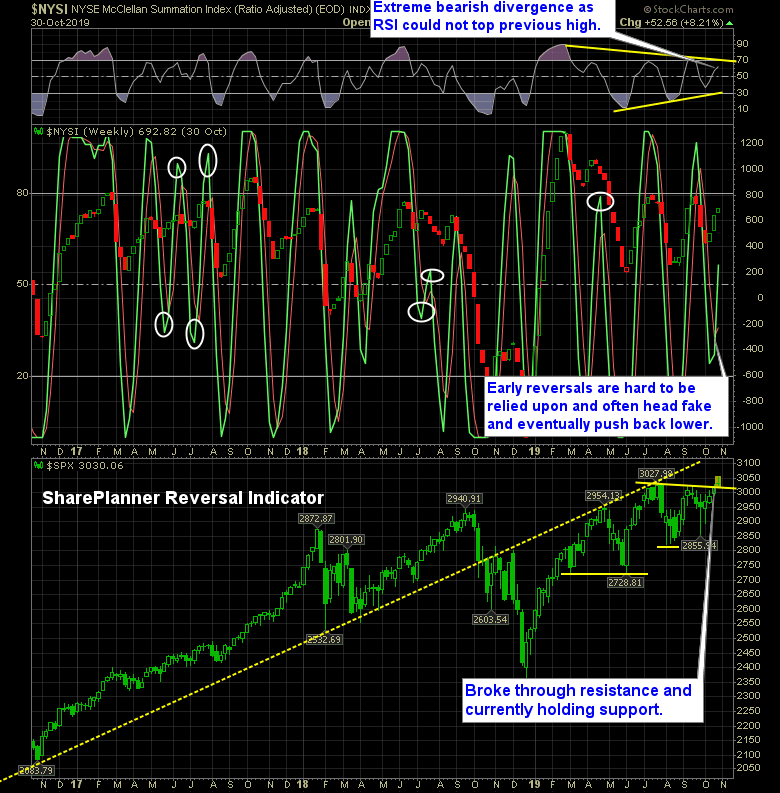

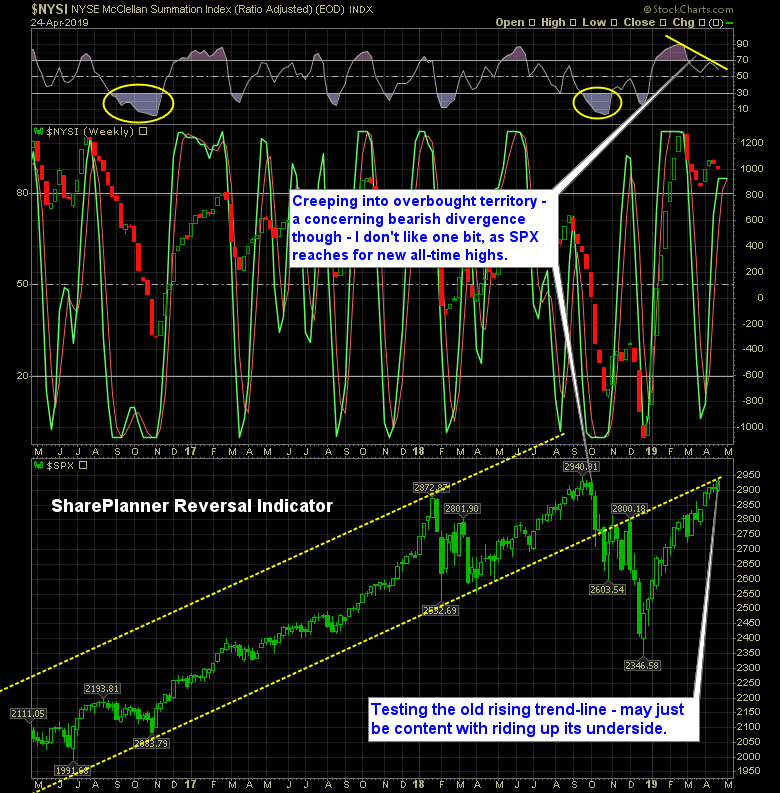

SharePlanner Reversal Indicator: Market Breakout to Be Trusted?

