Big time play by the Fed to assuage investor fears over the putrid economic conditions the United States is currently facing. Cutting rates between 75 and 100 basis points is huge and will likely reverberate across international markets. Its likely too, that other countries will step up their efforts in rate cutting. But the language of the FOMC Statement was very clear and that is, they will do everything possible to keep market conditions from spiraling out of control. Which honestly scares me, because what the government has done up to this point clearly hasn’t done much to fix the problems that we are facing, and I remain skeptical as to whether it will do anything in the future either.

On another note, I think our economy would be better served if we could have fewer public officials asserting their opinions and viewpoints to the media and the country at large. Today you have the Fed stating that they have not run out of ammunition in dealing with economic problems, but over in Chi-Town you have Obama stating the exact opposite. Now, there’s no doubt that he will soon be our President and will have the responsibility of leading our country, but he isn’t yet, and the lack of coordination between him and the other government entities, namely the Fed and Treasury, brews more confusion in the broader markets.

Without turning this into a political column, I have to wonder in some cases, if his attempts to talk down this market is so that he can inherit an economy that has priced in the greater extent of the financial turmoil prevailing in U.S. (It would be clever of him to do so). Who knows, I just think we would be better served if we had one President at a time, regardless of your opinions of the current administration.

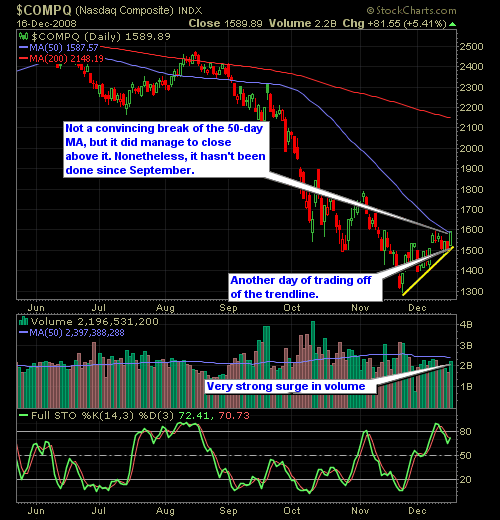

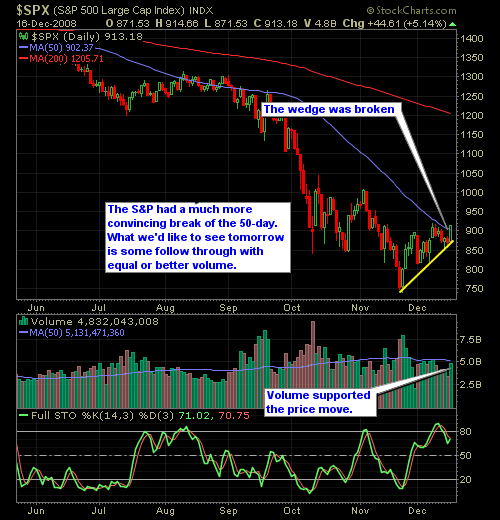

On a technical note, here’s some interesting tidbits: the major indices broke through their 50-day moving average with the Dow doing so in the most convincing manner. Indices are becoming overbought on the daily charts, but on the weekly and monthly charts, they are grossly oversold still, which should mean that the bulls have some fire-power for a Santa Rally. The VIX index may drop below 50, which would be a welcome sign for investors – a break below 45 would be huge for bulls.

Here’s the Nasdaq and S&P charts…

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

How should one go from their regular 9-5 job into full-time trading? As a swing trader, we don't have to necessarily be full-time, and instead we can combine our trading into a lifestyle that allows us to maximize our time and earning ability.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.