My Swing Trading Approach

I increased my long exposure yesterday, and may look to do so yet again today, should the market strength continue. Overall, the market conditions are picking up and becoming much more ideal for swing-traders.

Indicators

- VIX – Continuing to sell off hard, and may see a retest of the March lows in the weeks ahead. Sold off 4.9% yesterday to close at 16.56.

- T2108 (% of stocks trading below their 40-day moving average): Best reading on T2108 since the sell-off in January began. Higher-high established on the chart and now 56% of stocks are trading above their 40-day moving average.

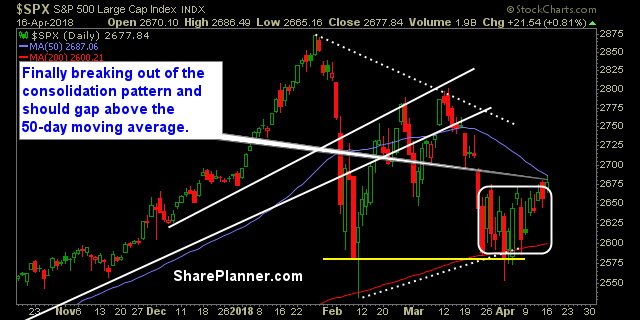

- Moving averages (SPX): Tested perfectly the 50-day moving average yesterday, but failed to break through – no major rejection in price though. Should see a gap above today.

- RELATED: Patterns to Profits: Free Training Course

Industries to Watch Today

Energy continues to be the market’s big winner of late. Financials lagged the market the most. Industrials was the strongest of all the sectors and is showing a rapidly improving chart.

My Market Sentiment

Breaking out of consolidation was huge for the bulls yesterday, but it was unable to break through the 50-day moving average. Look for a gap above the 50-day moving average at the open, and then pay attention to whether the bulls can hold on to the MA into the close.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 4 Long Positions