Rumors of Jerome Powell being fired led to a fury of call buying in SPDRs Technology Sector (XLK)

$PLTR - major gap still left unfilled, and a pullback to one of the two support levels underneath would be the best opportunity to me. $XHB consolidation prior to the the break through resistance, sets up well for higher prices with tight risk management. $IWM two hard rejections off of the 200-day moving average Heavy

This move in Technology ETF (XLK) over the past month blew right through its rising channel and never looked back. MercadoLibre (MELI) short-term rising channel in play - looking for a bounce back towards 1400, if it holds. Cameco (CCJ) pushing through huge resistance as it breaks out of a long-term triangle. Not a huge

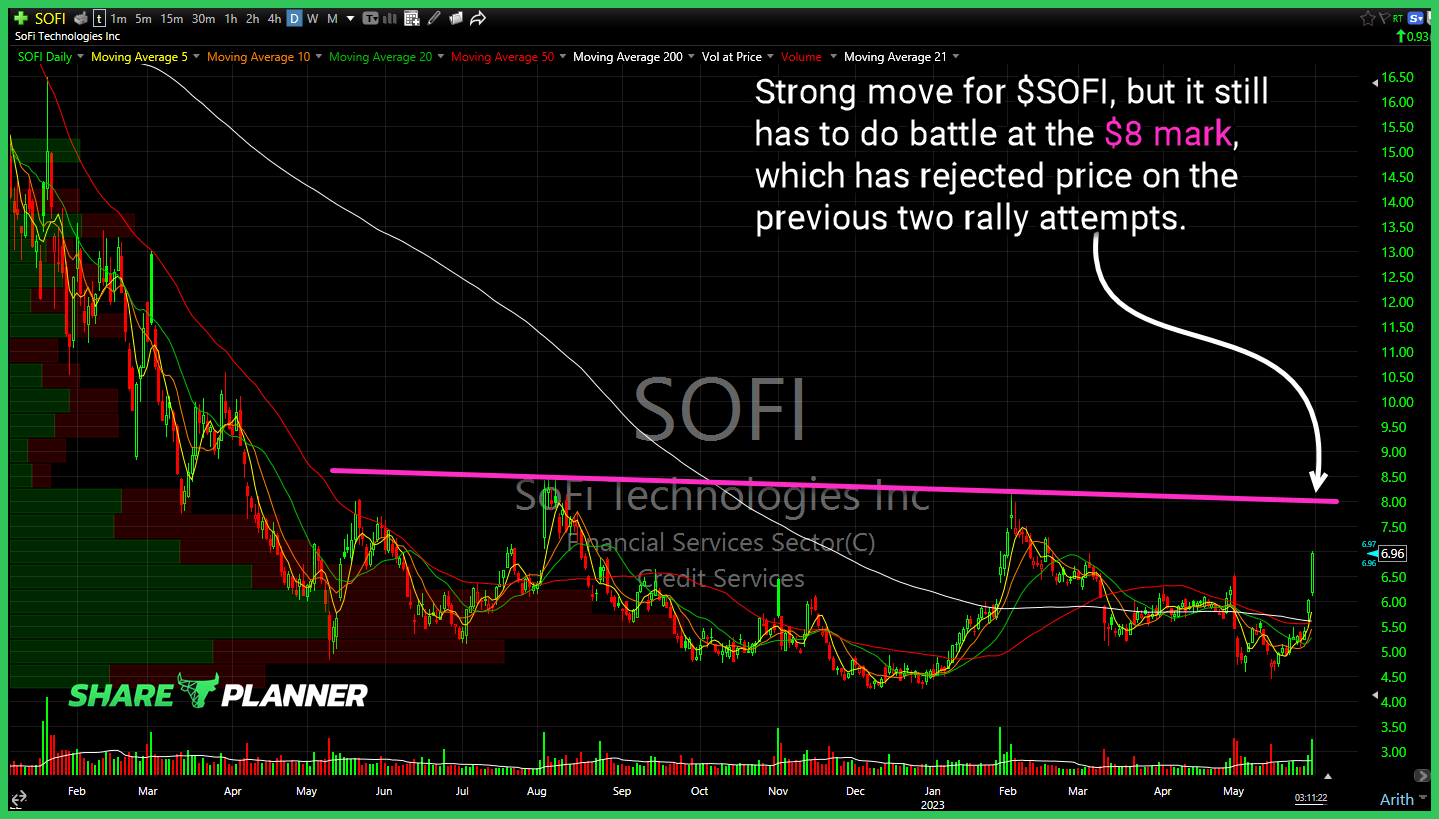

Strong move for $SOFI, but it still has to do battle at the $8 mark, which has rejected price on the previous two rally attempts. $NVDA gap closed, but the effort to bounce it after that failed. Watch for an attempt at filling the second gap. $UNH price action still a struggle, but if it

