My Swing Trading Approach

I hate these gaps higher, as it carries a far greater amount of risk coming into the trading session, considering how many of them the market has faded over the past two months. Nonetheless, I’m 100% cash, and didn’t participate in Friday’s sell-off. I am looking to trade in either direction depending on how the market behaves in the early going.

Indicators

- Volatility Index (VIX) – Minor pop higher of 3.5%, which wasn’t overly impressive and still putting in lower-highs since October’s highs. Not nearly the pop I would have suspected considering recent market weakness.

- T2108 (% of stocks trading above their 40-day moving average): This one continues to leave me scratching my head as it diverges against the market’s will. Despite Friday’s sell-off, T2108 actually managed to rally higher to the tune of 2.2% to 28%.

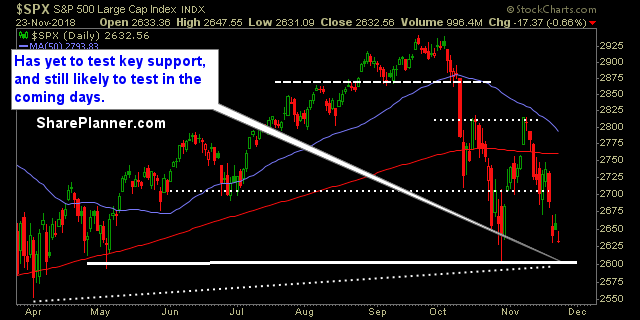

- Moving averages (SPX): Currently trading below all the major moving averages here.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Healthcare continues to garner interest and now back above the 200-day moving average. Utilities continue their three day pullback and a strong rally today in the market will likely drive it further lower. Overall though, the sector is probably the strongest of all the sectors. Technology well off their recent lows, but outside of energy, the most problematic sector, while Energy has yet to show any desire to bounce and likely to test the February lows as support from February through April is currently being tested.

My Market Sentiment

One of the most traditionally bullish trading weeks of the year, resulted in the worst trading week for the bulls since March. There are some support levels below that seems likely to be tested, so be leery of the gap higher this morning and the potential for it to fade and push lower.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 100% Cash.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.