Swing Trading Strategy:

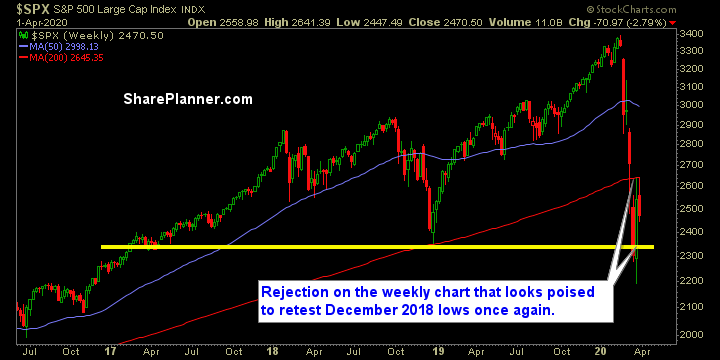

Time to retest?

You had a massive sell-off yesterday, where SPX dropped 4.4% and 114 points. Not the ideal look for a market that has now sold off two straight days and puts in jeopardy the rally off of last week’s lows. This is where traders have to decide for themselves whether they are going to start booking their gains over the past week, or risk being shaken out later and the rally being all for nothing. I came into yesterday short on the market and continue to hold those short positions into today as well. I may even use some of the early morning strength to increase my short position in the market .

Indicators

- Volatility Index (VIX) – Nothing major for the VIX and even went negative in the early going, but finished 6.6% higher on the day which is less than what you’d expect on a day where the market dropped over 4%. Nonetheless, you didn’t see any panic selling or large drops on the indices, but instead it was a slow trickle lower, and that kept volatility on the sidelines.

- T2108 (% of stocks trading above their 40-day moving average): Saw a 24% drop yesterday as the indicator dipped back below 5% again. Still a very extreme reading.

- Moving averages (SPX): Broke back below the 5-day and 10-day moving averages, and now back below all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

No sector was spared yesterday, but still of most interest to me is the fact that Real Estate continues to see the greatest amount of weakness. Energy looks to get a boost today with China stock piling oil now and sending crude futs up 10%. Be careful with the Financials as that is one sector that could see some headline risk in the coming days as this pandemic and economic shutdown continues to roll on.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How does war impact the stock market and what are the potential risks and hazards that impact traders attempting to remain profitable in their swing trading? In this podcast episode, Ryan Mallory covers everything managing the volatility that comes with the headline risk, dealing with heightened levels of emotions, securing open profits, and market exposure to uncertainty in the stock market.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.