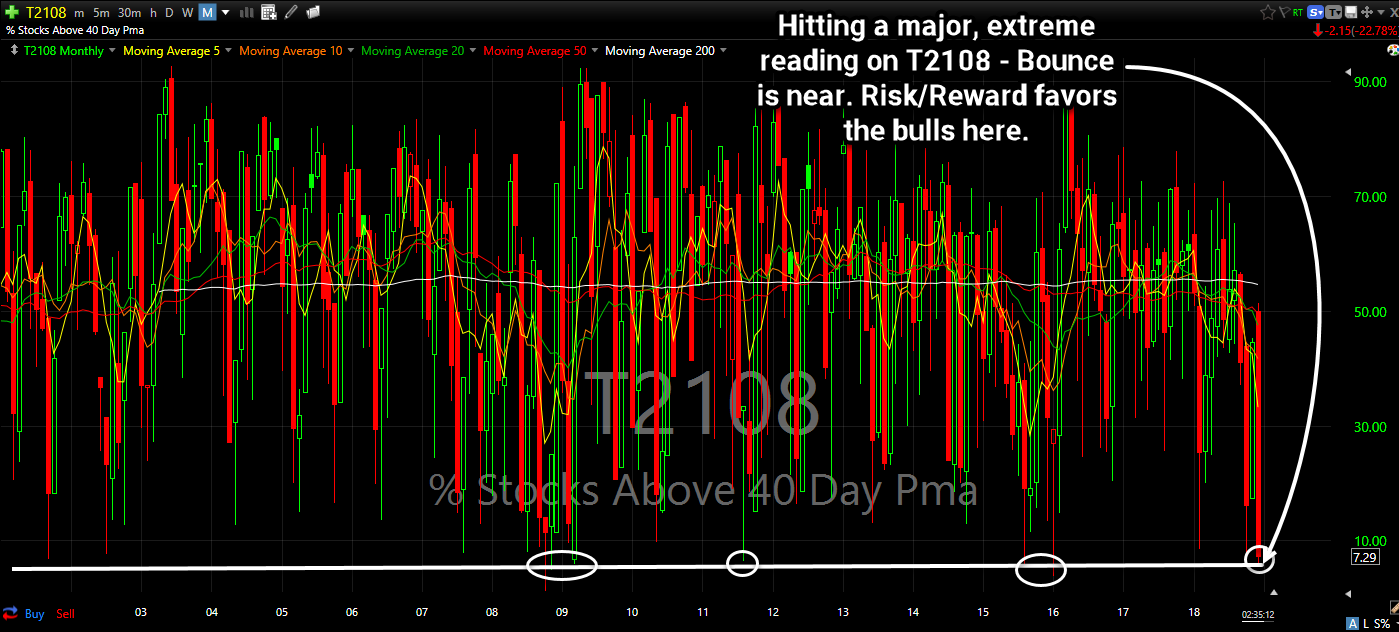

T2108 Flashes Huge Buy Signal

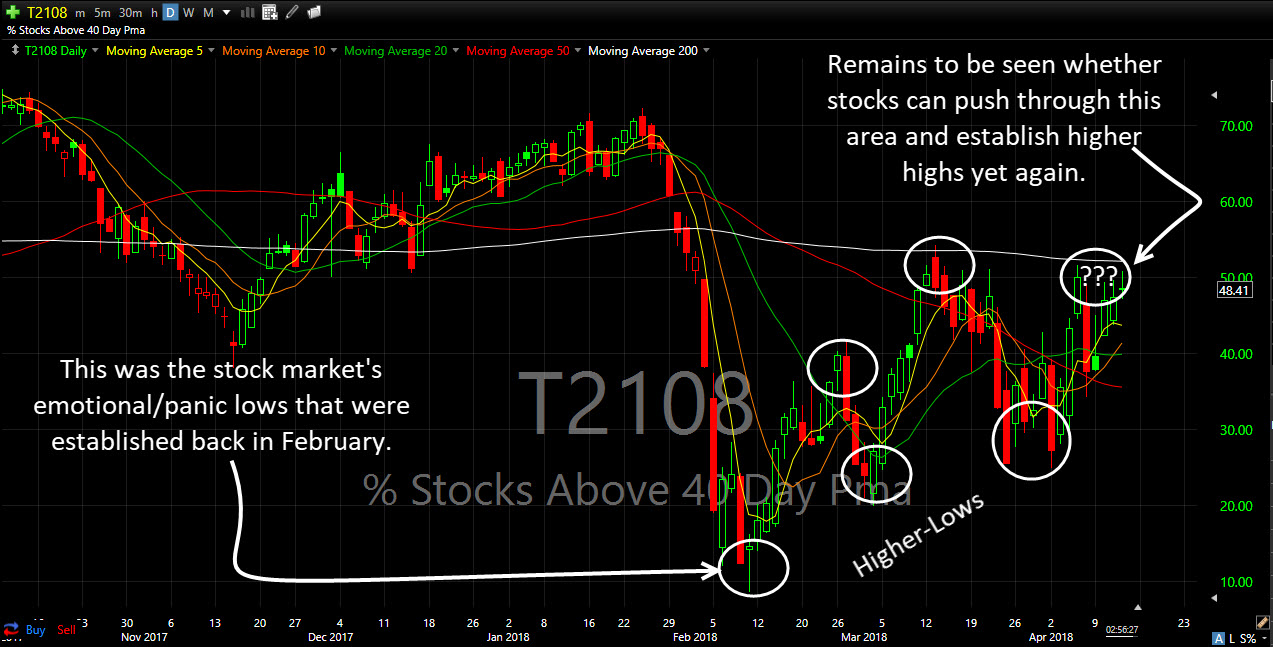

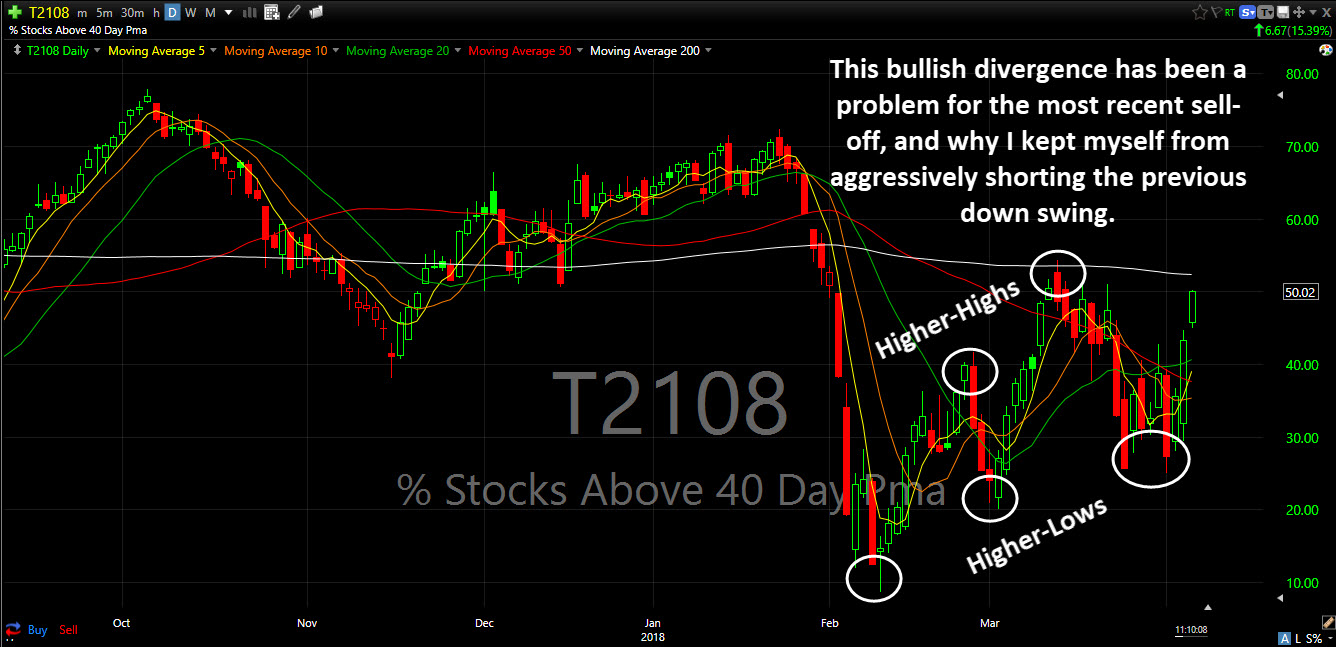

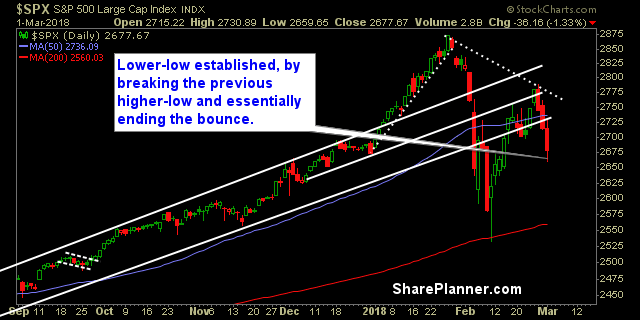

It takes a lot to get the market this oversold, and usually it comes on the heels of the bulls becoming completely exasperated. And that is what happened today when the bears drove this market another 65 points down on the S&P 500 following yesterday’s Fed sell-off, which happened to [...]