These are my least favorite articles to write, because they require me to think very hard, and deep about a problem I am having in my trading, that demands immediate attention. Of late, and this hasn’t always been the case, I have noticed that I am not being patient enough with general market conditions and

As many of you already know, one of the biggest factors in successful trading is how well you manage the trade – that is the stop-losses you place, the amount of capital that you put to work, where you take profits, and how you protect the profits that you already have. You could, no doubt,

Having a set of principles to abide by when trading is critical. I get a lot of emails from traders asking me if I do this or that, and how do I react in “ABC” Scenario and so forth. As a result, I thought it would be helpful to you all, to post my own

I am in the process of implementing some new charting software over the course of the next few months. Currently I use a myriad of services for screening my stocks, from Stockcharts, to some stuff that Microsoft has, to a few low-profile software providers you’ve probably never heard of before. In the past, it worked

Market sentiment is nervous to say the least, even bulls are starting to realize this could be too much too fast. Economic conditions are still bad (take a look at retail and job reports), yet traders continue to stick their hand in the cookie jar in order to get every last crumb remaining, and recently

Last couple of weeks – I’ve been some-what break-even on my trading. Not the best of performance, however, like last week there is a number of lessons and observations to take from this week in trading. My trades for the most part were good trades with good entries, only one of them, Apple (AAPL)

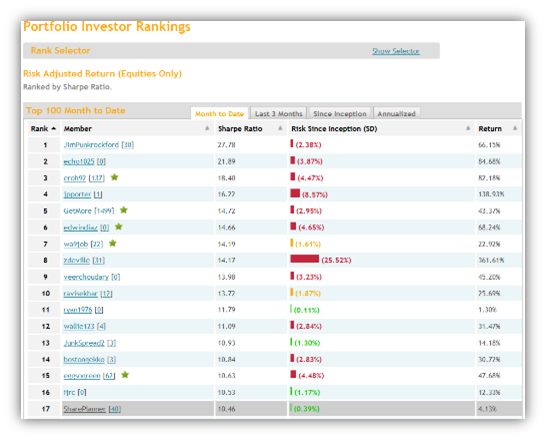

So today was the first day that I was eligible for Covestor’s Investor/Trader Top 100 Ranking. Because my account has only be tracked for one month, I was only eligible for the Top 100 Month-to-Date, but since the month is soon to be coming to a close, let’s take a moment to see where I

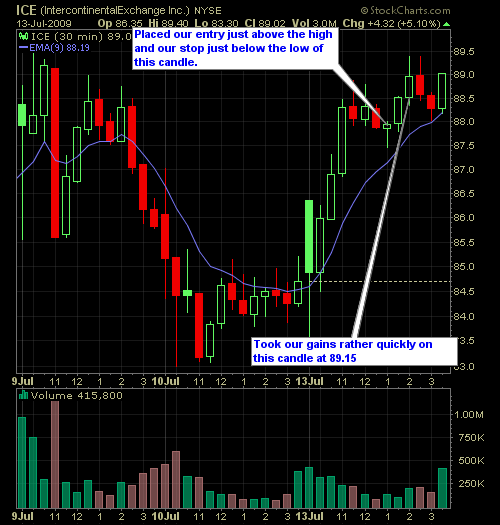

So I wasn’t suppose to trade today, but I did anyway – not what I had in the plans. However, a great trade in (ICE) presented itself, and I couldn’t resist – the type of setup I should have patiently awaited for more throughout this past week, but didn’t. Nonetheless, I got in at 92.44

It took me just 45 minutes to rack in gains of over $500 today ($494 after commissions and SEC fees). That, my friend, is not a bad day at all. There was a great trade in DIA to be had at the 10:30am candle that I missed (due to being on a mini-vacation and

Let’s face it, you are not going to have a good day trading stocks every day. It just doesn’t happen, and those who say it does are nothing but a bunch of frauds. Every day is its own riddle to unravel and mystery to solve, and sometimes you just aren’t going to be on top