July 17, 2008

The rally from the past two days have been textbook so far. A strong rally followed up with a descent follow through. The question now becomes, is how much faith do we put in these two rallies. Absolutely none! Here’s why. The bears are going to short this rally – I’m pretty confident of that. Short traders aren’t going to give up after how much success that have had over the past month or so of trading, and why should they? Its worked to this point, and when something works in the markets, you continue to take advantage of it until the status quo changes, then at that point, you have to change your strategy.

Just like in the movie, “National Treasure”, when the father is telling his son to keep the status quo. When the status quo changes, you have to be willing to change. At this point though the status quo remains the same. Politicians feel a little bit better about things, and the market has rallied 3-4% in two days but the financials are still in a mess, and no one really knows to what extent, oil has sold off, but it is going to take numerous failed attempts by the longs to drive prices higher, before oil finally regresses and sells off hard.

However, when the day comes where the bears try to drive the market lower, and the bulls will dig in – that my friend is when you know the status quo is changing. But that hasn’t happened yet. All we got was a predictable textbook bounce. Which is what we expected when we covered our short position in MORN (10-point gain). Now the market has rallied some, giving bears some more breathing room to the downside, allowing for them to establish new short positions.

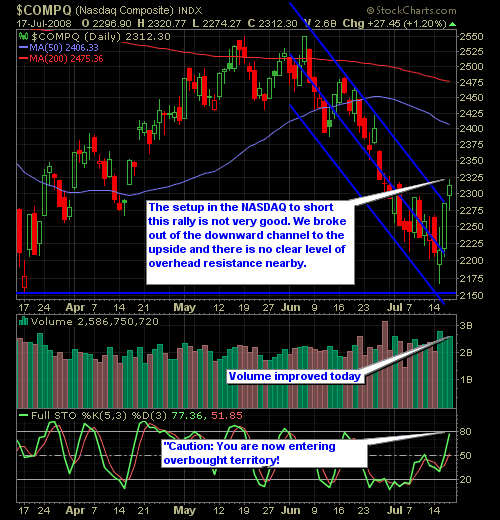

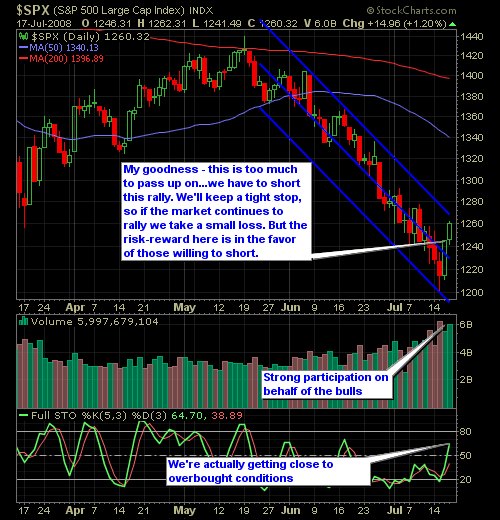

Here’s the NASDAQ and S&P Charts…