Apple (AAPL) is just one of those stocks you can never get enough of. On a day-trading basis, I probably broke-even to slightly in the green, but on a swing-trading basis it has done me pretty good. I think I’ve probably traded it seven or eight times and only once have I had a negative return. This time around could be different, but so far, so good. I’m in the green, and have a full position at work.

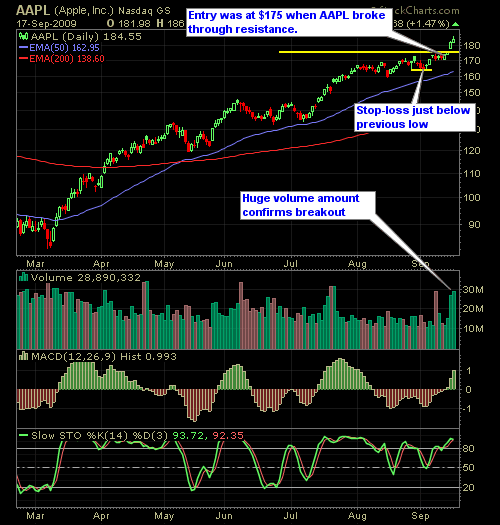

What has also been pretty impressive to me is the volume surge that Apple has seen the last two days. Yesterday I can understand; Cramer had been pumping it on his pathetic show (of course I wouldn’t mind the audience size that he enjoys for my blog!), but today, where the market actually finished down overall, saw Apple finish up 1.5% on volume that was higher then the day before. So to me, that tells me that there is definitely a push to get this stock up to $200 or more.

Also worth noting is the breakout we saw in price once the stock broke through the 175 resistance area on the charts. These are great setups that often times realizes huge gains.

Funny thing that is no way verifiable, but I’ve always thought that the century-mark on stocks (i.e. 100, 200, 300, etc.) can act as a magnet of sorts. You get close enough to it (180’s and 190’s) and if automatically seems pull the stock up and beyond the century level. Apple seems to be on that same course, that if nothing else, it is being “willed” to $200. What it does from there who knows. Another stock that a friend of mine mentioned to me on the same subject matter, is Goldman Sachs and its push to $200. There is no scientific research to back up my theory, and it doesn’t always work, it is just something that I’ve noticed during my years of trading and hopefully occurs again with Apple.

Here’s the Apple Chart…

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.