Trading Plan for March 3, 2011

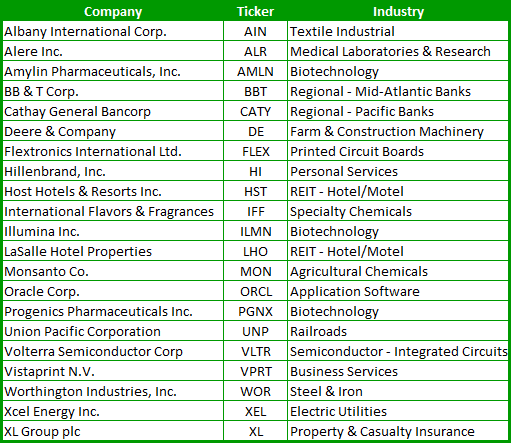

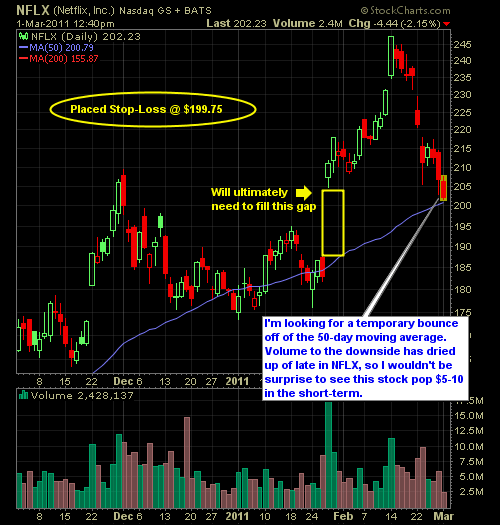

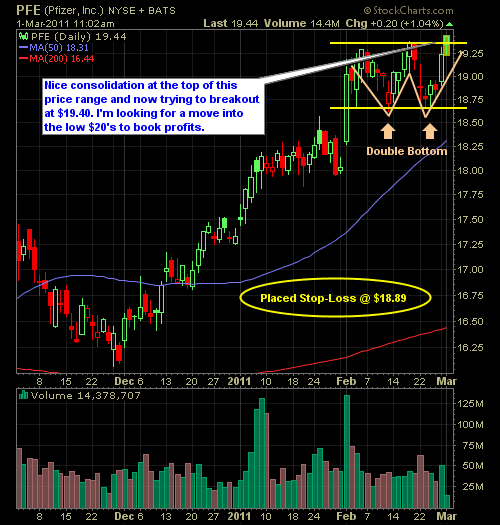

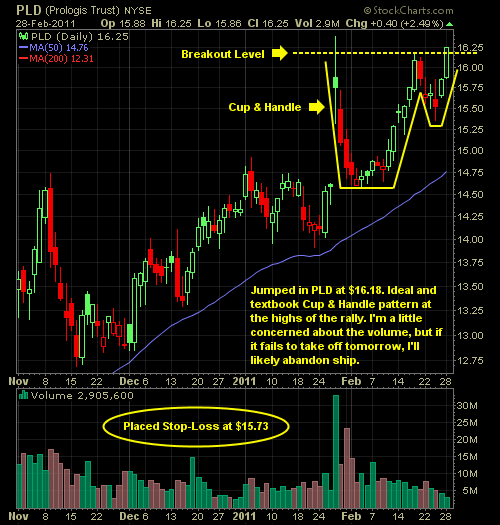

Current Long Positions (stop-losses in parentheses): CPWR (10.90), TICC (11.90), NFLX (199.75), PFE (18.89), PGH (12.65), SCO (43.99) Current Short Positions (stop-losses in parentheses): None BIAS: 45% Long Economic Reports Due Out (Times are EST): Monster Employment Index (6am), Jobless Claims (8:30am), Productivity and Costs (8:30am), ISM Non-Manufacturing Index (10am), EIA [...]