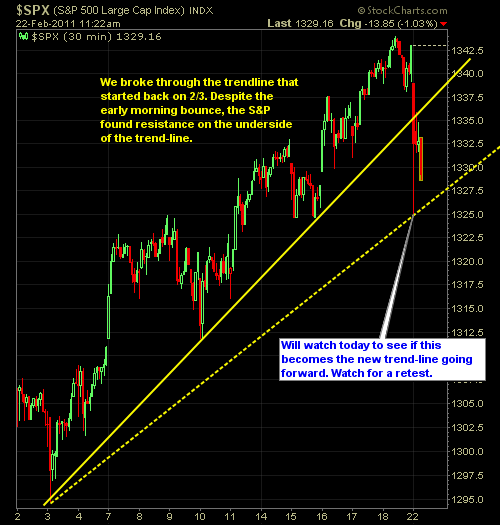

S&P At A Glance

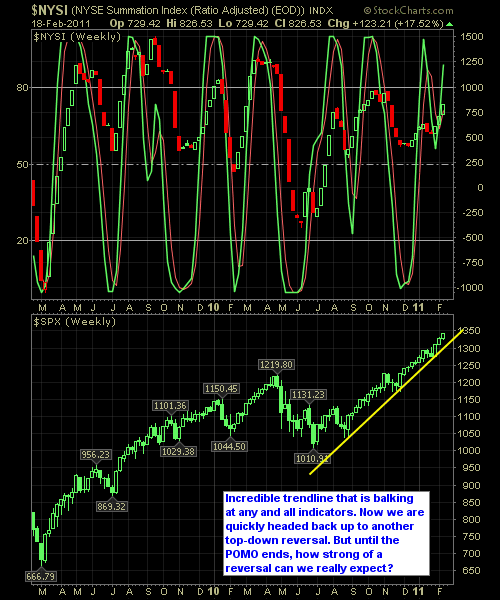

Some selling that has a lot of similarities in reason to the one we saw back on 1/28. So far the dip buyers have put some capital to work to keep the selling from getting out of hand, but some damage has been done to the intraday trendlines that were [...]