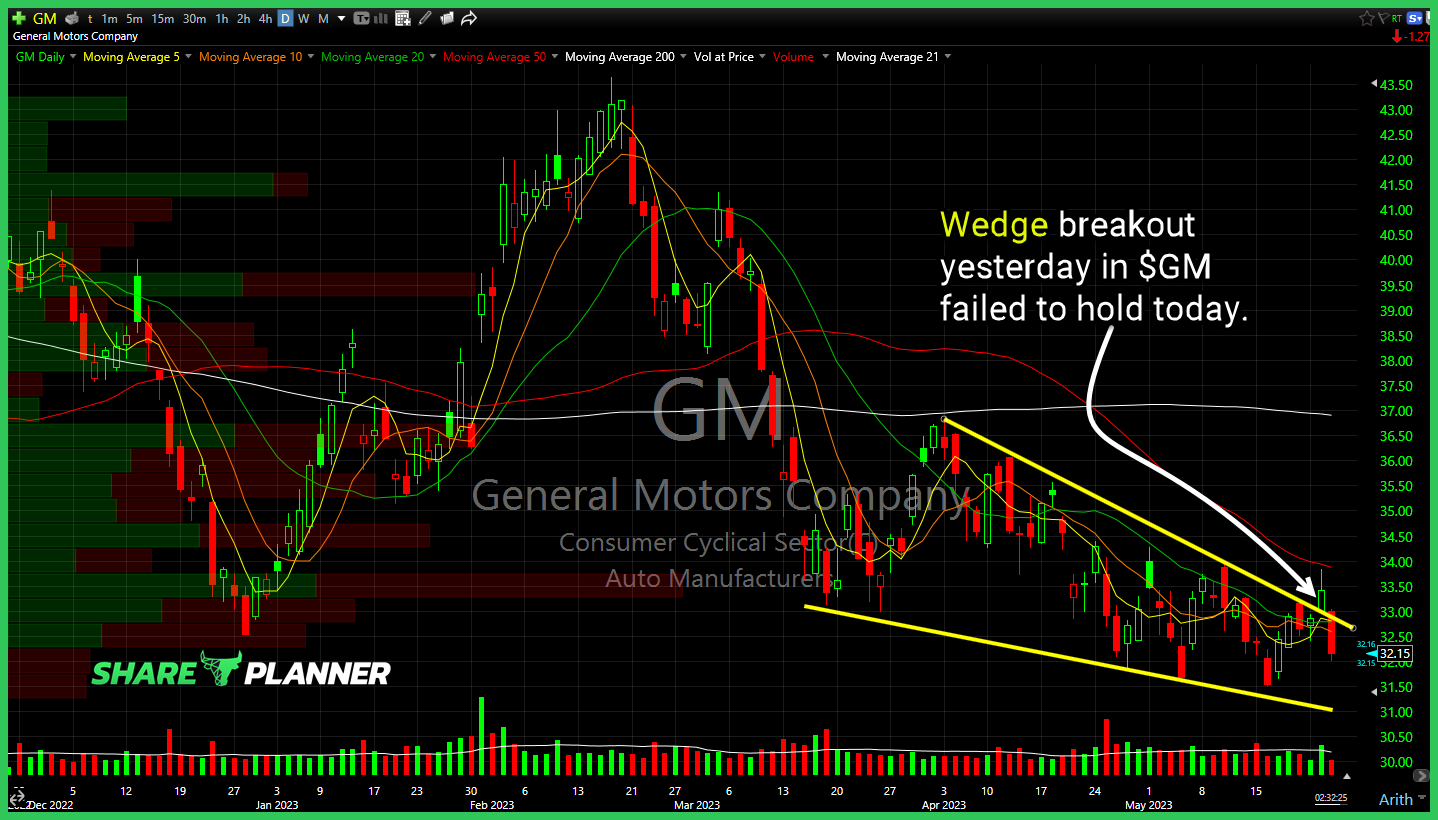

Wedge breakout yesterday in $GM failed to hold today. A lot of these happening in stocks right now. Especially in the non FAANG plays $BBWI with not the most convincing breakout so far, but it is still managing to hold the support level. $SHOP bull flag pattern worth watching still $TGLS breaking short-term support and

