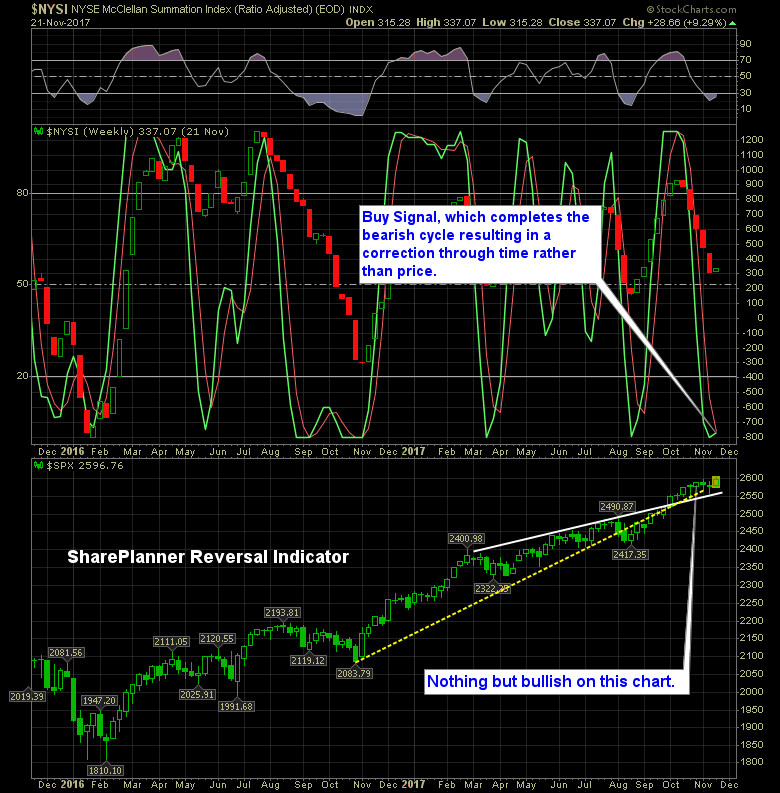

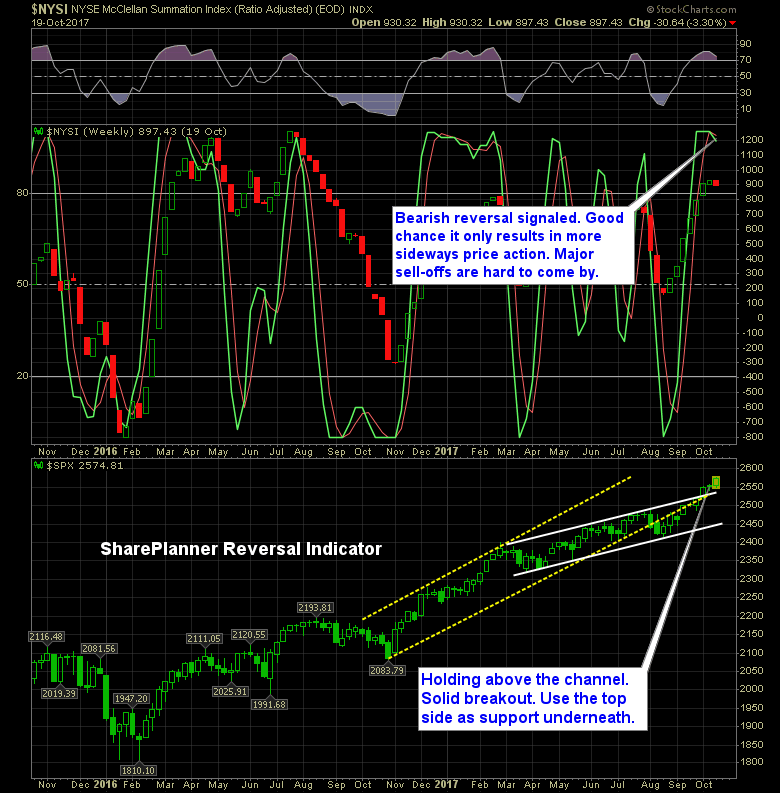

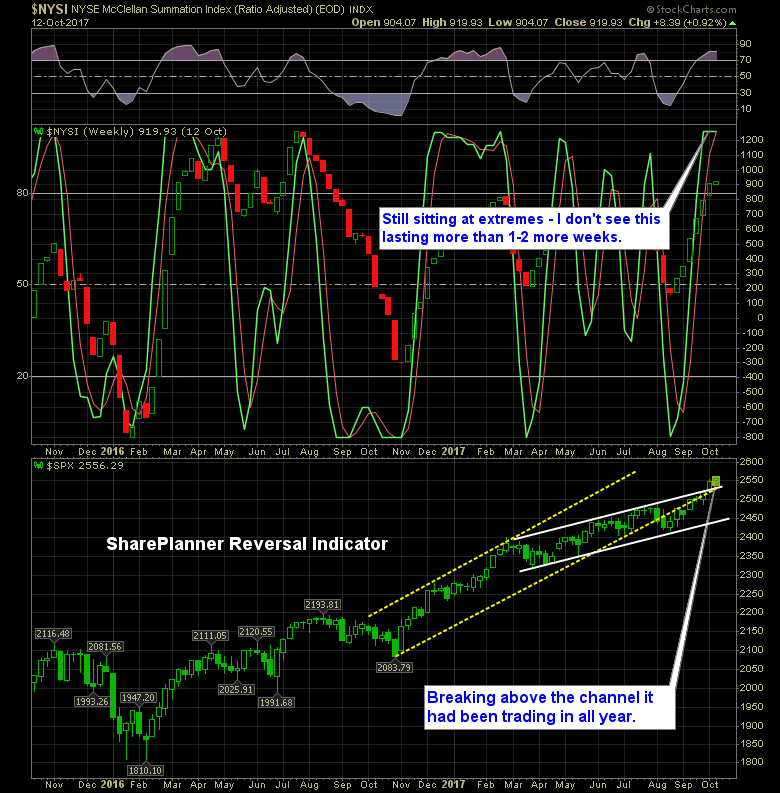

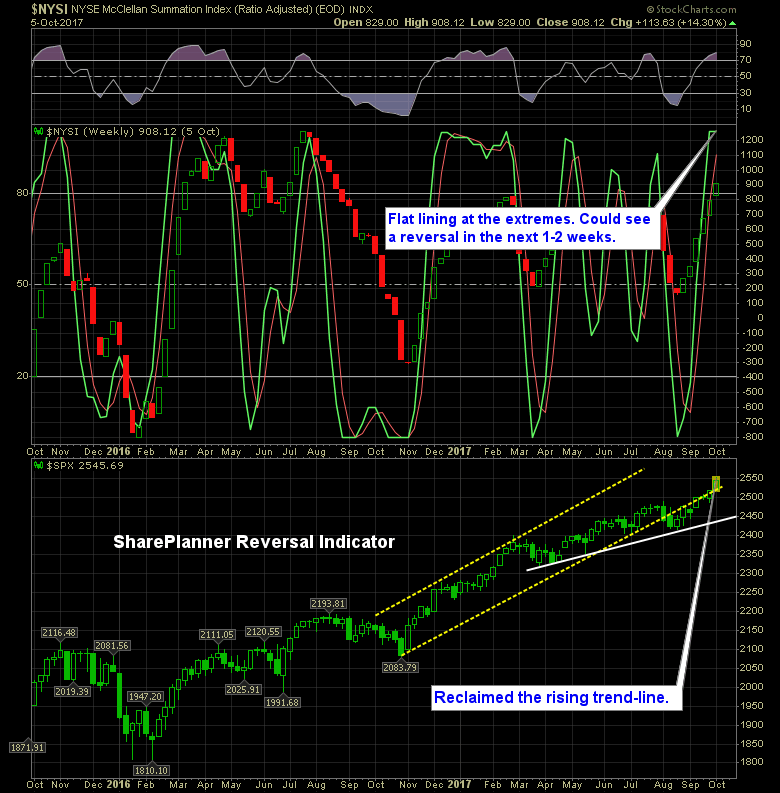

