-shorts is rather impressive too. This all indicates that the short side of the trade is becoming increasingly crowded and when the crowd jumps in is when the smart money needs to “jump-out”.

Can’t say that today will be that day, but after the week the market has had, I would be weary of holding any short position through the weekend. We are near that price level, where the Feds like to artificially boost the market with some unexpected news announcement – just an observation based on experience.

For intra-day trade purposes, here are a couple of charts to consider as the day moves forward. I consider an entry into this market in either direction (unless you initiated a short position prior to yesterday’s close) extremely high risk. I would let this market calm down at first, anywhere from 30 minutes to an hour into the session before trying to trade this market.

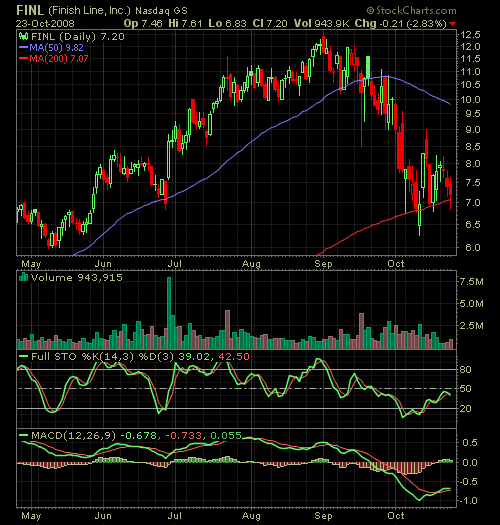

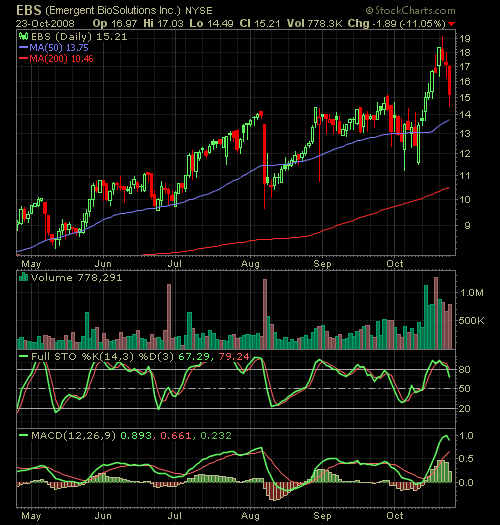

Here’s the Short Charts…

FINL could see further price action to the dowside with a break of the 200-DMA and a break of yesteday’s lows. But any major gap downs would steer me away from this stock.

EBS is coming off of a very nice run-up in horrid market conditions. Could see further down side to the sub-14’s.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.