$WYNN rolling over and breaking a key support level here. Watch declining resistance for potential push back on $MRNA $PLUG running hard into an area of resistance that make complicate the bounce off its lows. $PINS running into the underside of broken trend-line support. A break back above would put it in the gap. Strong

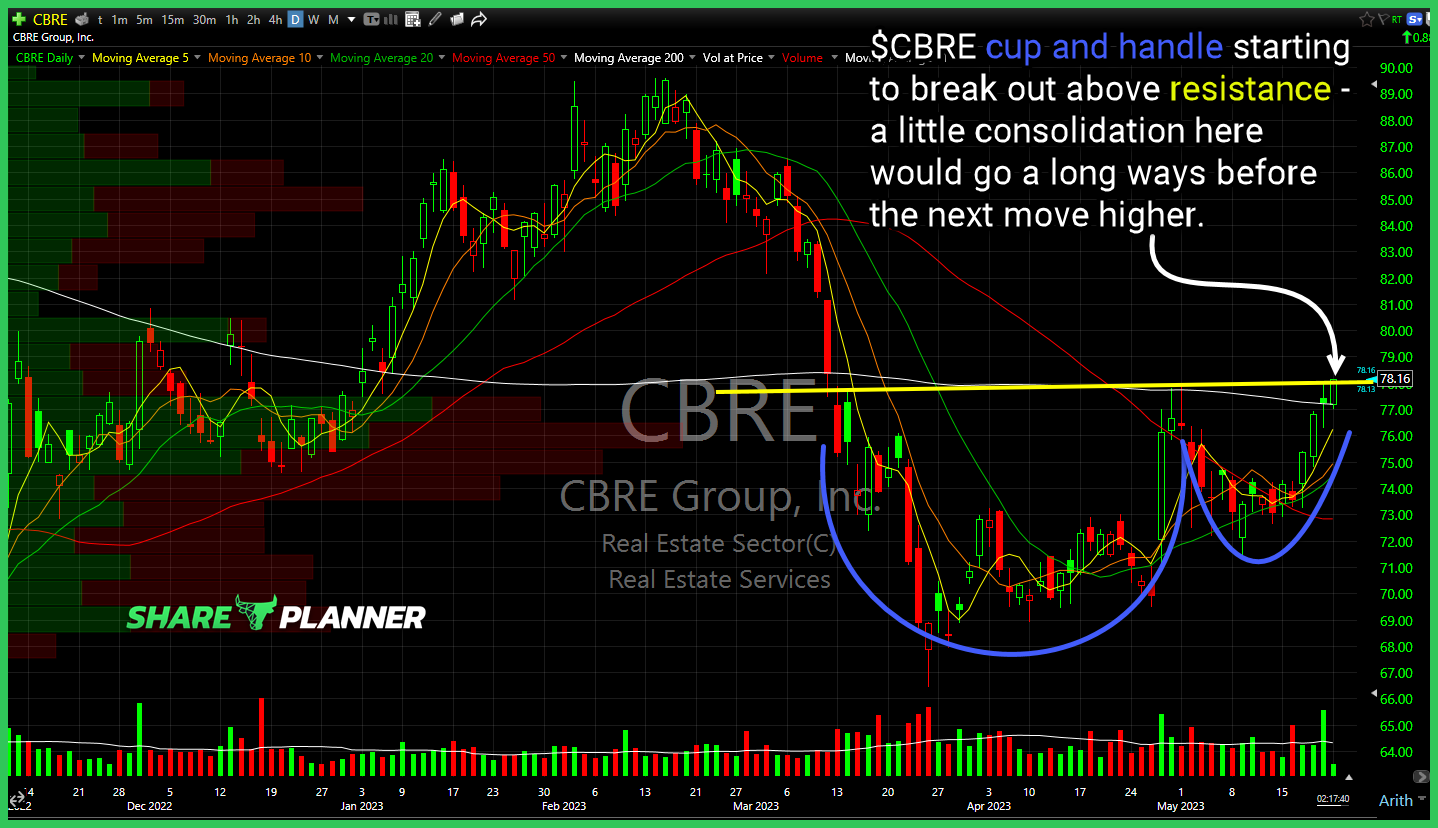

$CBRE cup and handle starting to break out above resistance - a little consolidation here would go a long ways before the next move higher. $GME 200-day moving average has been a headache the previous two attempts to break above, marking temporary highs. Will need to break and close above it to change the narrative.

