15 Stocks Ready For A Short Squeeze

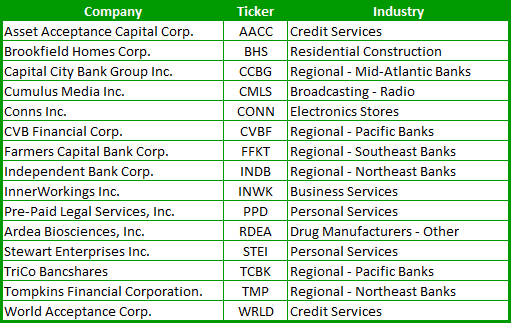

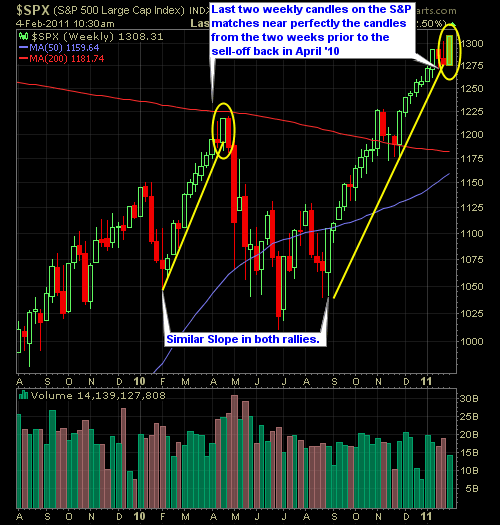

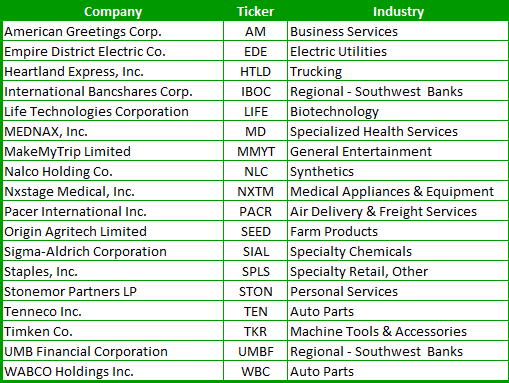

Below is a list of small-cap stocks that have been heavily shorted by the street, and should the market continue to rally, these stocks could see their share price launch into the stratosphere (if they haven’t begun so already) because of the bears being forced to cover their short positions [...]