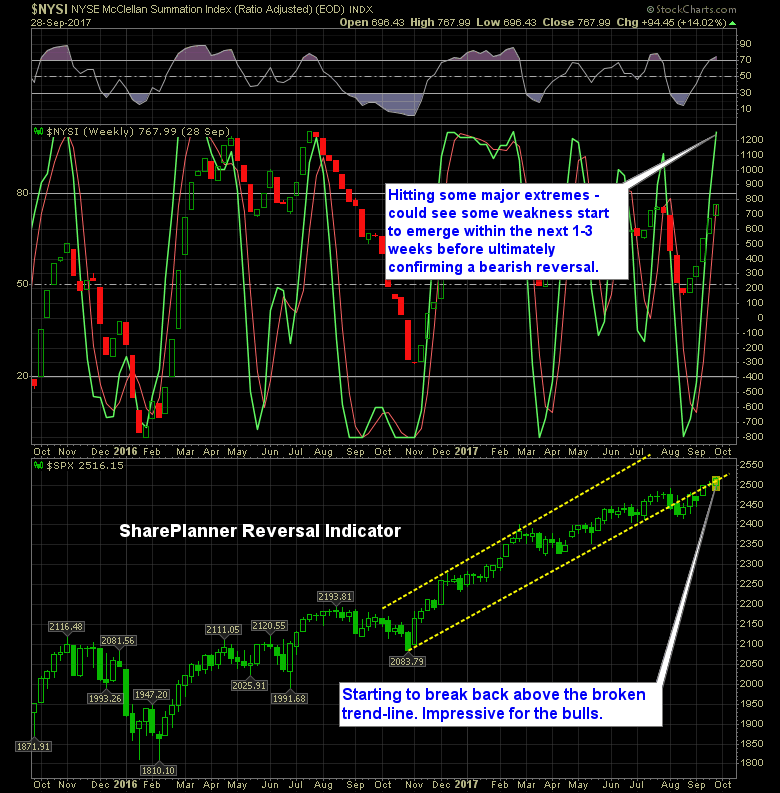

Swing Trading with Ryan Mallory

The Very Obvious Bullish Reversal Signal

