Oh yeah, I’m talking about a much bigger pullback in Bitcoin than what anyone else is talking about.

Feel good about today, and for however long this bounce lasts. For now, this is nothing more than a dead-cat bounce.

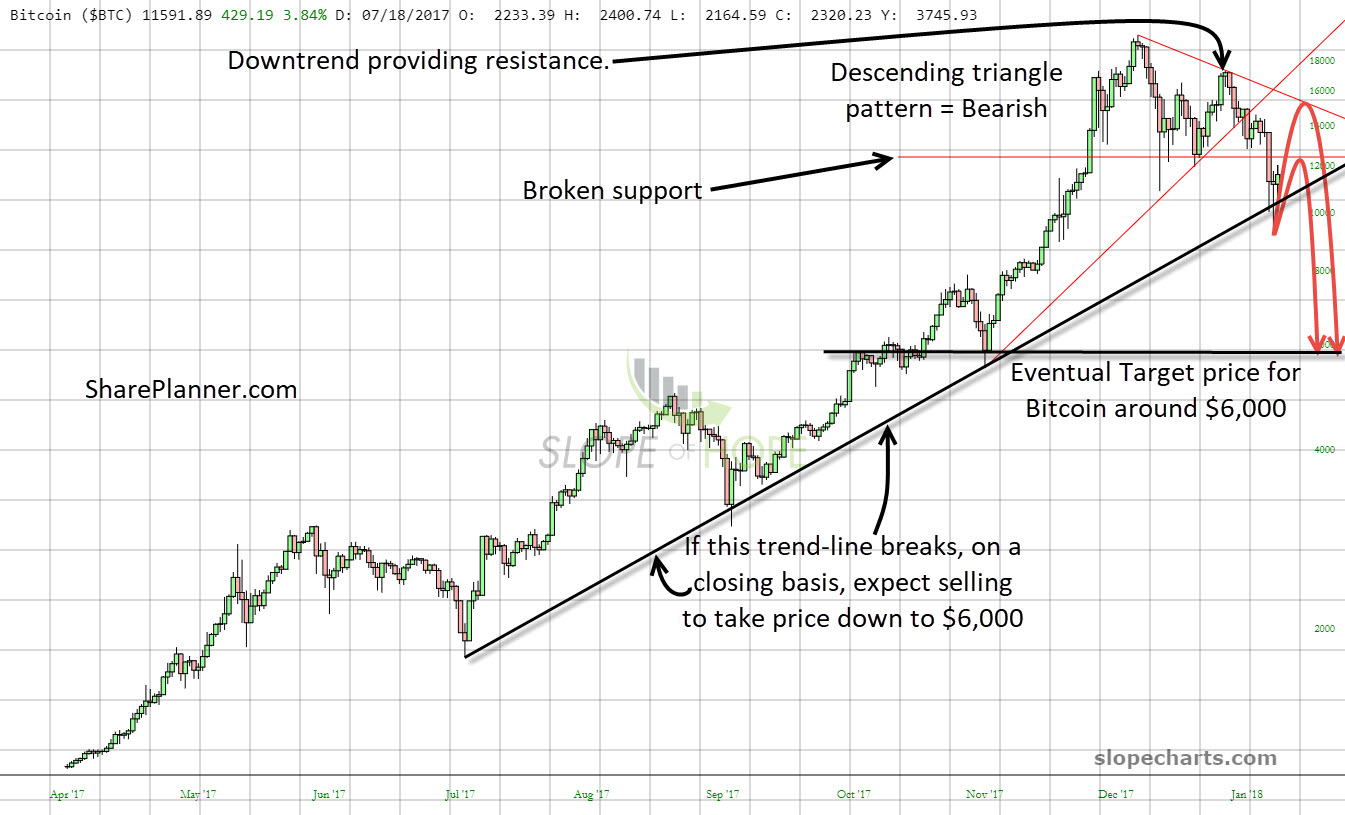

Sure I could be wrong on this chart, but for that to happen, and for the chart below to be rendered null and void, it needs to break back above $20,000 fairly soon, and at the moment, that is asking for a 100% move, despite the bullish trend that Bitcoin had been riding is now broken.

You have one more trend-line that the bulls can hope to count on, and while it has violated the trend on an intraday basis, it has held up so far on a closing basis.

However, if that breaks, it is going to go south, very quickly – to $6,000.

Call me a ‘hater’ or whatever, but I am telling you this without a bias and without a position in this currency or any other currency (except for the US Dollar and a few Canadian coins that some random gas station attendant gave me as change) and with no plans to ever have one in the future.

The bitcoin chart has so many bearish developments to point out:

- Topping pattern in the form of a descending triangle, that is inherently bearish has has already confirmed.

- Lower-high and lower-low already in place.

- Most recent trend-line on the daily chart broken aggressively.

- Distribution at the top and key support broken

Conclusion: Don’t let the hype out there, have you buy something simply because you feel like you are missing out on the latest craze. The chart is broken on Bitcoin (BTC.X). And there is absolutely no good reason to buy it here.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Is it better to be lucky or skillful when it comes to being a good trader? I would argue you can have it both ways, but it requires that skill manages the luck, and at times when luck is simply against you too.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.