Trading Plan for March 9, 2011

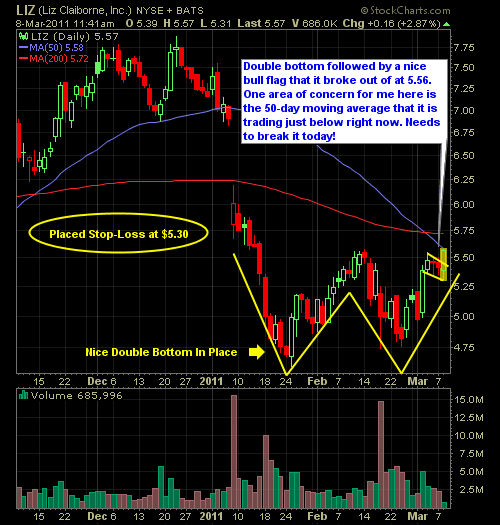

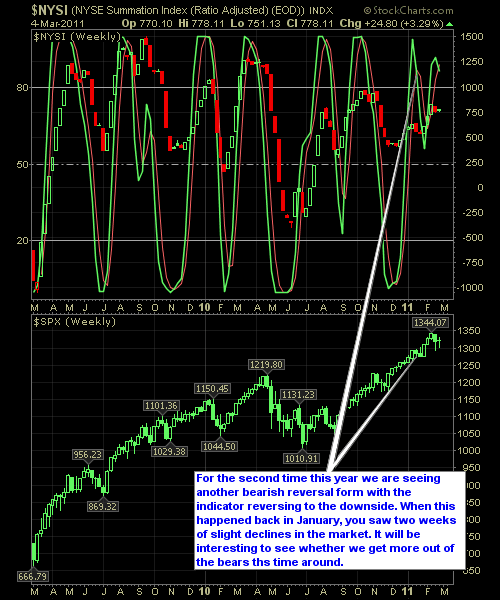

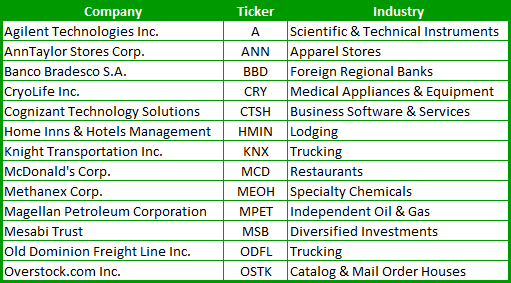

Current Long Positions (stop-losses in parentheses): CPWR (11.37), TICC (11.90), PGH (12.65), LIZ (5.30), IRC (9.23) Current Short Positions (stop-losses in parentheses): None BIAS: 33% Long Economic Reports Due Out (Times are EST): MBA Purchase Applications (7am), Wholesale Trade (10am), EIA Petroleum Status Report (10:30am) My Observations and What to Expect: [...]