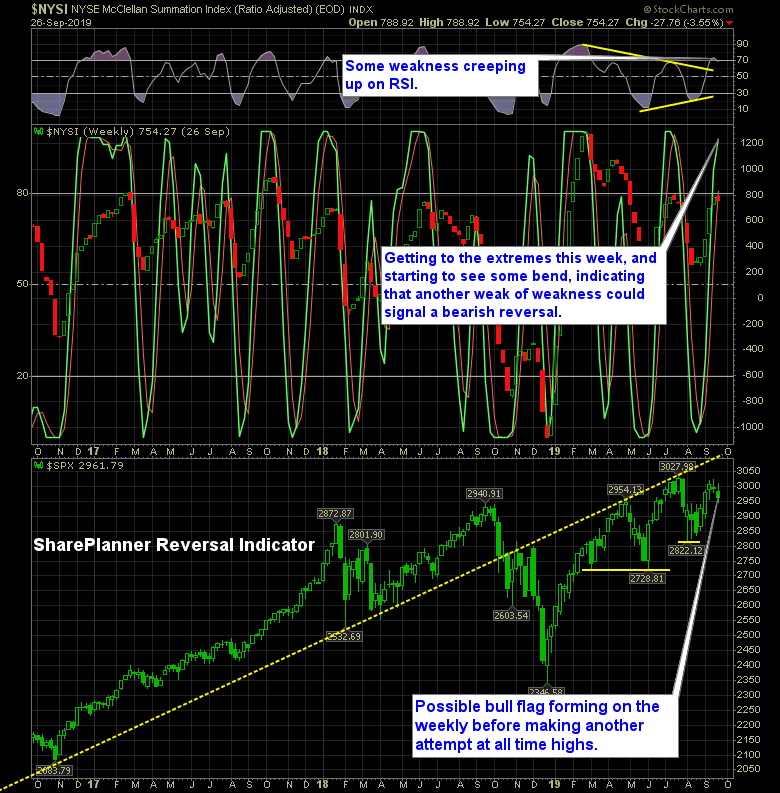

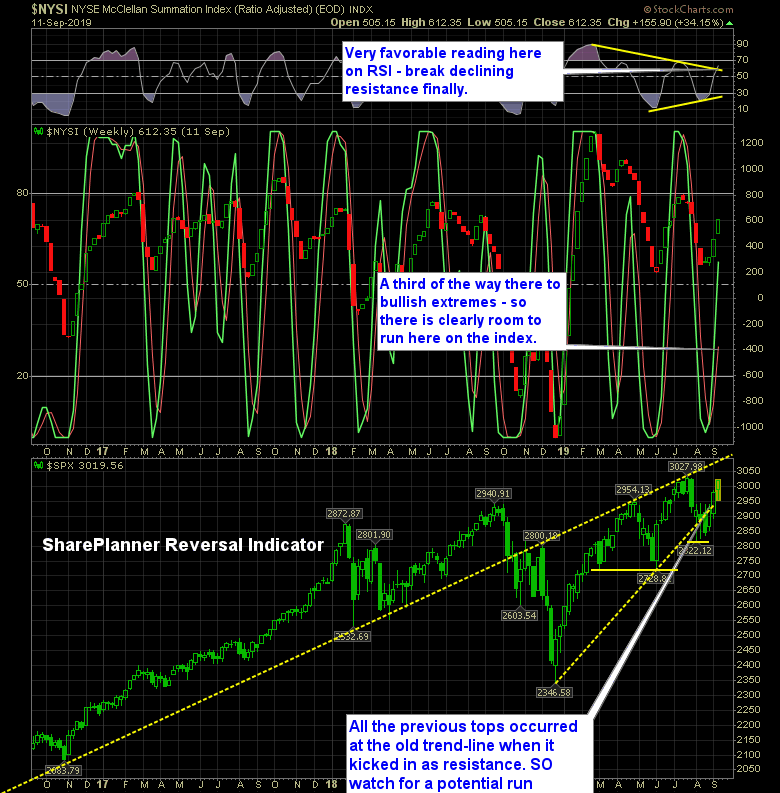

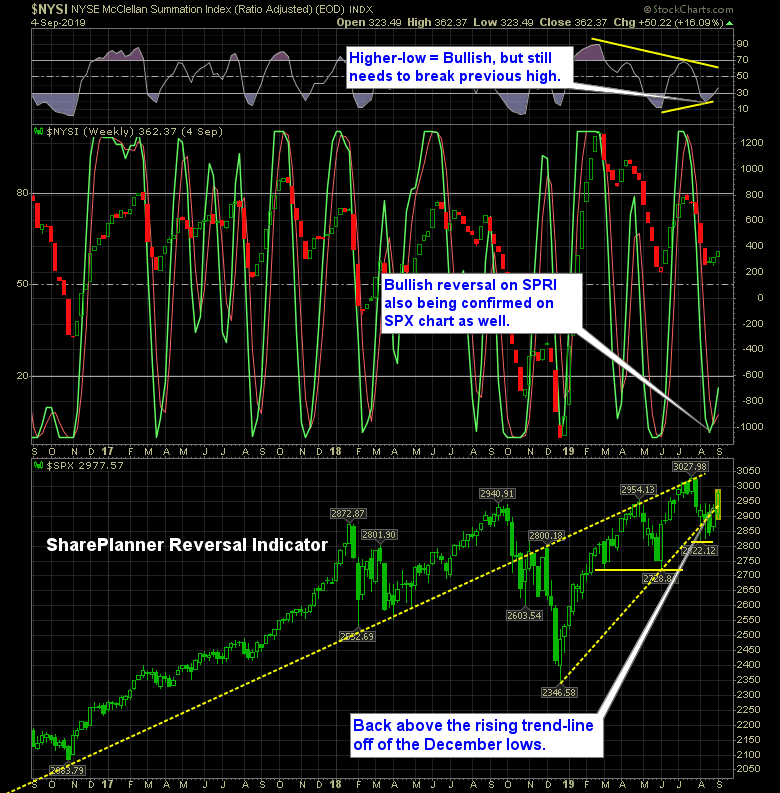

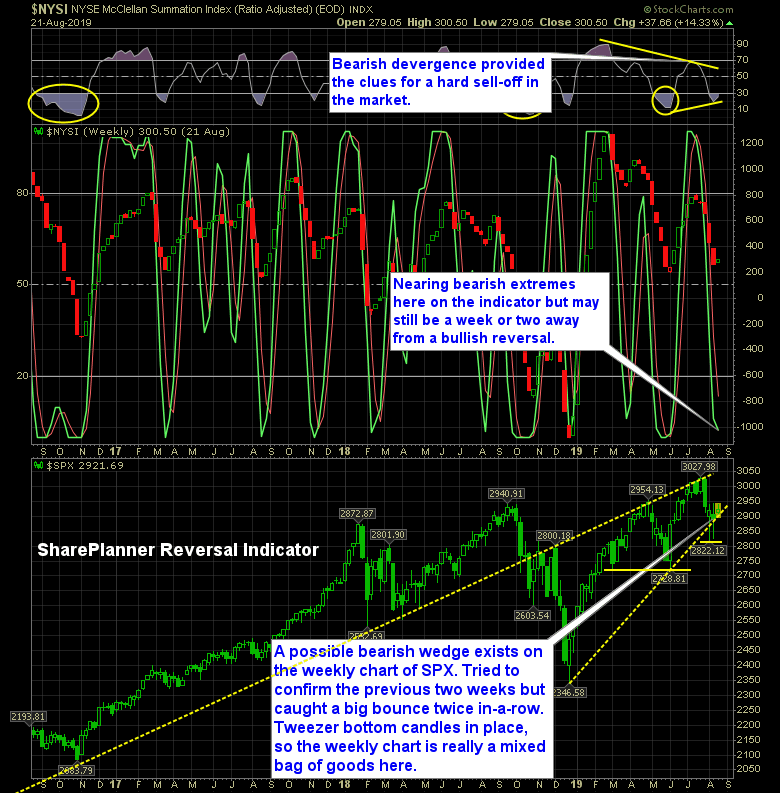

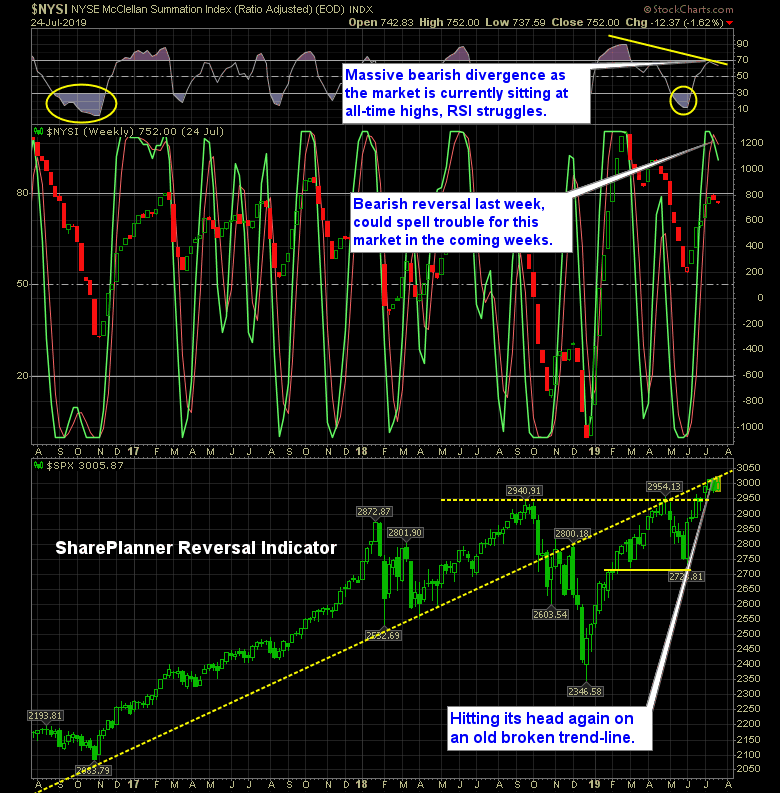

