Swing-Trading Outlook #635

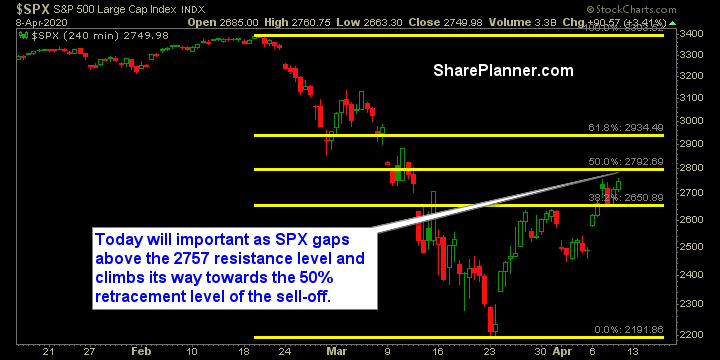

Swing Trading Strategy: A potential cure from GILD… Perhaps the greatest counter rally anyone will ever see, the bounce off of the March 23rd lows in many ways has been unexplainable and perplexing, and if you are keeping watch at home, the Nasdsaq 100 is now up +2% on the [...]