July 14, 2008

Today was very interesting in the action that we got from Wall Street. Solid opening followed by an immediate sell-off, tells me that the bears will continue to use any market rally to reload their short positions. The fear in the market is becoming widespread, which makes us very cautious in going heavily short at this point in the decline. Typically when the markets are getting as much front page exposure as they were today by the media, it usually means capitulation is beginning and at the very least a rebound (whether short lived or not) may be at hand. However, I’m not going to call a bottom or even attempt to. This market is one of the most fragile markets I’ve ever seen, and trying to bottom fish, could be problematic for your portfolio.

It’s obviously that the Fed, White House, Congress and every other bureaucrat are throwing everything at the financial markets, including the kitchen sink, and yet, the brakes have yet to be applied on the selling. Remember that even though this is a great short-selling environment, we are at a point in the sell-off where you are fighting a lot of powerful entities that are doing everything they can to keep this market falling further. That doesn’t mean it won’t continue its current trend, but just the right tweaking by the ‘powers-that-be’ could send this market into a very quick recovery (for example – JPM buying BSC and the subsequent three month rally). If you are going to play this market, then the best advice that we can give is to keep your stops tight – very tight.

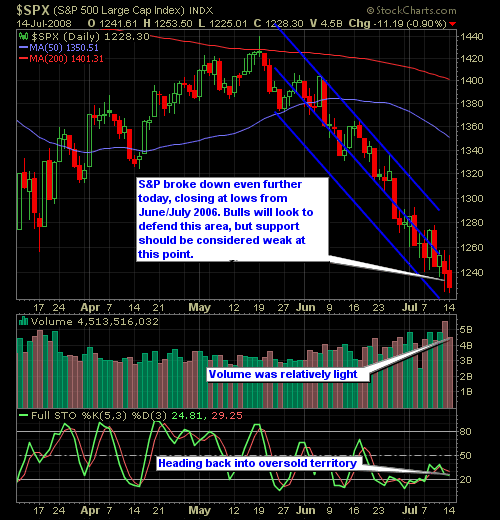

Here’s the NASDAQ and S&P Charts…