Funny how when we used the word “panic” in last nights post to describe the mentality on Wall Street, that you would get a rally out of the market to the extent that today saw. But that is typical, in that when things seem at its worst, is when things are likely to get better on Wall Street.

Interesting how word leaked late in the day that the government was crafting a plan to rescue banks and other institutions from bad debts. Don’t believe for a second that the leak wasn’t intentional, because it was. The purpose for doing so was to see what Wall Street’s response would be to such a plan, and so far they are getting the response that they were hoping for.

In fact, as the article is being written about, Treasury Secretary Paulson is sending a plan to Congress for their OK. That plan is undoubtedly going to be passed, mainly because Congress is inept with anything in regards to financials, and they want this whole problem off their plate before they go on another vacation.

Currently futures are running at 230 points in the green in anticipation of tomorrow’s open. If the government’s plan is what we expect it to be, then this provides a security blanket across the board to financial institutions and should provide the markets with a solid catalyst going forward.

However, it should still be encouraged by those looking to capitalize on this news, that caution is urged. Details are few at this point, and there is still a number of unexpected events that can happen in the financials and in the markets all together. So, don’t go all in, as the person who tests the water with both feet, always sinks to the bottom. So play it safe. There will be plenty of opportunities

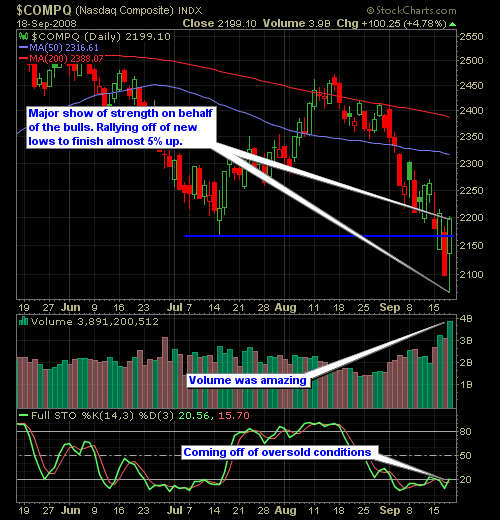

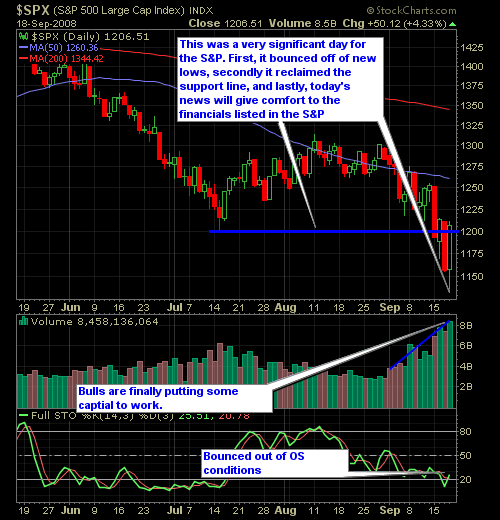

Here’s the Nasdaq and S&P charts…