Swing Trading with Ryan Mallory

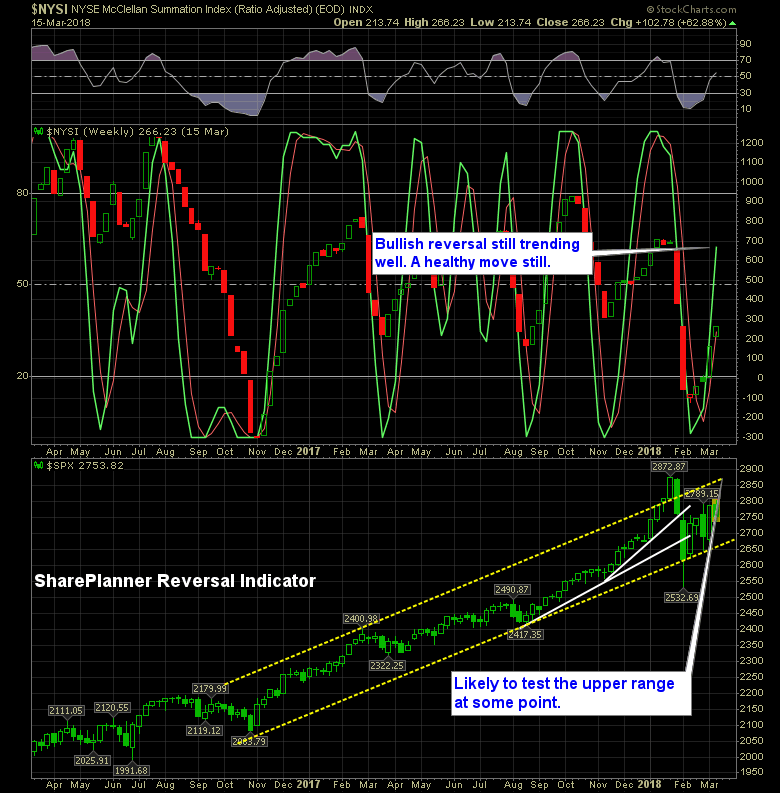

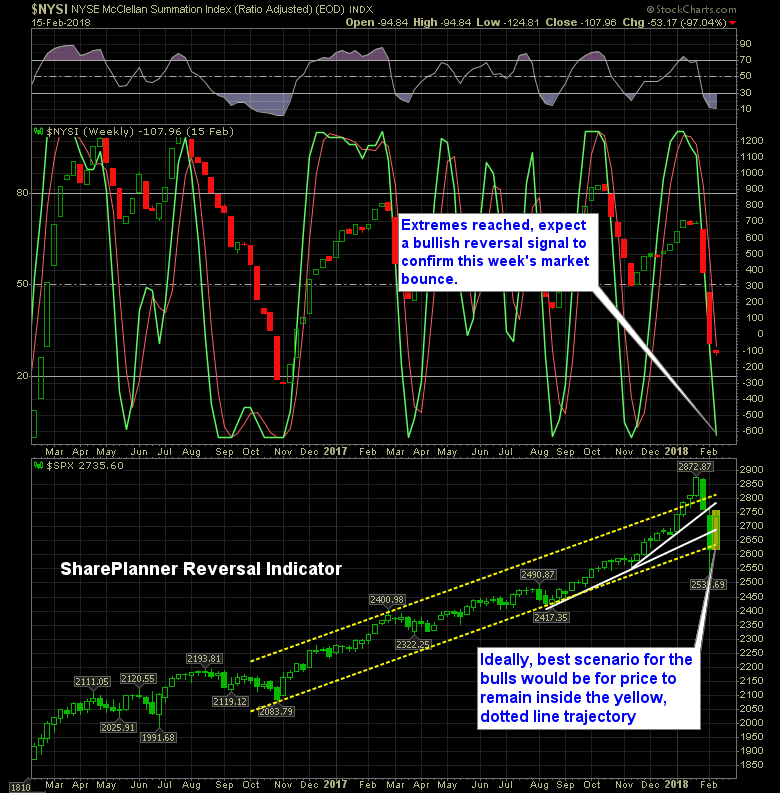

SharePlanner Reversal Indicator: Trending Well

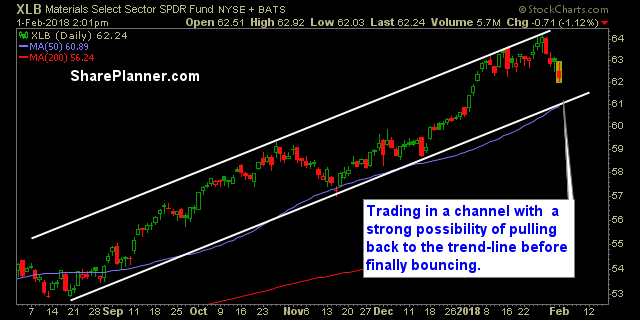

It has been a couple of weeks since we received the bullish reversal and it remains strong today. Price action this week has been less than desirable, to put it mildly, but that hasn’t affected the SharePlanner Reversal Indicator from trending bullish still. […]