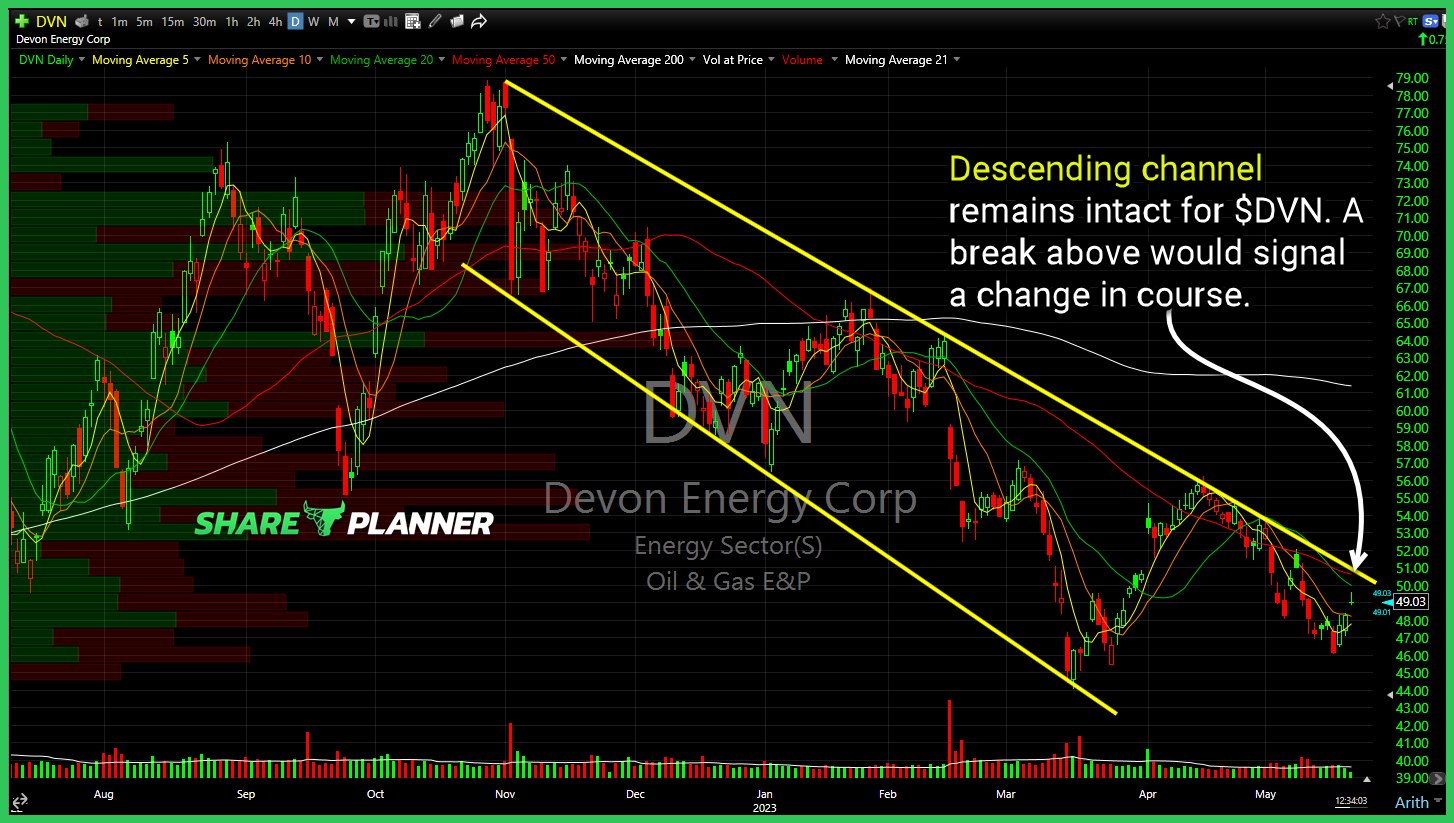

Descending channel remains intact for $DVN. A break above would signal a change in course. $SHLS with a nice push through declining resistance, but needs to breakout of consolidation to get bullish on it. $CRS attempting a bounce here off of short-term rising support. Should the bounce hold be mindful of resistance in the mid-$50's

$NKE attempting here to avoid confirming a double top pattern by trying to bounce off of price level support.

