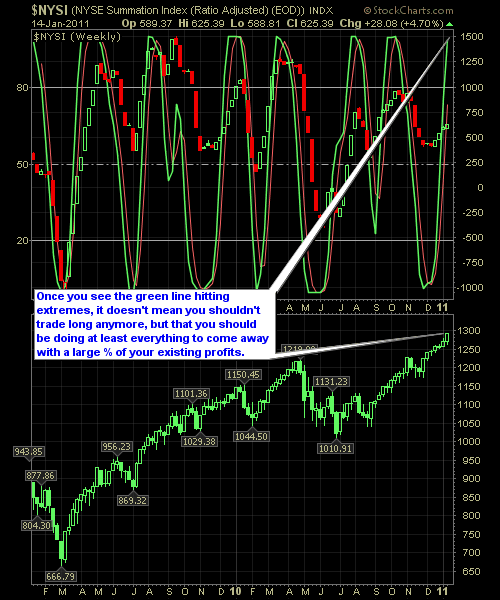

NYSE Reversal Indicator

NYSE Reversal Indicator is starting to finally hit some extremes – the market has made a good run of it since the indicator bottomed back in late November, and there is a legit chance that there is still more room for the market to go even higher. However, I for [...]