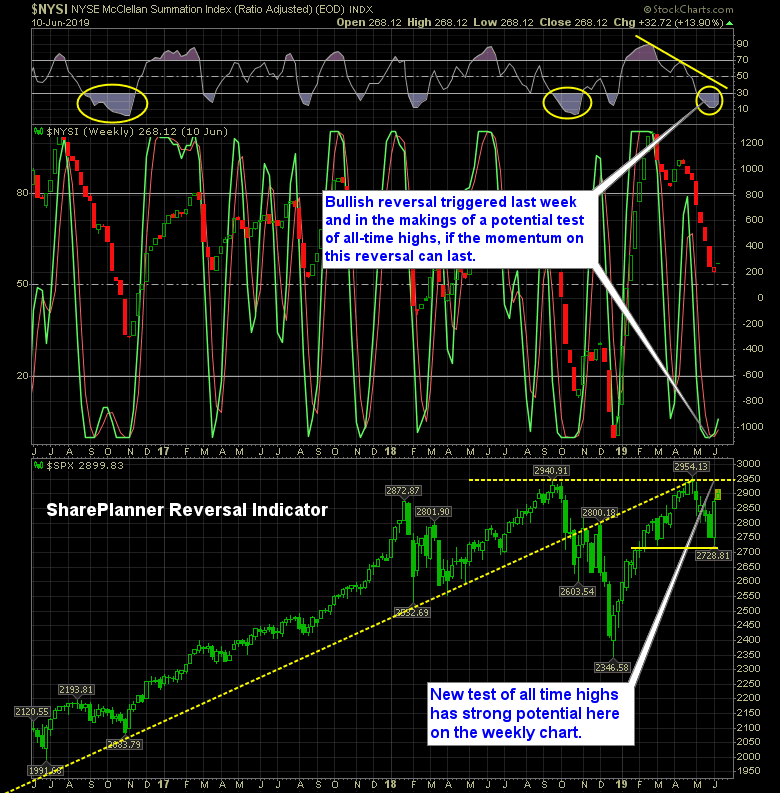

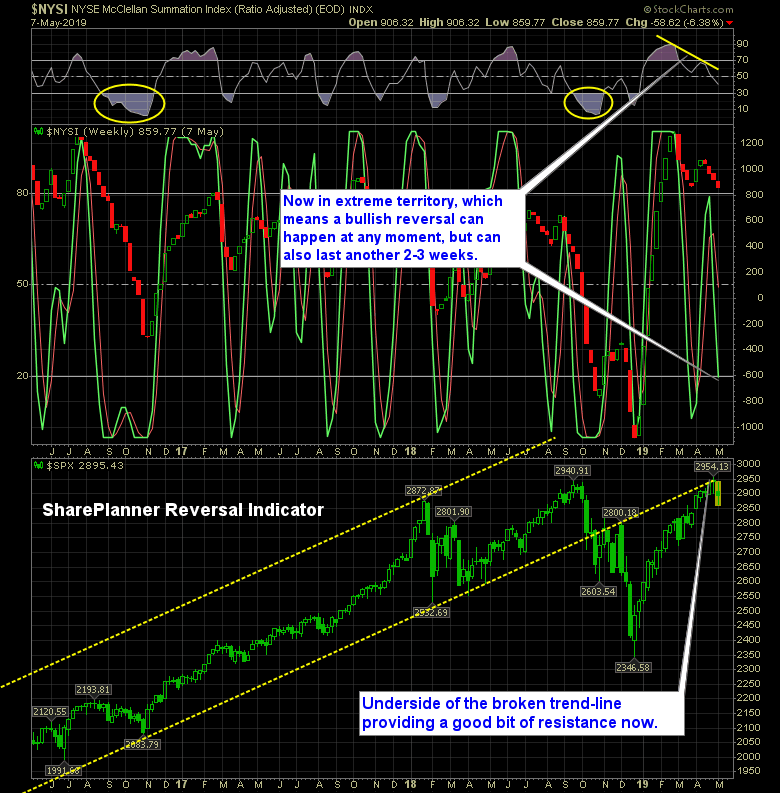

Bullish reversal in place on my market indicator, but can it be trusted? The reversals on the SharePlanner Reversal Indicator are always best served when they happen at extreme levels, because there is enough reflex bounce to get price moving in a substantial way. But this confirmation comes at [...]