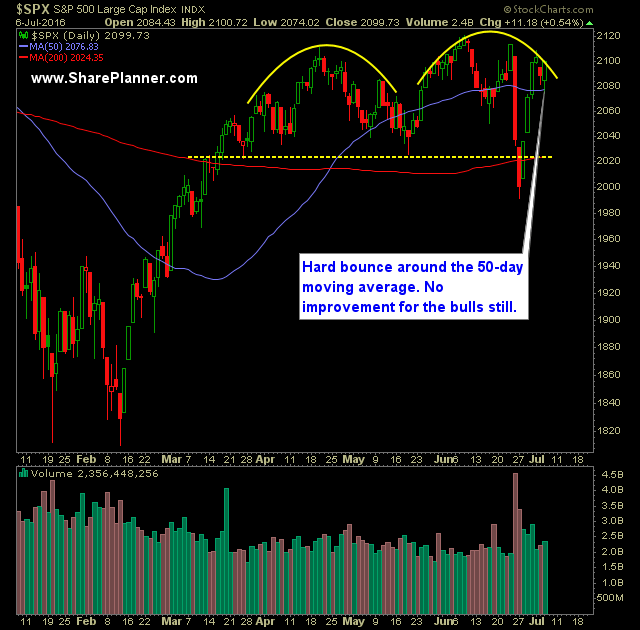

Technical Outlook:

- Massive bounce yesterday at around the 50-day moving average, and closing a shade below 2100.

- Again the bears let go of another opportunity to jump start a sell-off.

- SPY volume dropped off yesterday and was notably below recent averages for the first time in 10 trading sessions.

- VIX continues to struggle with the mid-16’s, following another test yesterday that failed and dropped VIX back down into the 14’s.

- T2108 (% of stocks trading above their 40-day moving average) rose 7% yesterday to 53%.

- SPY gap from Monday’s well-off was filled yesterday.

- Possible case can be made that there is an inverse head and shoulders pattern on SPY 30 minute chart though it is not typical of where they are usually found at.

- For the bulls: need to get back above Friday’s closing price.

- For the bears: need to break below the double top confirmation level currently at 2030.

- In general Q3 doesn’t ten to be a very good quarter historically for stocks. In recent past that has also been the case. Last August, there was an extreme sell-off.

- Market is assuming that rate hikes are pretty much off the table for all of 2016.

My Trades:

- Covered FDX yesterday at $151.19 for a 2% profit.

- Added one new short position to the portfolio yesterday.

- Will look to add 1-2 new trades today.

- Best risk/reward currently is currently to the downside.

- Currently 30% Short / 70% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode, Ryan gives a dire warning to traders in this stock market who are continuing to bid up stock prices believing that a major market bottom has been put in place, using reckless trading strategies and piling into overvalued stock trades.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.