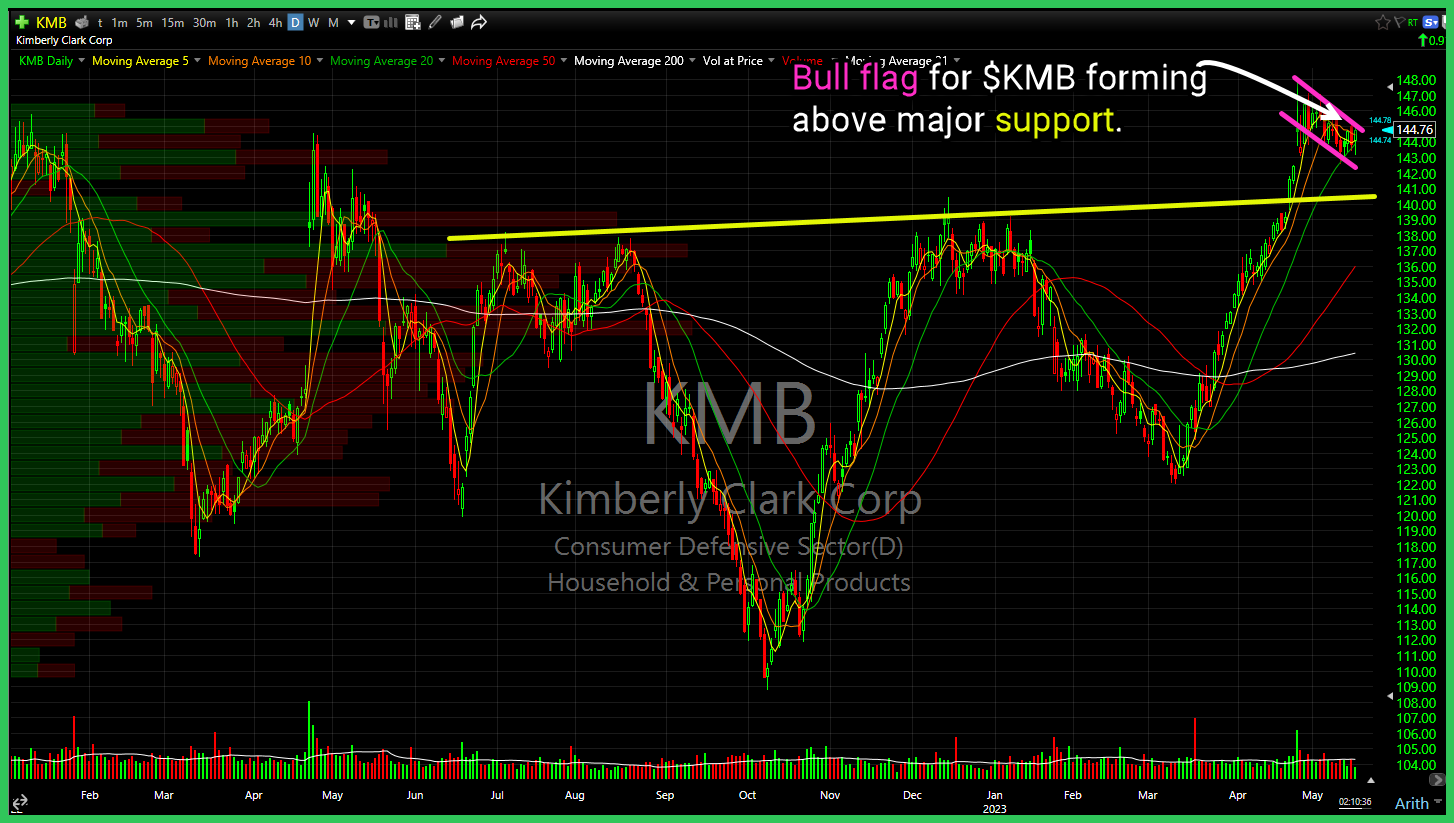

Bull flag for $KMB forming above major support.