Some High-Flying Stocks To Trade

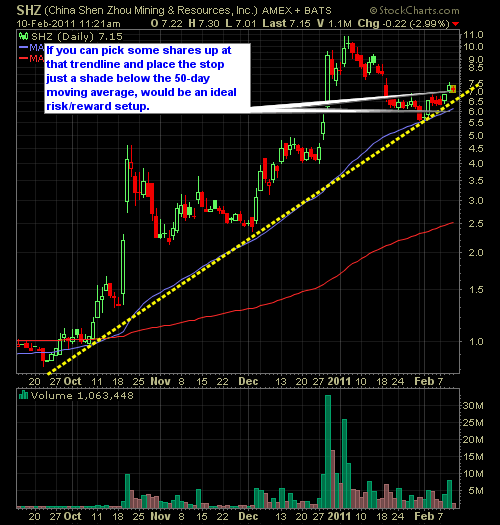

Looking through some low-dollar stocks this morning, I found three in particular that looked prime for the trade. I’m going to warn you though, these stocks move fast and furious, so you want to pay close attention to them, and use tight stop-losses. LONG: China Shen Zhou Mining & Resources [...]