Trading Plan for Jan 24, 2011

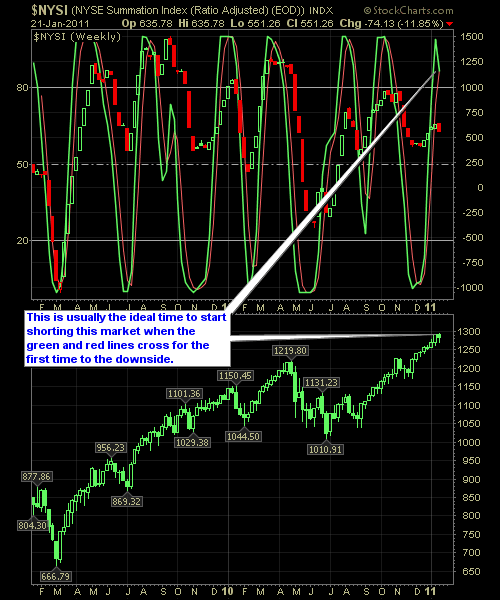

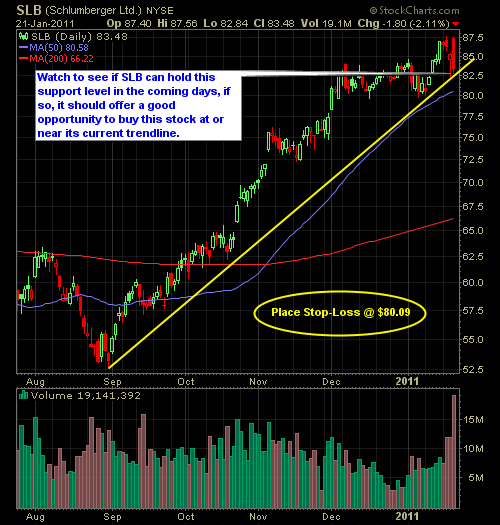

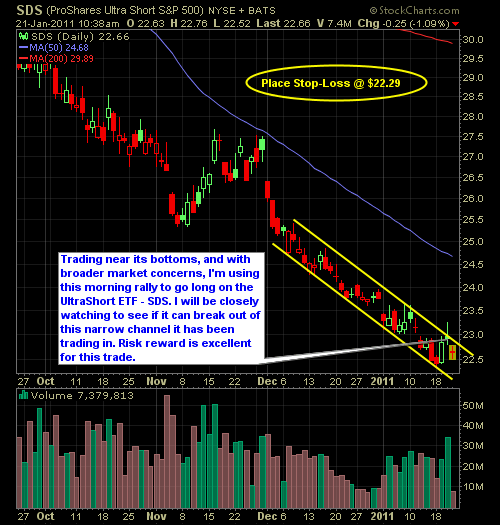

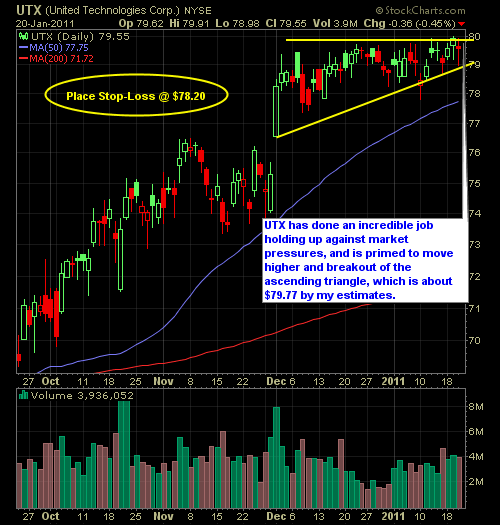

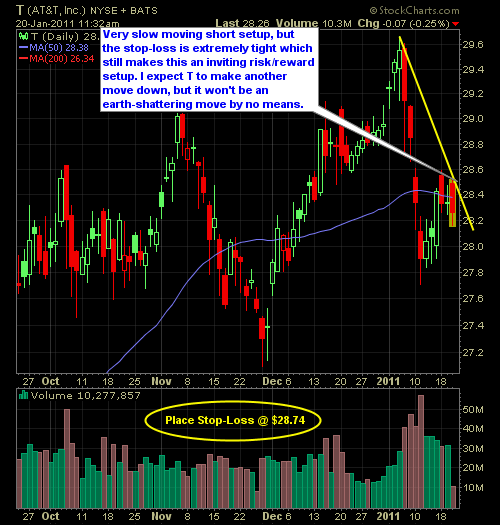

Current Long Positions (stop-losses in parentheses): QID (10.49), GLD (128.65), SDS (22.29) Current Short Positions (stop-losses in parentheses): PII (75.36), T (28.74) BIAS: 21% Short (counting QID and SDS as shorts) Economic Reports Due Out (Times are EST): None My Observations and What to Expect: Futures are flat to slightly [...]