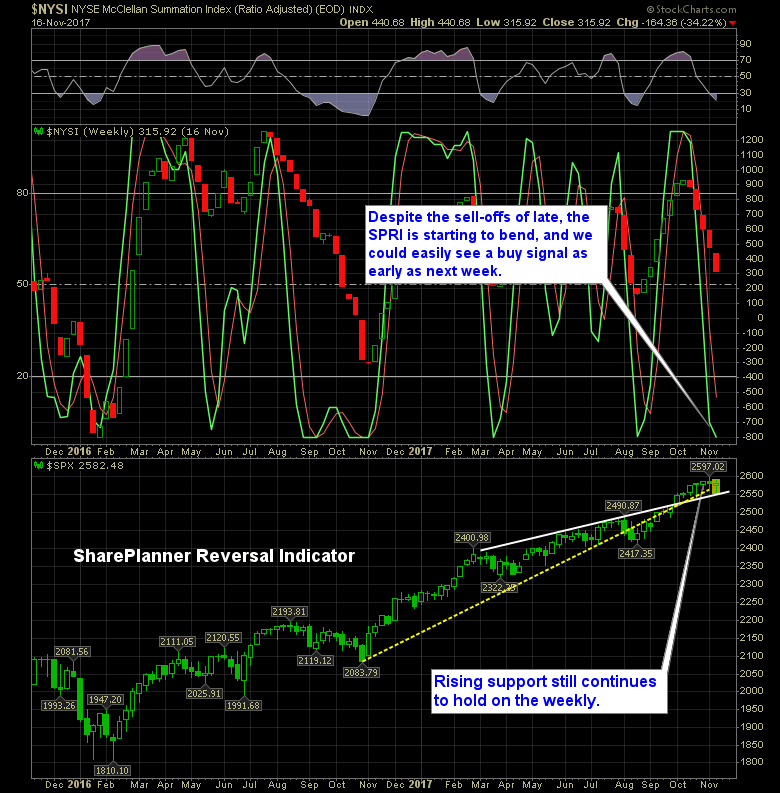

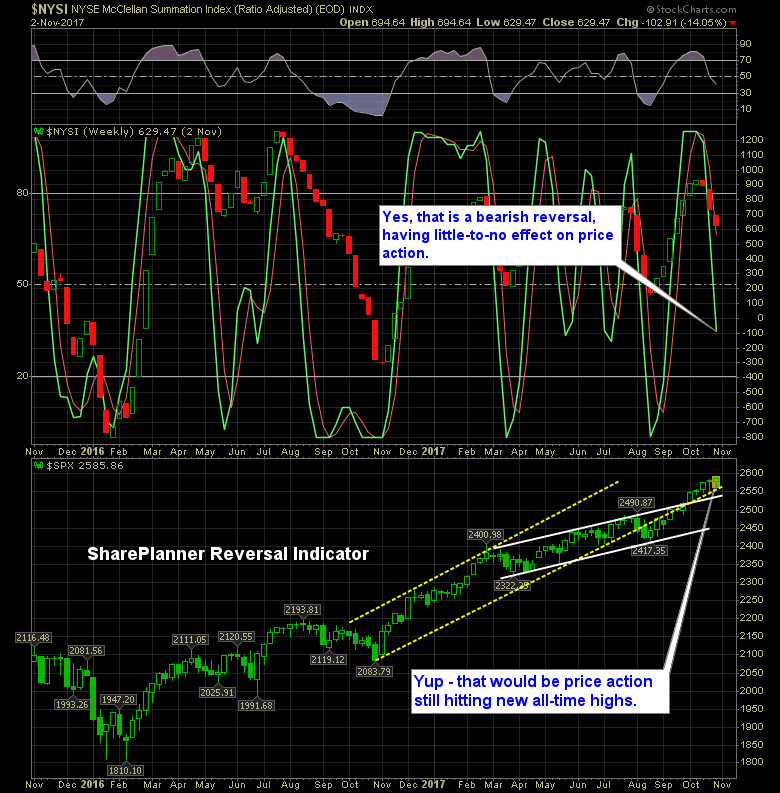

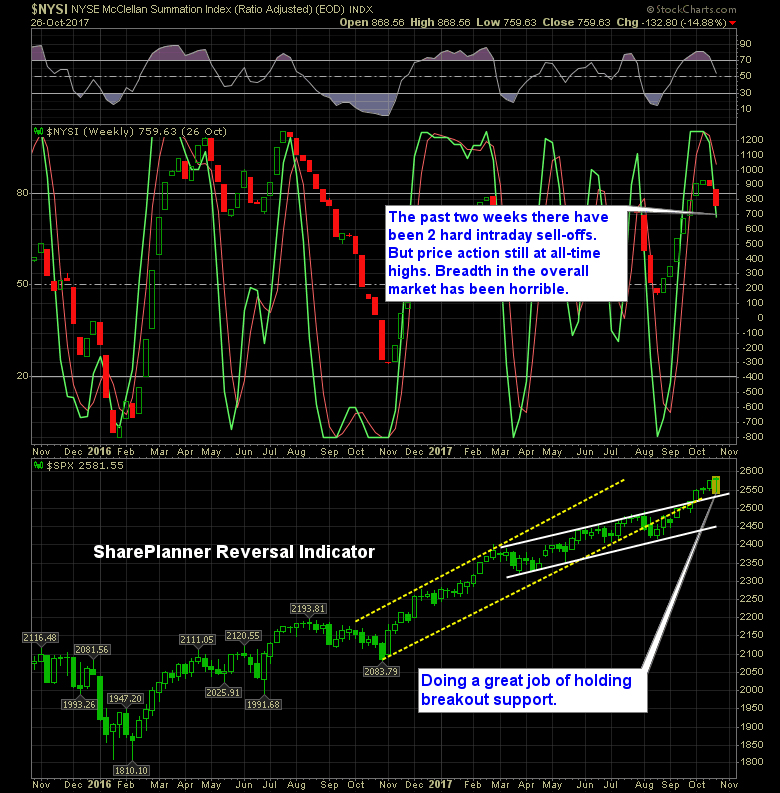

Alright, it might sound humorous in saying this, but the SharePlanner Reversal Indicator just flashed a bullish reversal signal. But hasn’t the market been in bull mode all year long? […]